According to a November 7, 2023 Press Release from the U.S. Treasury, “the global economic outlook continues to face elevated uncertainty associated with Russia’s war against Ukraine, geopolitical stresses in the Middle East, still-elevated core inflation, and the potential for stresses in China’s property sector to deepen.”

Each of these issues have been with us to varying degrees for several years, and will extend into 2024. This raises a question on how to invest in the market during uncertainties that were encountered in 2023, and what needs to be evaluated in the coming 12 months. There are numerous financial investment approaches, but in this article I discuss stocks, particularly in the semiconductor sector, which has shown the greatest growth in 2023. I also discuss choices between investing in individual semiconductor stocks versus the exchange-traded fund (ETF) approach.

One way to simplify investment is through an ETF. Exchange-traded funds combine aspects of mutual funds and conventional stocks. Like a mutual fund, an ETF is a pooled investment fund that offers an investor an interest in a professionally managed, diversified portfolio of investments. But unlike mutual funds, ETF shares trade like stocks on stock exchanges and can be bought or sold throughout the trading day at fluctuating prices. There are more than 2,000 ETFs in the U.S. and approximately 10 semiconductor ETFs.

The semiconductor industry has faced challenges in the last three months due to speculations about consistently rising interest rates. However, as indications emerge that the Federal Reserve’s intense campaign of interest rate hikes is approaching its conclusion, there is a potential for a turnaround in the sector’s downturn. The growth of artificial intelligence applications brings the potential for new avenues of growth within the semiconductor industry.

This is my third Seeking Alpha article on the VanEck Semiconductor ETF (NASDAQ:SMH) since late 2020, and it remains my top ETF. In this article, I discuss the performance of SMH to date, but also analyze the top holdings as the market moves into 2024, primarily because like in everything else, there are winners and losers among the semiconductor companies and among SMH holdings.

Strong Semiconductor Performance in Past Year

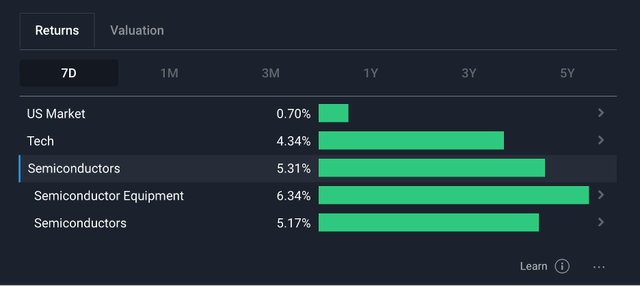

Over the last seven days ending November 13, 2023, the Semiconductors industry has risen 5.31%, with Semiconductor Equipment up 6.34% and Semiconductors increasing 5.17%, as shown in Chart 1.

Simply Wall St

Chart 1

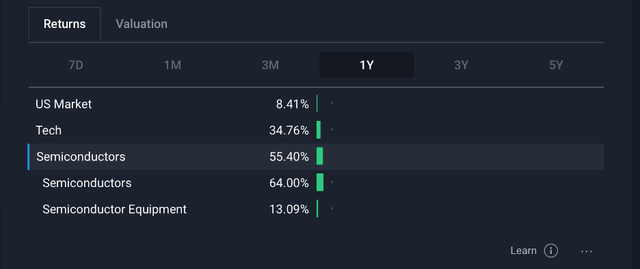

Chart 2 shows that the industry has gained 55.40% over the past year, with Semiconductor Equipment increasing 13.09% and Semiconductors jumping 64.00%.

Simply Wall St

Chart 2

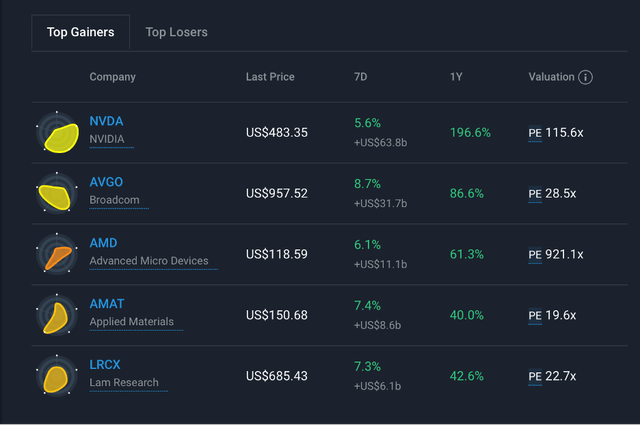

The strong semiconductor performance in the past seven Days is driven by gains by five companies listed in Chart 3 – Nvidia (NVDA), Broadcom (AVGO), Advanced Micro Devices (AMD), Applied Materials (AMAT), and Lam Research (LRCX). Share performance over the past year along with PE ratios are also shown.

