Every year during Halloween, Solo Brands (NYSE:DTC) gets a good bit of free marketing. At least, as a DTC shareholder, that’s how I like to think about it. If you’re confused, I’m referring to the numerous firepits you see set up in your neighbor’s driveways during trick-or-treating. You may even have one yourself.

As I walked from house to house with my kids this year, I couldn’t help but notice the vast number of stainless steel firepits in driveways. Of the 70 or 80 houses we visited, I’m guessing 30% had a firepit in the driveway. I’m sure not all were Solo branded, but a good many were. And it made me optimistic about DTC’s future as I don’t recall all these firepits being there last year.

Indeed, DTC is one of my higher conviction growth picks. In this article, I’ll review the bull case for why this microcap maker of Solo Stove (backyard accessories) and Chubbies (clothing) has mega potential.

What I Don’t Like

Before jumping in with all the things I like about DTC, I’ll start by discussing some of the things I don’t like about the company.

Prior acquisitions lacked purpose

Over the past few years, DTC made acquisitions which I believe lacked clear purpose. Most notably, ORU Kayak and ISLE paddleboards.

At the time of acquisition, DTC was comprised of the Solo Stove brand solely. And selling kayaks and paddleboards just didn’t seem to make a lot of sense. Indeed, it still doesn’t in my opinion.

This is especially true when you consider neither business has much revenue. In DTC’s annual report for 2022, the company disclosed a purchase price of $19.3 million for ORU Kayak which had $28.2 million in revenue. Whereas ISLE was purchased for $21.8 million and had $17.8 million in revenue.

From a growth perspective, I can’t see DTC making meaningful share gains in the kayak or paddleboard business. And even if it did, is there enough TAM to make a difference in market cap? I’m not convinced.

I could even argue this point for the Chubbies brand which DTC acquired for $93 million and had $89.3 million in revenue in 2022. But this acquisition has been far more successful than the others. The brand will likely comfortably surpass $100 million in revenue for 2023.

But still, Chubbies, which sells swimwear and leisure clothing, fits better with ORU Kayak and ISLE than it does Solo Stove.

Goodwill is a future headwind

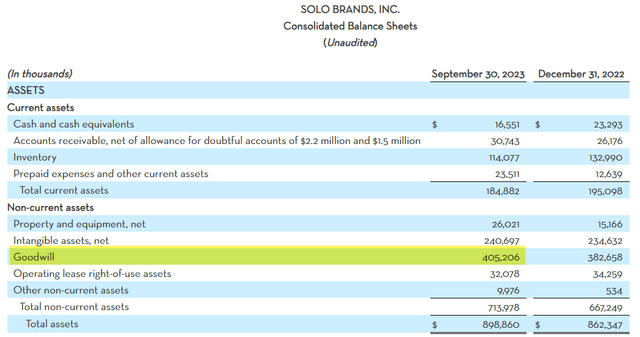

DTC’s prior acquisitions have resulted in a lot of goodwill on the balance sheet. Indeed, DTC’s Q3 2023 earnings release showed $405 million in goodwill, which is actually higher than the company’s market cap of $365 million as of this writing.

As such, I expect impairment charges to be a headwind to EPS in the future. I understand the cash has already been spent, thus the impairment will be “non-cash”. But it has the potential to be a drag on EPS, market sentiment, and share price.

DTC Balance Sheet Q3 2023 (DTC Investor Relations)

DTC shareholders received a dose of this in Q2 2022 when the company booked a $27.9 million impairment charge to write-down goodwill associated with the ISLE acquisition. Which, as mentioned above, didn’t appear to provide much value.

DTC’s past history of questionable acquisitions and use of capital gives me pause. It’s possible the company continues down this path of M&A for the sake of M&A. But as I’ll highlight later, I don’t believe that will be the case.

What I Do Like

Expansion into wholesale

As Solo Brands’ ticker ‘DTC’ implies, the company was founded on direct-to-consumer. But in 2023, the company shifted to an omni-channel approach, leaning more heavily into wholesale with the expectation its “DTC” business may dip over the short-to-medium term.

In its most recent quarter, DTC’s wholesale revenue grew 114% year-over-year while direct-to-consumer dipped 12%. What’s encouraging, though, is Solo’s wholesale and “DTC” channels have a similar contribution margin.

Meaning, profits are similar regardless of channel. Gross margins may be lower for wholesale, but factor in marketing and advertising expenses required for “DTC”, and it’s a wash on the bottom line.

Plus, Solo products sitting on shelves in Target (TGT), Costco (COST), Academy Sports and Outdoors (ASO), REI, Dick’s Sporting Goods (DKS), SCHEELs, and other retailers is phenomenal exposure DTC may not otherwise receive via its website.

If DTC’s growth runway in wholesale were a baseball game, we’d be in the bottom of the first.

Free cashflow generating

In my experience, it’s unusual for a company that’s investing for growth to be throwing off a significant amount of free cashflow (“FCF”). But that’s precisely what we find in DTC. It’s a capital-lite business.

