Amicus Therapeutics, Inc. (NASDAQ:FOLD) focuses on rare and orphan diseases, particularly Fabry and Pompe. The company’s portfolio includes Galafold and Pombiliti. Notably, Galafold is an oral treatment that seems effective for Fabry by stabilizing the dysfunctional enzyme alpha-Gal A. FOLD’s Pombiliti is a combination therapy with Opfolda, indicated for Pompe disease. Pombiliti replaces and stabilizes deficient or dysfunctional GAA enzymes needed for glycogen breakdown, helping with muscle causes of weakness and atrophy. So far, these two drugs are FOLD’s main value drivers, and I believe they remain well-positioned for future growth. Despite some revenue concentration risks, FOLD’s outlook remains mostly favorable. Therefore, I rate the stock a “strong buy” for investors who understand the embedded biotech risks.

Fabry and Pompe: Business Overview

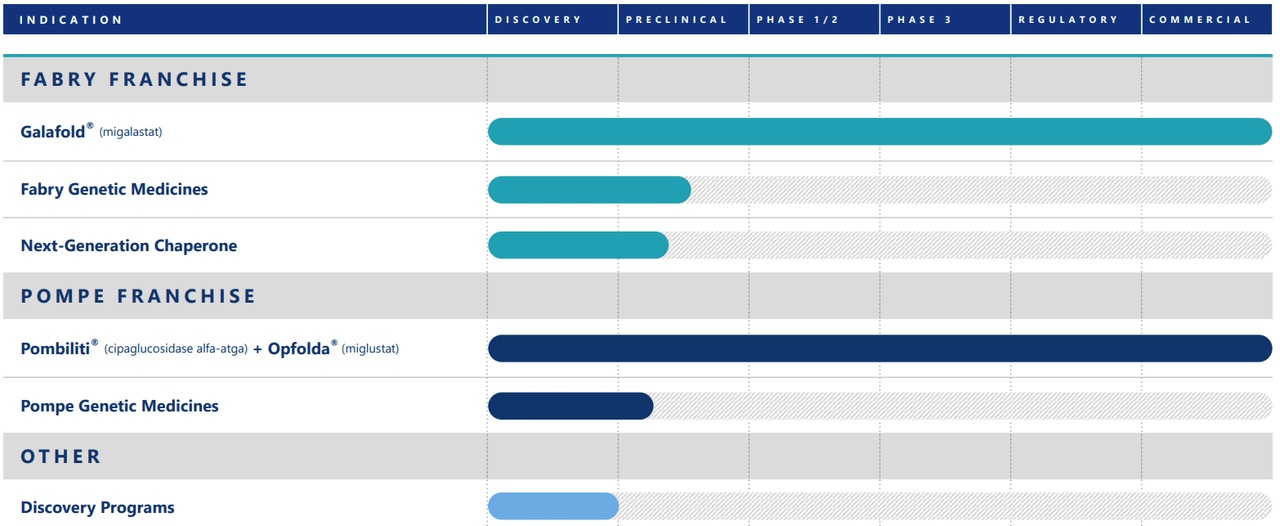

Amicus Therapeutics is a commercial-stage biotechnology company headquartered in Princeton, New Jersey. It was founded in 2002 and went public in 2007. FOLD is now developing therapies for rare and orphan diseases. Its IP portfolio includes two FDA-approved products, Galafold (migalastat) and Pombiliti (cipaglucosidase alfa-atga). Galafold targets Fabry disease therapy, while Pombiliti can be combined with Opfolda (miglustat) to treat late-onset Pompe disease.