Simply Wall St

Chart 3

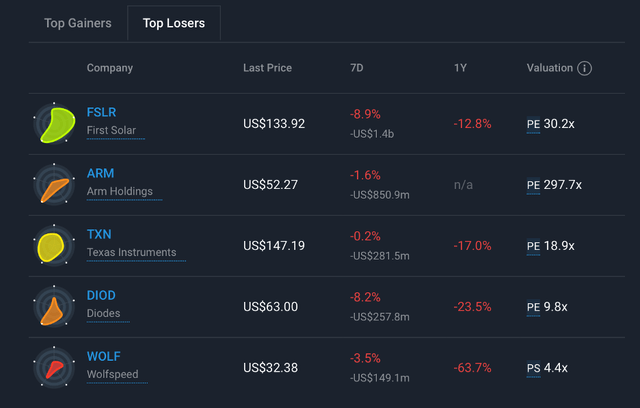

As I said, there are also losers in the semiconductor sector, as shown in Chart 4. These include First Solar (FSLR), a solar company (which is considered a semiconductor because of a PN junction), ARM Holdings (ARM), Texas Instruments (TXN), Diodes (DIOD), and Wolfspeed (WOLF).

Simply Wall St

Chart 4

SMH Top Holdings

The VanEck Semiconductor ETF (SMH), with assets of $10.37 billion under management, is an exchange-traded fund with a dividend yield of 0.76% and a net expense ratio of 0.35%. Two holdings, Nvidia and Taiwan Semiconductor (TSMC) (TSM), are the top two companies and account for 33.3% of the ETF’s portfolio. With a significant concentration in only two stocks, the ETF becomes highly sensitive to any notable fluctuations in its main holdings.

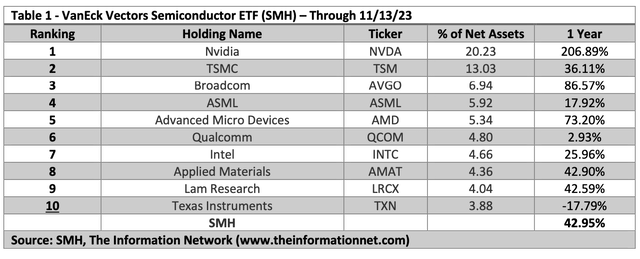

Table 1 shows the top 10 holdings for SMH. Included in the top holdings are three semiconductor equipment suppliers ASML (ASML), Applied Materials, and Lam Research. SMH achieved a 1-year performance of 42.95%.

As a correlation between Table 1 and Chart 3 above, the top five companies for the past seven days, NVDA, AVGO, AMD, AMAT, LRCX, are all included in the SMH Top 10. These five companies make up 40.9% of SMH Net Assets.

SMH

However, on the flip side, of the two underperforming stocks in the SMH holdings, Qualcomm (QCOM), and TXN, the latter is included in the Top Losers for the past seven Days. These two stocks make up just 8.68% of SMH Net Assets.

Profile of Top 10 SMH Holding Companies

Nvidia announced its earnings on Tuesday, November 21, after the market closed. The company blew past expectations on both the revenue side and the earnings side. Despite beating top line and bottom-line estimates, the stock has slipped slightly since the announcement and SMH has followed suit.

Taiwan Semiconductor reported robust financial results for October, revealing a substantial 34.8% increase in net revenue compared to the previous month. October’s consolidated sales amounted to around NT$243.20 billion (US$7.53 billion), showcasing a noteworthy 34.8% upswing from September and a significant 15.7% year-over-year surge. This impressive growth is attributed to the heightened demand for TSMC’s cutting-edge chip process. Looking ahead, TSMC has projected consolidated sales for the fourth quarter of this year to range between US$18.8 billion and US$19.6 billion.

