If you love stock investing or even business in general, it’s hard to not be captivated by founder success stories. From Steve Jobs to Elon Musk, there are more than enough examples of founder success to inspire the next generation of entrepreneurs.

For investors, finding the next Jobs can be a tall order but the rewards can be astronomical. As author and investor Christopher Mayer put it, “Many of the greatest businesses of the last 50 years had a human face behind them – an owner with a vision and tenacity and skill…” I completely agree with Mayer and believe many investors are on the hunt for the next legendary founder.

Today I’d like to discuss an exciting growth company that was created and is still led by the company’s four original founders. That company is Sprout Social.

The Company

Sprout Social (NASDAQ:SPT) has created a platform to help companies manage the various complexities around social media. The company’s cloud software creates a centralized platform so organizations can manage their social media across the various major social media sites such as Twitter, Facebook, TikTok, Pinterest and many more.

Social media has never been more important to businesses. As stated by Sprout Social’s president Ryan Barretto during the latest quarterly call, “Business leaders nearly universally agree that Social has become the primary channel for customer care, customer retention and customer feedback. Social is where your customers are and it has become imperative for brands to meet them there.”

I agree with Barretto and research from a recent Harris Poll illustrates his point as 80% of business leaders anticipate their company social media budget will increase over the next three years and 44% of leaders expect their social media budget will increase by more than 50% despite macroeconomic pressures impacting company budgets.

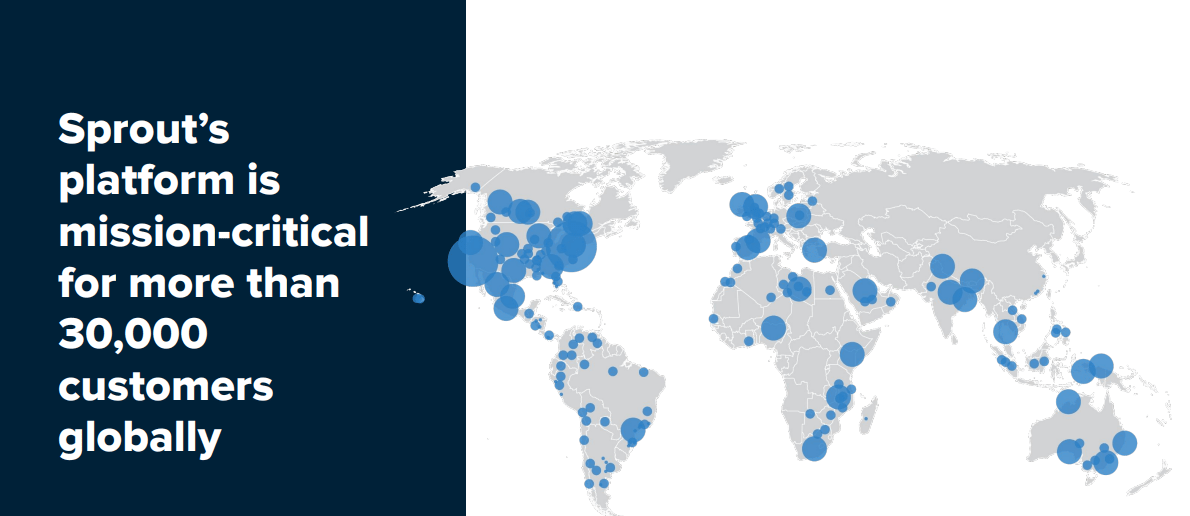

As stated on the company’s 10-K filing, Sprout Social has more than 34,000 customers across more than 100 countries:

Investor Presentation

Sprout Social certainly has a large number of customers and that number will likely increase as Sprout also recently acquired Tagger Media, Inc. for $140 million last month. Tagger is an influencer marketing and social intelligence platform. As Sprout Social’s CEO stated during the company’s Q2 earnings call, “We believe the combination of Tagger and Sprout will allow us to create a market leader in both social media management and influencer marketing.”

Moat and Opportunity

Sprout Social does appear to have an advantage within this industry as their platform is “all-in-one” and as the company states the platform is “easy to use, secure, and reliability.” Sprout Social’s main competitors include Hootsuite, Khoros, and Sprinklr.