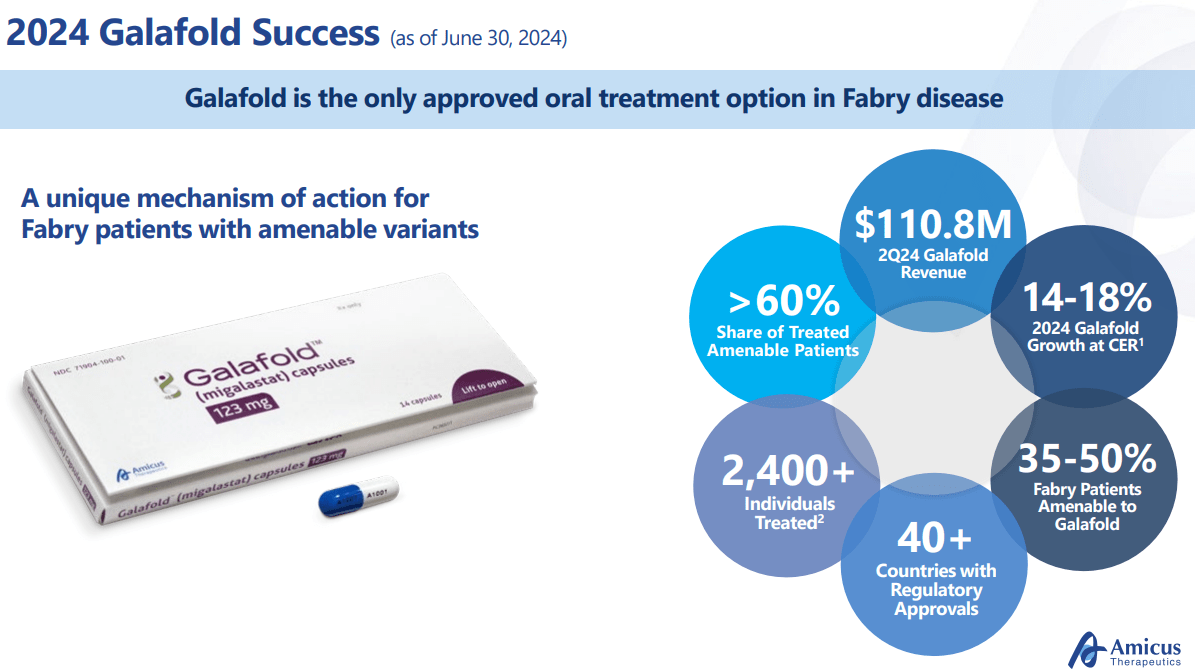

Source: Corporate Presentation. August 2024.

For context, Galafold is an oral medicine used to treat adults diagnosed with Fabry disease with amenable GLA gene variants. This rare genetic illness is characterized by a buildup of fat called globotriaosylceramide (GL-3) in tissues due to a dysfunctional enzyme, alpha-Gal A. Thus, Galafold acts by stabilizing this enzyme, allowing the decomposition of the accumulated fat that causes Fabry’s symptoms. This is how Galafold can help alleviate some of the symptoms of Fabry disease, such as pain in the hands and feet, skin lesions, sweating anomalies, gastrointestinal problems, and progressive kidney and heart damage. Unfortunately, Fabry is relatively underdiagnosed and has an estimated prevalence between 1 in 40,000 and 1 in 117,000 males.

On the other hand, FOLD also has Pombiliti in combination with Opfolda for treating late-onset Pompe disease, which typically presents in adolescence or adulthood. This condition stems from GAA gene mutations, producing acid alpha-glucosidase [GAA] enzyme deficiency. When there’s a GAA deficiency, the body has issues breaking down glycogen into glucose. Since glycogen is stored in muscles, this leads to muscle weakness and atrophy. Thus, Pompe can be particularly serious when it affects the diaphragm or intercostal muscles, making it potentially life-threatening due to respiratory failure. Therefore, FOLD’s Pombiliti acts as an enzyme replacement therapy [ERT] using a version of the GAA enzyme through DNA technology. Thus, Pombiliti is an enzyme replacement therapy that provides a recombinant form of the GAA enzyme to help break down glycogen into glucose. Then, GAA can be harvested and processed as a remedy for Pompe disease because it helps break down glycogen into glucose. Opfolda is key because it stabilizes the recombinant enzyme, preventing it from degrading.