Broadcom recently conducted its third-quarter fiscal year 2023 financial results conference call, revealing consolidated net revenue of $8.9 billion — a 5% year-on-year increase. Semiconductor Solutions revenue experienced a parallel 5% year-on-year rise to $6.9 billion, while Infrastructure Software saw a similar 5% growth to $1.9 billion. The company’s wireless business remained steady, and the increase in hyperscale spending was fueled by investments in generative AI. Broadcom’s networking revenue reached $2.8 billion, reflecting a 20% year-on-year increase, constituting 40% of the semiconductor revenue. The company anticipates networking revenue to accelerate by over 20% year on year in Q4.

ASML released its third-quarter 2023 results on October 18, reiterating its 2023 revenue-growth forecast of 30%. However, it anticipates flat revenue for 2024. A concerning aspect highlighted in the report was the 71% year-over-year decline in net bookings to 2.6 billion euros ($2.76 billion), compared to $9.45 billion in the same period last year.

Advanced Micro Devices surpassed consensus estimates for earnings by 4 cents and revenues by $95 million. The company anticipates fourth-quarter 2023 revenues of $6.1 billion (+/-$300 million), indicating a year-over-year decline of 9%. CEO Lisa Su forecasts the new MI300 AI accelerator to generate $400 million in Q4 revenue, with expectations of exceeding $2 billion in sales next year.

Qualcomm‘s fourth-quarter fiscal 2023 earnings per share of $1.59 exceeded consensus by 14 cents, with revenues of $8.63 billion surpassing the estimate of $8.55 billion. The company projects revenues of $9.1-$9.9 billion and earnings per share of $2.25-$2.45 for the first quarter of fiscal 2024.

Intel (INTC) surpassed expectations on both the top and bottom lines and provided an optimistic fourth-quarter revenue guidance. It reported earnings per share of 41 cents, beating the consensus estimate of 21 cents and marking an 11% increase from the year-ago quarter. While revenues declined 8% year over year to $14.2 billion, they exceeded the estimated $13.5 billion.

Lam Research exceeded revenue and earnings estimates for the first quarter of fiscal 2024, with earnings per share of $6.85 surpassing consensus by 78 cents, and revenues of $3.48 billion exceeding the estimated $3.41 billion. For the second quarter of fiscal 2024, the company anticipates revenues of $3.87 billion.

Texas Instruments reported disappointing third-quarter 2023 results, falling short of earnings estimates by a penny and revenue estimates by $35 million. For the fourth quarter of 2023, the company expects revenues in the range of $3.93-$4.27 billion and earnings per share in the band of $1.35-$1.57.

Investor Takeaway

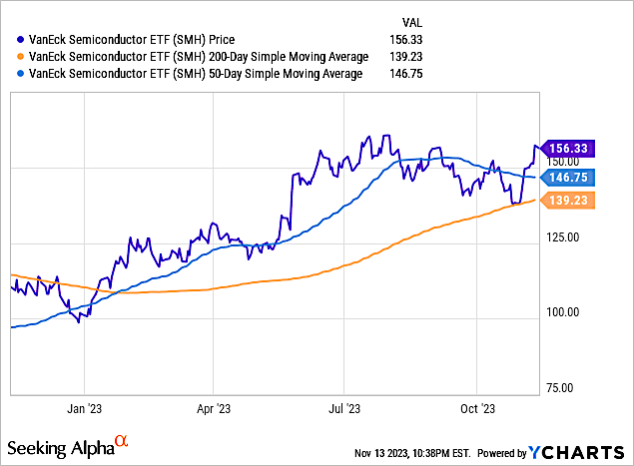

In early November 2023, SMH sustained its upward momentum, surging beyond the short-term resistance at $150 and validating a breakout. Prior to this, the stock navigated towards support for consolidation around $140, where it effectively attracted buyers in proximity to the 200-day Simple Moving Average (SMA). Subsequently, the stock reversed its trend, establishing a foundation above the 50-day SMA, as shown in Chart 5.

YCharts

Chart 5

SMH is currently positioned well above the resistance level and recently hit an all-time high of $165.44 on November 20.

Chart 6 shows that Seeking Alpha’s Quant ratings give SMH a Strong Buy.

