Investment Thesis

KB Home (NYSE:KBH) faces near-term headwinds from a high-interest rate environment, but some leading indicators, like improved new orders and stabilizing backlog, indicate that we are near the bottom of the cycle and sales should improve in FY24. Further, a potential reversal in the interest rate cycle and the company’s focus on increasing community count should contribute to the company’s sales in the medium to long term. The long-term housing fundamentals are also attractive with a decade-plus underproduction of new homes since the great housing recession of 2008 which is resulting in limited resale home inventory.

The company’s margins are expected to benefit from healthy levels of pricing in new orders, cost reductions, and productivity improvements. The company’s Built-to-Order business model also usually carries higher margins.

While I like the company’s outlook, I can’t say the same about valuation. The stock is already trading near its one-year forward FY24 end book value, which I believe is appropriate in the current high-interest rate environment. So, while I like the company’s outlook, I would prefer to wait for a better entry point before becoming more positive on the stock. For now, I have a neutral rating on KBH stock.

Revenue Analysis and Outlook

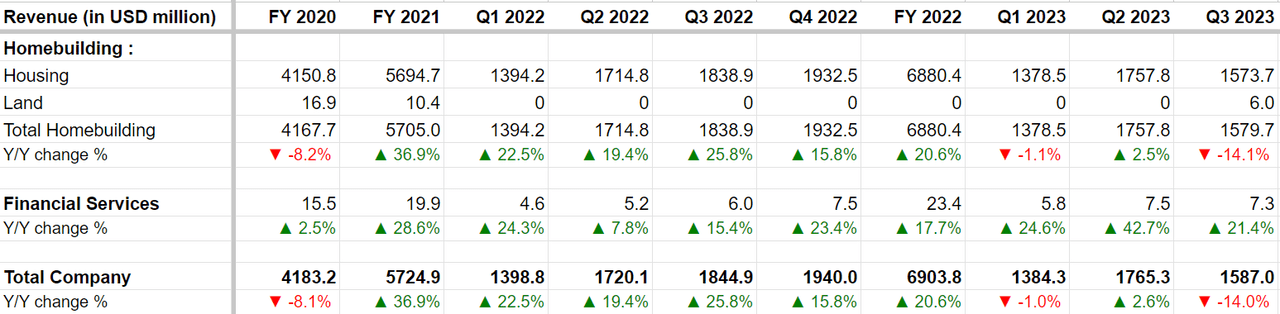

After experiencing strong growth in FY21 and FY22, the company’s revenue growth was negatively impacted in recent quarters due to high mortgage rates which led potential homebuyers to put their home purchases on hold.

In the third quarter of 2023, the company’s revenue declined 14% Y/Y to $1.587 billion, driven by a 14.1% Y/Y decline in the core homebuilding revenues as the number of homes the company delivered dropped by 6.6% Y/Y to 3375, with the average selling price falling 8.3% Y/Y to $466,300.

KBH’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, while the fourth quarter and early 2024 revenues should be down Y/Y, there are signs of potential stabilization in backlog and order rate which indicates a recovery in the second half of FY24.