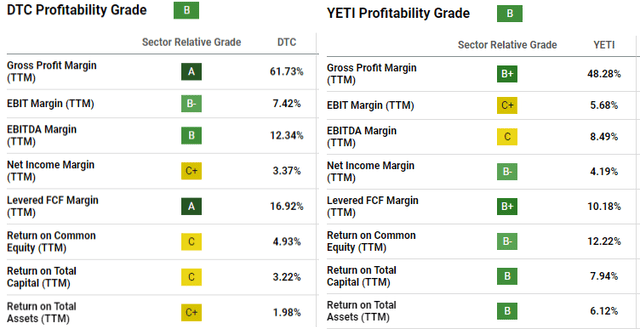

For the trailing-twelve-months (“ttm”), DTC generated $88 million in FCF on revenue of $519 million. That’s a 17% FCF margin. It also means DTC is trading at a price-to-FCF ratio of 4.15.

To put it in perspective, for the ttm YETI Holdings (YETI) generated $162 million in FCF on revenue of $1.59 billion, which is a 10% FCF margin. So, DTC’s revenue is only a third of YETI’s, while the company generates half as much FCF as YETI.

DTC vs YETI Profitability Grade (Seeking Alpha)

Need I remind you, YETI’s current market cap is $3.65 billion (22.5 price-to-FCF ratio). DTC’s is $365 million. That’s a 10x difference. Which seems way out of balance considering how much FCF DTC is generating on a relative basis.

Plus, I can’t help but see similarities in DTC and YETI with respect to their customer base. DTC is sold in many of the same retailers as YETI, and I think it’s on a similar growth trajectory.

Refocused M&A strategy

As mentioned above, DTC hasn’t been very disciplined in the mergers & acquisitions space. During the Piper Sandler Growth Frontiers conference on September 13, DTC CEO John Merris admitted as much. He even mentioned DTC’s own employees were questioning its prior acquisitions, and were struggling to understand the company’s direction.

However, Merris also stated the company would be much more disciplined and strategic with M&A opportunities going forward, focusing specifically on brands which fold in seamlessly into the Solo brand (i.e. outdoor living and backyard experience). Merris pointed to DTC’s recent acquisitions of Terraflame and IcyBreeze as positive examples.

After listening to Merris address shareholders at the Piper Sandler conference, I feel more confident DTC will make better capital allocation decisions in the future. (FYI – the transcript isn’t available on Seeking Alpha, but you can listen to a recording on the Quartr app).

Valuation

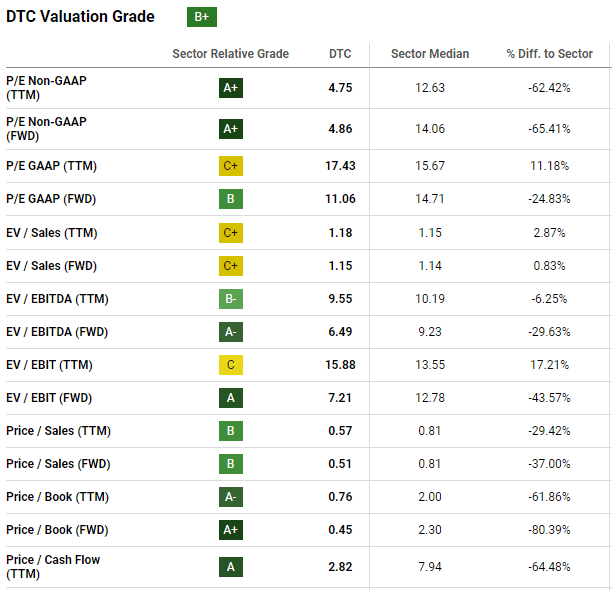

I’ve mentioned a few valuation metrics already, but let me build on it here. Seeking Alpha assigns a valuation grade of B+ to DTC. And as you can see, the vast majority of valuation ratios indicate DTC is trading at a discount to the sector median.

DTC Valuation Grade (Seeking Alpha)

If I go back to the YETI example, and DTC generates half as much FCF as YETI, could we assume it should trade at half the market cap? Maybe, and if so that’d be a valuation of $1.8 billion, which is nearly 5x DTC’s current valuation.

Let’s also look at price-to-sales (P/S). In the current macroenvironment, I’m not surprised to see the sector median at 0.81 as listed above. But DTC is trading at a 30% discount to that.

In my opinion, DTC is attractively priced at current levels, especially when considering its future potential.

Conclusion

I’m a huge fan of Christopher Mayer’s book, “100 Baggers: Stocks That Return 100-to-1 and How To Find Them.” If you haven’t read it, I highly recommend.

In the book, Chris highlights a common characteristics of past 100 baggers, and that’s that each started from a market cap of less than $500 million. Because when you’re already close to the floor, the ceiling is a long way up. DTC is very close to the floor.

Personally, I like DTC’s growth trajectory, profitability, and potential to return multiples of my original investment. I’m not claiming DTC as the next 100 bagger, so please don’t misinterpret. But I like it’s potential to return 5x or better over the long haul.

Read the full article here

Leave a Reply