Source: Corporate Presentation. August 2024.

It’s also worth mentioning that FOLD’s pipeline includes candidates in the preclinical stage for treating Fabry and Pompe diseases. It’s also developing chaperone therapies to stabilize dysfunctional proteins, particularly the enzyme α-Gal A. This could lead FOLD towards better clinical results for Fabry’s disease. The company is also working on an open-label Rosella study for infantile-onset Pompe disease to address this unmet medical need.

Secular Winds: Revenue Prospects

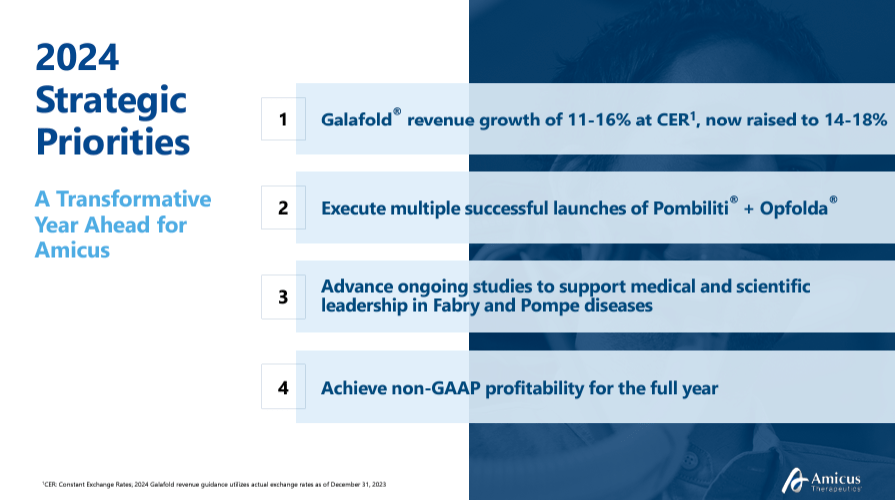

Nevertheless, I believe Galafold and Pombiliti are evidently the company’s main value drivers. During the FOLD’s latest earnings call, management emphasized Galafold’s significant role in revenue growth. Initially, the company projected 11-16% growth at constant exchange rates [CER], but this was later revised to 14-18% due to Galafold’s strong performance.

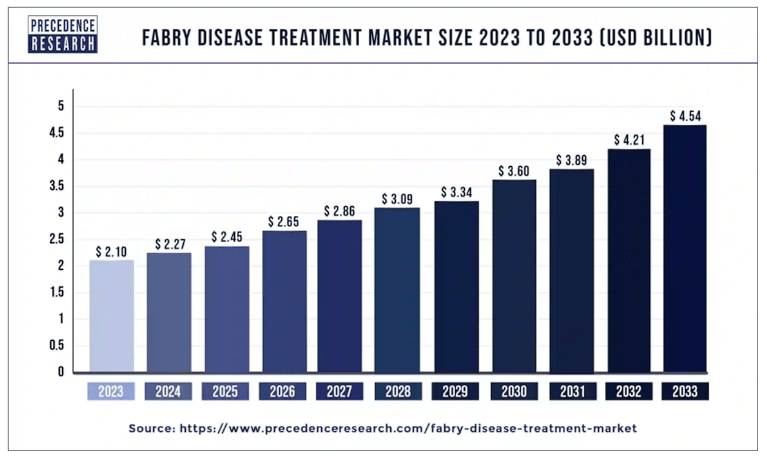

This outperformance benefited from the sizeable Fabry disease market, estimated at $2.3 billion in 2024. This market will reach $4.5 billion by 2033, giving Galafold considerable secular tailwinds. Management mentioned that the patient subpopulation with amenable mutations is expected to reach $1.0 billion by the end of the decade. Notably, Galafold has captured over 60% of the global amenable market and has an 85-90% share in mature markets like the US. More importantly, FOLD expects Galafold to reach similar global market share levels, largely due to its competitive advantage as the only oral treatment option.

Source: Precede Research.