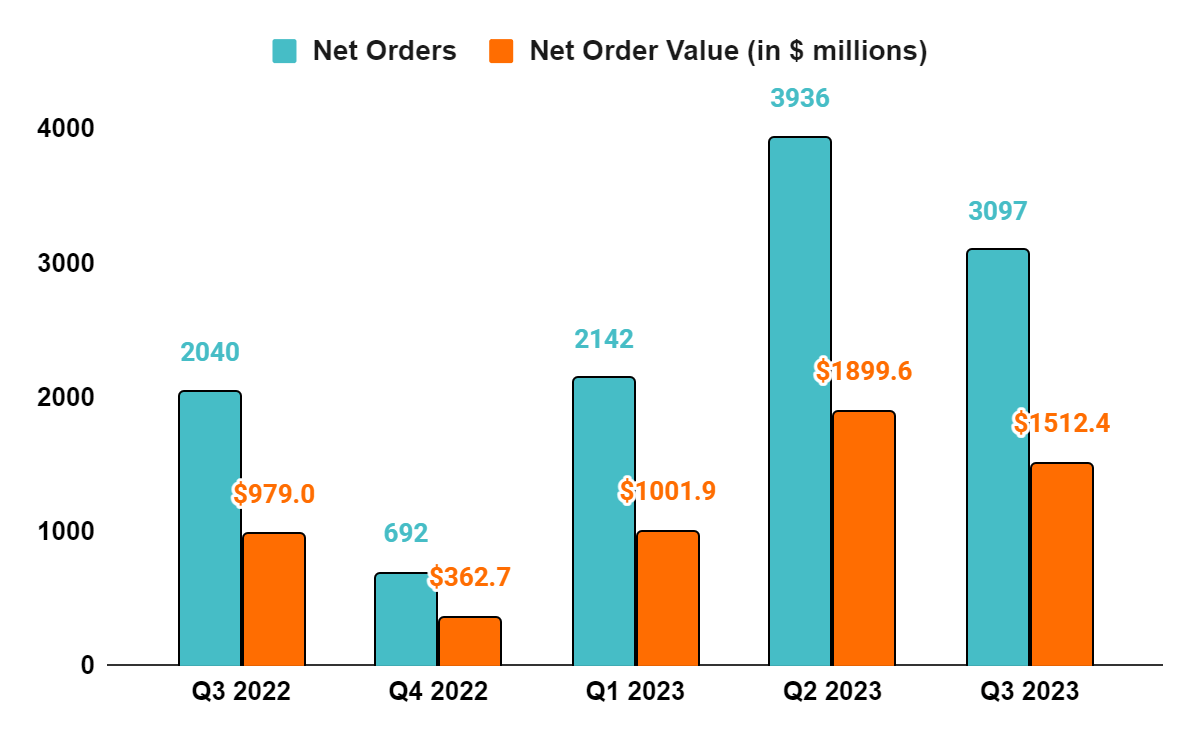

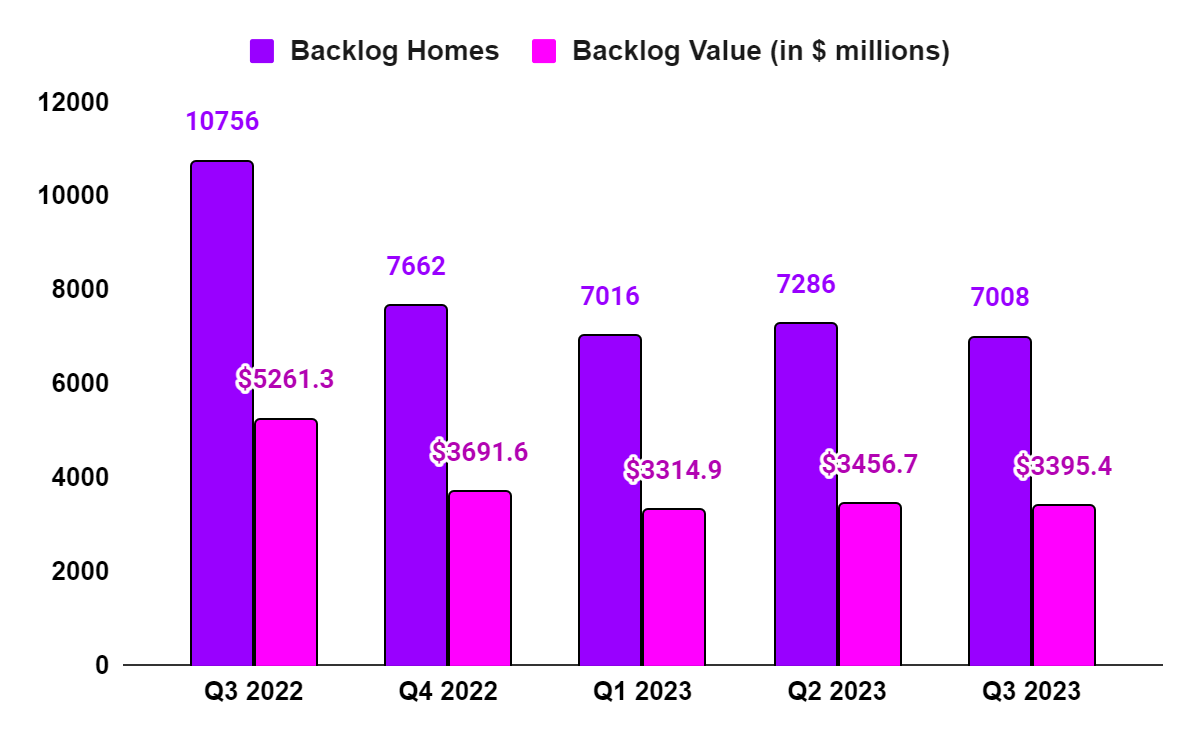

Despite high interest rates, with 30-year mortgage rates over 7%, KBH reported steady customer demand for new homes in the third quarter. The net orders grew 52% Y/Y to 3,097 units in the third quarter, reflecting improved demand conditions for new homes and a Y/Y lower cancellation rate. The value of net new orders was up 54% Y/Y to $1.51 billion and the company achieved an absorption (net orders per community per month) of 4.3, which is above the company’s historical average third-quarter pace before pandemic-driven volatility. While the backlog declined 34.8% Y/Y to 7,008 homes and its value dropped by 35.5% Y/Y to $3.4 billion, the backlog value has been stabilizing for the last four quarters. Since orders and backlog provide good visibility on future revenues, I believe revenue should also see some bottoming, especially in the second half of FY24 (there is a lag of a couple of quarters between the company receiving an order and it completing sales by delivering the finished home to the homebuyer.)

KBH’s Net Orders and Net Order Value (Company Data, GS Analytics Research)

KBH’s Backlog Homes and Backlog Value (Company Data, GS Analytics Research)

While some investors are worried about the company’s build-to-order model saying customization results in higher home prices and may result in less demand as buyers are currently focusing on affordability, this is not what is really happening in terms of KBH sales as we can see from its strong net order growth. KBH has increased its focus on providing homebuyers with affordable housing options and ~70% of its communities offer plans with square footage below 1,600 catering to the needs of budget-conscious homebuyers. So, I believe the concerns around order trends are not valid, and the company should continue to see healthy orders.

Further, the company is planning to increase its community count by ~15% by the end of FY24 from the current levels. The company has invested a good deal in land acquisitions in recent quarters and has over 57,000 lots owned or under contract that should support its plans of more than 150 new community openings over the next five quarters. The increased community counts mean more orders and should help the company’s growth in the long run.

Moreover, the high-interest rate environment that is impacting the company’s sales is expected to reverse as there have been some positive indicators, with inflation trending in the right direction, which could lead to the Federal Reserve cutting interest rates in the coming year. The analysts at Deutsche Bank recently commented that they see a meaningful rate cut starting in June 2024. Once the Federal Reserve starts cutting rates, we should see a good recovery in the industry. The undersupply of new homes in the U.S., due to a significant underbuild since Great Housing Recession, has resulted in a tight demand-supply environment, which should also support recovery once the interest rate cycle reverses.

In summary, while there are near-term headwinds, I believe we are close to bottom and can see revenue recovery starting from 2HFY24.