Seeking Alpha

Chart 6

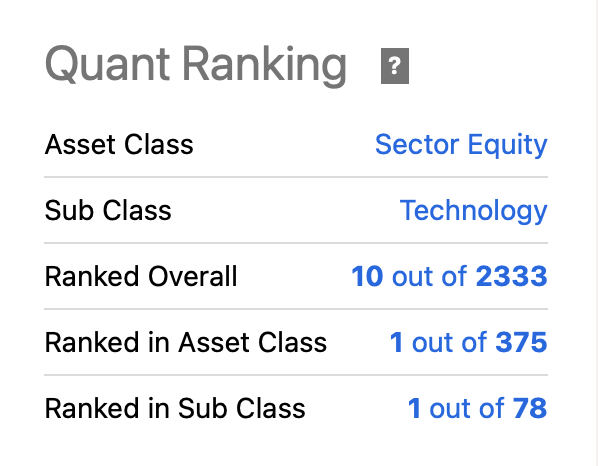

Chart 7 shows Quant Ranking for SMH. It shows the ETF has an overall ranking of 10 out of 2333 and 1 out of 375 in its asset class.

Seeking Alpha

Chart 7

As I noted in Table 1 above, SMH has a one-year performance of 42.95%. While strong and well above the average of companies ranked 2 through 10, which is 31.0%, the strong Nvidia growth of 206.89% dominates the Top 10 rankings.

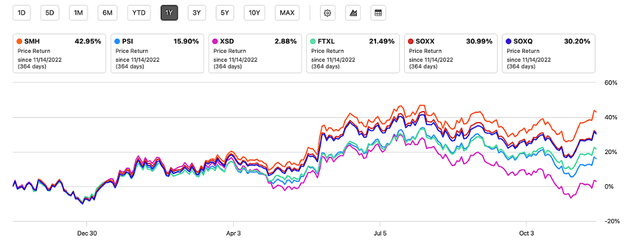

While SMH has outperformed other ETF peers, as shown in Chart 8, the impressive performance of SMH can be largely attributed to its overweight holding in Nvidia.

Seeking Alpha

Chart 8

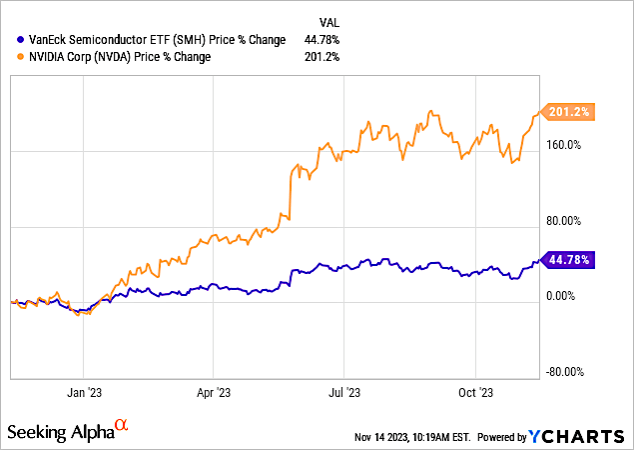

That raises the question – why invest in SMH when Nvidia has a much higher share performance. One obvious answer is diversity. Another is that investing in stocks is complex, and investing in an ETF moves the difficulty to a professional ETF manager. Finally, ETFs act as a buffer against volatile trading sessions. For example, Chart 9 shows how volatility is moderated with SMH (blue line) compared to NVDA. Yes, the growth rate is less for ETF, but investing, and particularly trading, is not for the faint of heart. Thus, a long-term investor would probably take the ETF approach – buy it and don’t worry about it.

YCharts

Chart 9

And since SMH is top heavy with 33.3% of its Net Assets taken up by just two stocks, why not invest in a different ETF that is more diversified? For example, in a December 5, 2021 Seeking Alpha article entitled “Is XSD A Better Semiconductor ETF Than SMH?” Chart 5 shows that the Percent of Net Assets for the Top 10 holdings of SPDR S&P Semiconductor ETF (XSD) ranged between 2.68% and 2.82% in December 2021. Currently, the Top 10 holdings range between 3.02% and 3.49%. However, while SMH is up 42.95% for the year, XSD is up just 2.88% for the year.

I rate SMH a Buy.

Read the full article here

Leave a Reply