Additionally, since FOLD’s 2023 Pombiliti launch, it has seen favorable US adoption as a combination therapy with Opfolda. Management mentioned some patients switch from other drugs like Nexviazym to Pombiliti after healthcare providers evaluate performance, but also due to positive word-of-mouth testimonials. This suggests that Pombiliti resonates well with patients and care providers alike, which I believe is incredibly promising for its future market adoption curve. For instance, Pombiliti entered new countries like Spain, Germany, Austria, the UK, and Switzerland. Executives mentioned those jurisdictions are also seeing positive results with Pombiliti.

In February 2024, FOLD announced that the WORLDSymposium awarded Pombiliti and Opfolda the 2024 New Treatment Award. These drugs are the first and only two-component FDA-approved treatment for late-onset Pompe disease, targeting patients not improving with other ERTs. More recently, on June 4, 2024, this combo therapy also received the 2024 Prix Galien UK’s Award for Best Pharmaceutical Product. Thus, I believe Pombiliti also has a valuable foothold in Pompe disease, a market projected to grow to over $2.0 billion by 2030.

Source: Corporate Presentation. August 2024.

Moreover, FOLD has pending regulatory applications in Australia, Canada, and Japan before the end of 2024. FOLD’s progress in securing reimbursement access was also particularly encouraging. Medicare and Medicaid approvals typically occur within approximately 30 days, which is key for revenue growth. Overall, the company clearly focuses on Europe and the US, but its drugs also have potential worldwide. So, I believe its IP is well positioned for sustained long-term revenue growth.

Reasonable GARP: Valuation Analysis

From a valuation perspective, FOLD trades at a $3.5 billion market cap, making it a mid-sized biotech in its sector. Its balance sheet holds $209.3 million in cash and equivalents and $50.7 million in marketable securities. This amounts to $260.1 million in short-term available liquidity against $388.9 million in long-term debt. Overall, the company’s book value is $132.5 million, indicating a P/B multiple of 26.4, which is undoubtedly high. For context, its sector’s median P/B is 2.4, so FOLD seems to trade at a considerable premium relative to its peers.

Source: Seeking Alpha.

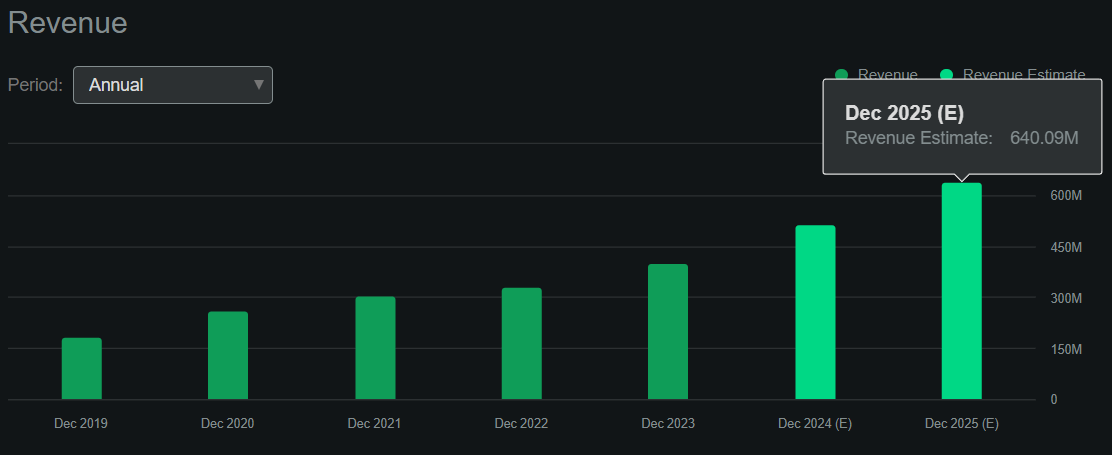

Nevertheless, I estimate its latest quarter generated $21.6 million in positive cash flow by adding its CFOs and Net CAPEX. This suggests an annualized cash flow run rate of about $86.4 million. However, it’s worth noting that according to Seeking Alpha’s dashboard on FOLD, the company is projected to reach $640.1 million in revenues by 2025, a 23.9% YoY increase. Thus, the company seems to be transitioning towards delivering strong cash flow for shareholders, making it self-sustainable going forward.