Margin Analysis and Outlook

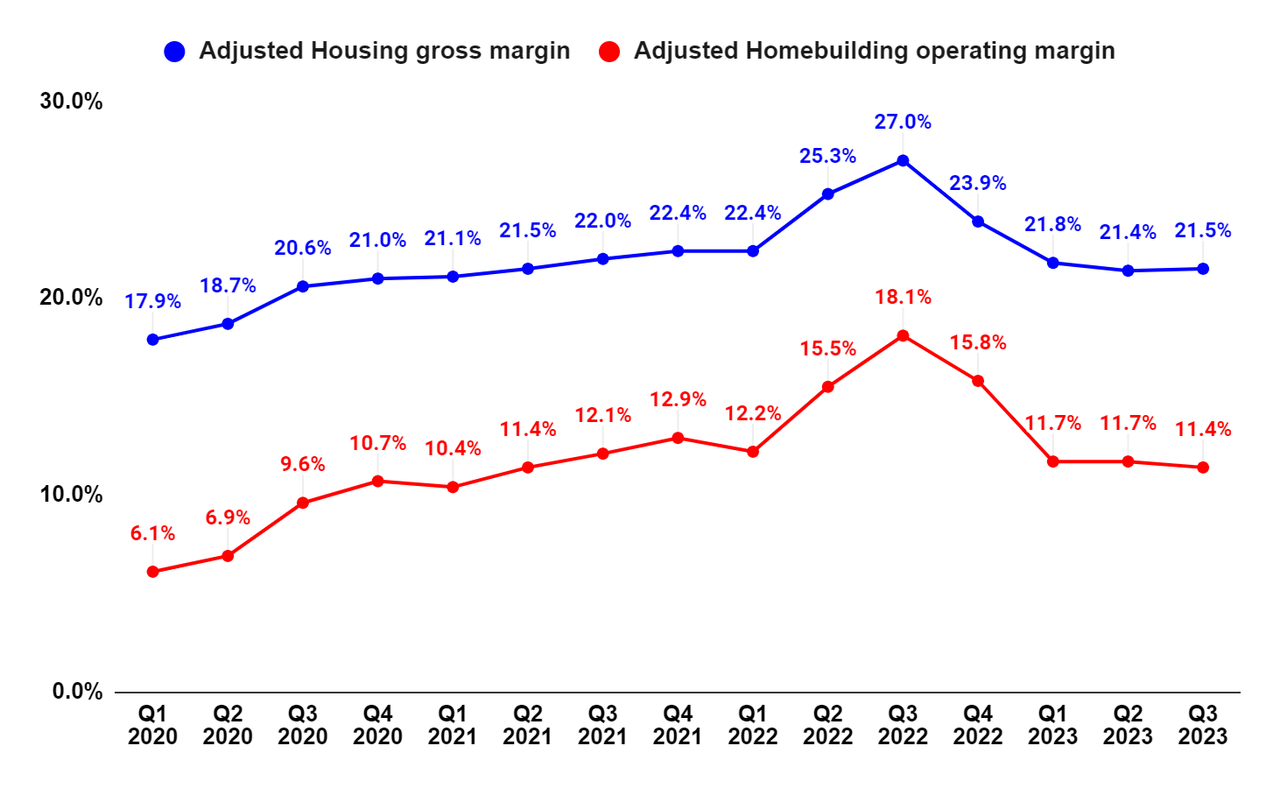

In Q3 2023, the company’s adjusted housing gross margin (which excludes inventory-related charges) contracted by 550 bps Y/Y to 21.5% due to lower pricing and other homebuyer concessions for orders booked in the prior periods, increased construction costs, and a mix shift away from the higher-priced West Coast region. SG&A as a percentage of housing revenues increased 130 bps Y/Y caused by reduced operating leverage from lower housing revenues and higher sales commissions. Lower adjusted housing gross margin and higher SG&A expense as a percentage of housing revenues led to a 670 bps Y/Y decline in adjusted homebuilding operating margin (excluding inventory-related charges) to 11.4%.

KBH’s Adjusted Housing Gross Margin and Adjusted Homebuilding Operating Margin (Company Data, GS Analytics Research)

Looking forward, I believe the company’s margins are near the bottom of the current downcycle and should see some improvement in FY24. In Q3, the healthy demand trend across the company’s end markets enabled it to raise prices for new orders in ~65% of its communities, while decreasing prices in only ~10%. The strength in pricing of the new orders that the company is booking bodes well for the company’s margins in the coming periods.

Moreover, the company is working on reducing homebuilding cycle time to its historical build time of between four and five months. The company has executed well on this front so far, with a 35-day sequential reduction in the third quarter, and KB Home is currently building homes in approximately six months. There should be a further reduction in this number, which should result in increased productivity for the company.

In addition, the company’s efforts on leveraging its highly customer-centric Built-to-Order business model also bode well for the margins. According to management, Built-to-Order homes have a 300 bps higher margin than speculative homes (move-in ready homes built before a home buyer makes a purchase) as customized homes allow the company to generate revenues from lot premiums as well as a design studio and structural options.

Overall, the company’s margin should also bottom around these levels and should see some improvement towards the back half of FY24.

Valuation and Conclusion

The company ended the third quarter with a Book value of $48.29 per share, and it is currently trading around $55.51 or ~1.15x last reported book value. In terms of forward estimates, if we look at the current consensus EPS estimates, the company is expected to post an EPS of $1.68 in Q4 2023 and $7.31 in FY24. KBH has an annual dividend of $0.80 per share. So, the company’s book value on a one-year forward basis or at the year-end FY24 should be close to $56.48 (=$48.29+ $1.68+$7.31-$0.80). So, the stock is trading almost near its one-year forward FY24 end-book value.

While I don’t see much downside from these levels given the company’s revenues and margins are likely to bottom, I don’t see much upside either given the stock is already trading near its one-year forward book value. I am not comfortable assigning the stock a premium valuation versus its one-year forward book value, given where the interest rates are. Hence, I have a neutral rating on the stock for now.

Read the full article here

Leave a Reply