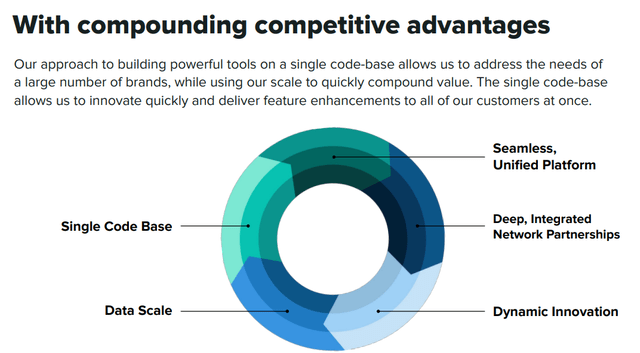

The company notes several key competitive advantages which act as key barriers to entry within their industry. A few of which include a unique single code base, deep, integrated network partnerships as well as few more which are shown below:

Investor Presentation

It seems Sprout’s customers can adjust the number of users per month and subscriptions can vary from one month to one-year or multi-year agreements. I do think having partnerships such as Sprout’s current partnership with Salesforce are vital to the company’s success.

There does appear to be a large opportunity in this industry. Social media has never been more important for businesses, and it will certainly play a key role for organizations in the next decade.

It is important for brands to be present on social media because consumers expectations are extremely high. As Sprout Social mentioned within their 10-K:

Consumers demand that brands be present and responsive across social networks, with more than 76% anticipating a response to a social media message within 24 hours and more than 90% expecting a response within 48 hours, according to The 2022 Sprout Social Index. According to the same report, when brands take too long to respond, 36% of consumers say they’ll share that negative experience with friends and family, 31% say they won’t complete their purchase, and 30% say they will buy from a competitor instead.”

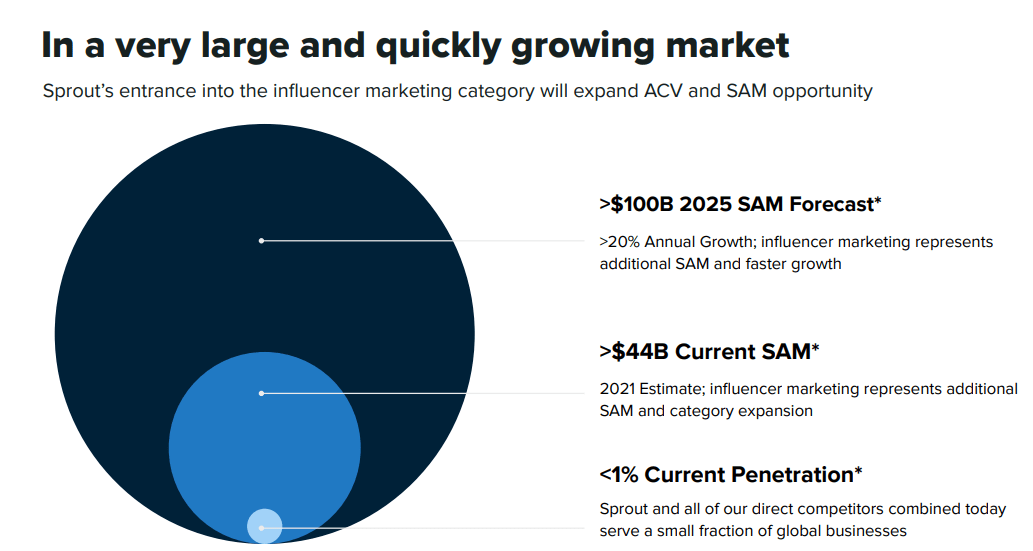

As social media presence is becoming more essential to businesses, Sprout believes their serviceable addressable market (SAM) is currently $44 billion and will jump to over $100 billion by 2025 as depicted in the graphic below:

Investor Presentation

Management

Sprout Social was founded in 2010 by four individuals, Justyn Howard, Aaron Rankin, Gil Lara and Peter Soung. Amazingly, all four of the company’s original founders are still with the organization. Soung is the Head of Growth, Lara is the Chief Creative Officer, Rankin is the Chief Technology Officer, and Howard is the CEO.

The company’s Chief Financial Officer is Joe Del Preto who previously worked at Groupon.

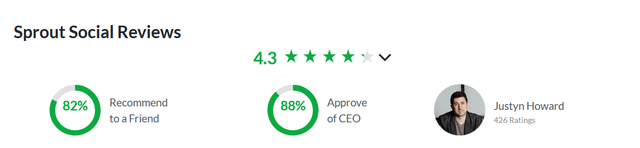

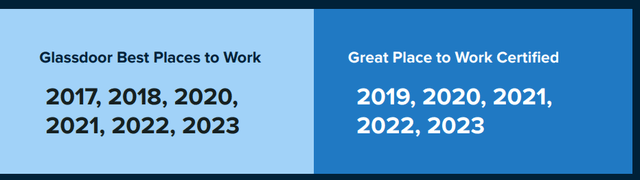

As you can see from these Glassdoor ratings, Sprout Social is viewed as a fantastic place work. Additionally, employees at the company clearly approve of Howard as the CEO.