In their earnings call, management mentioned that the higher end of their operating expense guidance for 2024 is now $360.0 million. If we assume they sustain those levels into 2025 and use the current quarterly 91.1% gross margins, then that implies $223.1 million in full-year EBIT for 2025. I estimate its EV at about $3.6 billion by adding its market cap and debt minus its short-term available liquidity. This would price FOLD at a more reasonable forward EV/EBIT of 16.3. For comparison, its sector’s median forward EV/EBIT ratio is 17.0, so FOLD actually appears cheap from that perspective. Thus, I believe FOLD trades at a compelling valuation, assuming its forecasted top-line growth materializes, so I lean bullish on the stock.

Investment Caveats: Risk Analysis

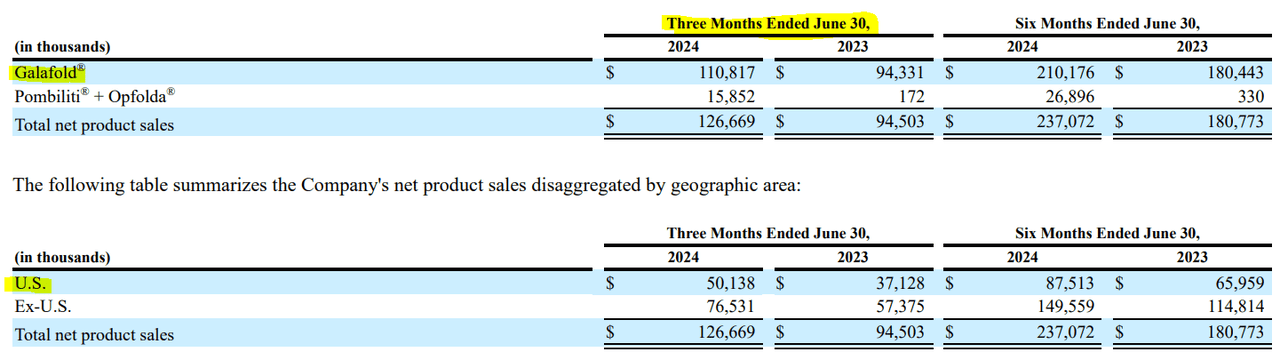

In my view, FOLD’s thesis is relatively safe, as it relies on two drugs with a solid competitive profile. However, the company seems overly dependent on Galafold in particular. In Q2 2024, this drug represented 87.5% of the company’s total quarterly product revenues. A positive aspect of its revenue composition is that only 39.6% of its revenues came from the US, which gives some geographical diversification. Nevertheless, FOLD is undoubtedly mostly a bet on Galafold. So, if another superior competitor emerges, it could derail the GARP bull thesis outlined in this article. This could re-price the stock at a lower multiple and lead to shareholder losses.

Source: FOLD’s Q2 2024 10-Q report.

Other than that, if regulators cause reimbursement complications for Galafold, it could also hamper its promising revenue growth trajectory. But overall, I think it’s reasonable to be bullish on the stock, as its positives seem to outweigh the potential risks. Hence, I rate FOLD a “strong buy” for investors who understand the previously mentioned risks.

Strong Buy: Conclusion

In conclusion, I think FOLD is a compelling investment at these levels. Its two leading drugs are Galafold and Pombiliti, both with relatively solid competitive profiles in their respective markets. Moreover, if the company’s current growth trajectory continues, it seems reasonably priced as a GARP biotech stock. While I accept some revenue concentration risks, the broader outlook for FOLD is mostly favorable. Hence, I rate the stock a “strong buy” for investors who understand the inherent biotech risks.

Read the full article here

Leave a Reply