Glassdoor

Sprout Social has been rated as one of the best companies to work for over the last several years as you can see below:

Investor Presentation

Sprout Social’s management team has done a wonderful job of creating such an admirable company culture.

Financials

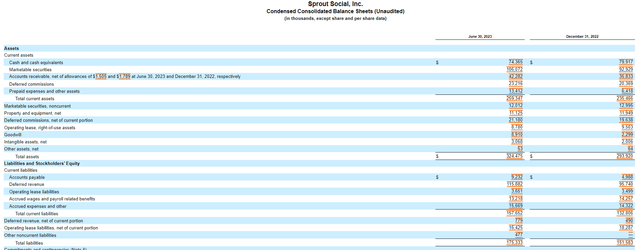

Sprout Social has a respectable balance sheet as the company has a cash balance of roughly $75 million after this latest quarter. Also, the company has a total current assets balance which covers all of the organization’s liabilities which are mostly deferred revenue:

SEC.gov

For Q2 2023 Sprout Social generated revenue of roughly $79 million which is an increase of 29% compared to Q2 2022. Most of this revenue was subscription revenue with services revenue accounting for less than $1 million for the quarter.

Core annual recurring revenue (ARR) from existing customers spending greater than $2,000 increased 33% and now represents 96% of the company’s total ARR. The number of customers spending more than $10,000 in ARR grew 27% compared to prior year. The number of customers contributing more than $50,000 in ARR grew 48% from Q2 2022 and the number of customers spending more than $250,000 in ARR grew more than 130% compared to prior year.

However, the total number of customers dropped 1% compared to June 30, 2022, as the company is focusing on customers contributing a higher ARR. The total number of customers for the quarter was 33,159.

Risks

Sprout Social has numerous risks which the company has outlined in depth within the risk factors section of their 10-K. In my opinion, the following three risks are the most serious risks for the company.

It is vital for Sprout Social to maintain key partnerships and third-party relationships. For Sprout, it is critical to be able to interact with third-party APIs. As social media network APIs are crucial for the company the business could suffer if the access to these APIs wasn’t provided or access becomes less favorable. Additionally, if Salesforce decided to integrate with another partner or create a similar service to Sprout’s it could adversely harm the business. However, I think it’s more likely Salesforce would simply buy out Sprout Social.

Second, the company needs to gain new customers. Most of the company’s growth is from current customers spending more annually. This grow can only last for so long. The Tagger acquisition will likely help with the continued growth but without new customers revenue growth will not continue at this current level.

Lastly, the company has an accumulated deficit of over $225 million. Sprout Social has never achieved profitability on an annual or quarterly basis. If the current quarter is any indication the company isn’t closer to achieving GAAP profitability.

Valuation

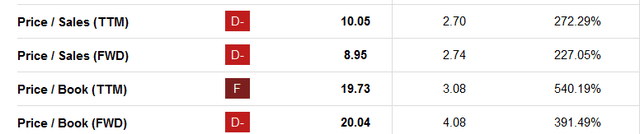

Similar to many of the other companies I have reviewed, Sprout Social is certainly not a cheap stock. As you can see from the below valuation metrics from Seeking Alpha, the overall value grade is a “D-” Sprout Social is higher than the sector median for many of these metrics such as the price to sales or price to book ratios shown below:

Seeking Alpha Seeking Alpha

Sprout Social is not close to becoming profitable so I wouldn’t be a buyer unless the stock dropped closer to its 52-week low.

Conclusion

Sprout Social appears to the leader in a niche industry, and I like that company’s four founders are still with the organization and have created such a stellar company culture as the Glassdoor ratings clearly illustrate.

I think Sprout’s partnerships are vital to the company’s on-going success such as the one with Salesforce. However, I do think Sprout’s product isn’t as “sticky” as similar SaaS products as thus the company is more reliant on maintaining and establishing such partnerships.

Additionally, the company is still posting large losses and doesn’t appear close to getting to profitability.

Given these factors, I’m waiting on the sidelines for a few quarters to see how the Tagger acquisition unfolds and to see if the company can establish additional key partnerships and get closer to profitability.

Read the full article here

Leave a Reply