On Tuesday, October 31, 2023, giant midstream master limited partnership Enterprise Products Partners L.P. (NYSE:EPD) announced its third-quarter 2023 earnings results. At first glance, these results were mixed, as the company managed to beat the expectations of its analysts in terms of top-line revenue but still announced an earnings miss. However, as I have pointed out in numerous previous articles, earnings per share figures are not especially important for a midstream company because they account for a number of different things that do not represent money leaving the business. The same is generally true for just about any business that operates in a very capital-intensive industry.

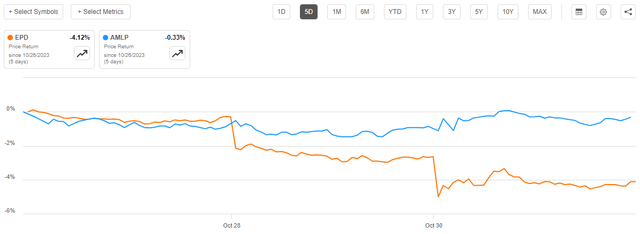

The most important metrics to use in evaluating the performance of a midstream company are the adjusted EBITDA (a proxy for pre-tax cash flow) and distributable cash flow. Enterprise Products Partners did okay here as both figures did increase slightly year-over-year, but it unfortunately was not very much growth. For its part, the market has been less than impressed, and Enterprise Products Partners’ partnership units are down 4.12% over the past five days:

Seeking Alpha

That is, to put it mildly, a fairly large decline for only a week’s time. It is made even more disappointing by the fact that the Alerian MLP ETF (AMLP) is only down 0.33% over the same period:

Seeking Alpha

Thus, the market is clearly disappointed in Enterprise Products Partners’ operating results. Admittedly, so am I as there is very little growth here.

With that said, the company’s long-term fundamentals remain intact and it does boast an impressive 7.68% yield at the current stock price. While yields have generally been rising over the past three months in all market sectors, that is still a very respectable yield that will appropriately reward investors for sticking with the company as its long-term story plays out.

Earnings Results Analysis

As long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Enterprise Products Partners’ third quarter 2023 earnings report:

- Enterprise Products Partners brought in total revenues of $11.998 billion during the third quarter of 2023. This represents a 22.43% decrease over the $15.468 billion that the company brought in during the prior year quarter.

- The company reported an operating income of $1.573 billion in the most recent quarter. That compares rather unfavorably to the $1.630 billion that the company reported in the year-ago quarter.

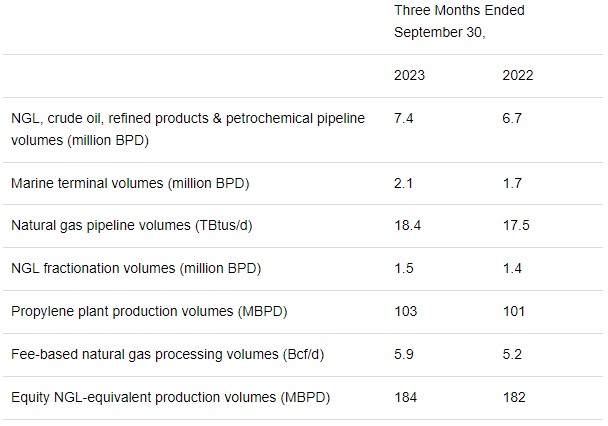

- Enterprise Products Partners transported an average of 18.4 trillion BTUs of natural gas per day through its nationwide pipeline transportation network. This represents a 5.14% increase over the 17.5 trillion BTUs of natural gas per day that the company transported on average during the equivalent period of last year.

- The company reported a distributable cash flow of $1.869 billion during the reporting period. That represents a very slight 0.05% increase over the $1.868 billion that the company reported during the corresponding quarter of last year.

- Enterprise Products Partners reported a net income of $1.318 billion during the third quarter of 2023. This represents a 2.30% decrease over the $1.349 billion that the company reported during the third quarter of 2022.

It seems certain that the first thing that anyone reviewing these highlights will notice is that Enterprise Products Partners generally reported worse results than it did in the prior-year quarter. Ordinarily, we would assume that this was caused by the company transporting, processing, or otherwise handling fewer resources than in the year-ago quarter. After all, the company’s business model typically results in the company’s financial performance correlating to the resource volumes that it handles. I explained how this works in a previous article on a similar company:

Basically, the company enters into long-term contracts with its customers. Under these contracts, the company provides transportation for the customer’s natural gas, natural gas liquids, crude oil, and other hydrocarbon products. In exchange, the customer compensates Enterprise Products Partners based on the total volume of resources that are handled, not on their value. This provides the company with a great deal of insulation against fluctuations in resource prices. In addition to this, the contracts that the company has with its customers include minimum volume commitments that specify a certain quantity of resources that must be sent through the company’s infrastructure or paid for anyway. This provides some protection against revenue and cash flow declines that might accompany production cuts. As it is typical for upstream producers to cut production when resource prices decline, this provides Enterprise Products Partners with further protection against the inherent volatility of commodity prices.

In short, the company’s revenue and cash flow should show some correlation with the volume of resources that it handles. However, as we can see here, Enterprise Products Partners generally reported higher resource volumes across the board:

EPD Earnings Press Release

Thus, we would expect that its cash flows would be higher than during the previous quarter. In fact, we do see that as both adjusted EBITDA and distributable cash flow showed a slight year-over-year improvement:

| Q3 2023 | Q3 2022 | % Change | |

| Adjusted EBITDA | $2,327 | $2,258 | 3.06% |

| Distributable Cash Flow | $1,869 | $1,868 | 0.05% |

(all figures in millions of U.S. dollars)

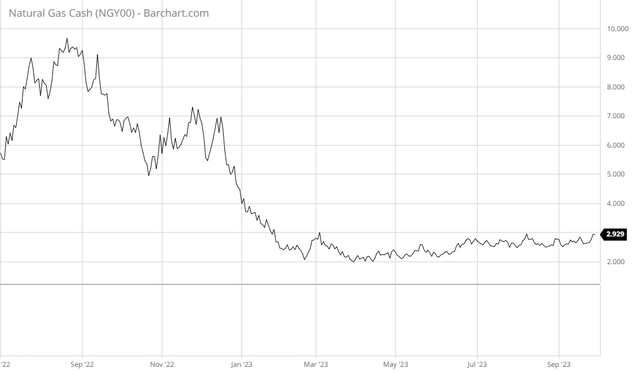

However, the company’s revenue was still down substantially relative to the prior-year quarter. Perhaps surprisingly given the company’s business model, a big reason for this is that natural gas prices were much lower during the most recent quarter than they were during the equivalent quarter of last year. We can see this here:

Barchart.com

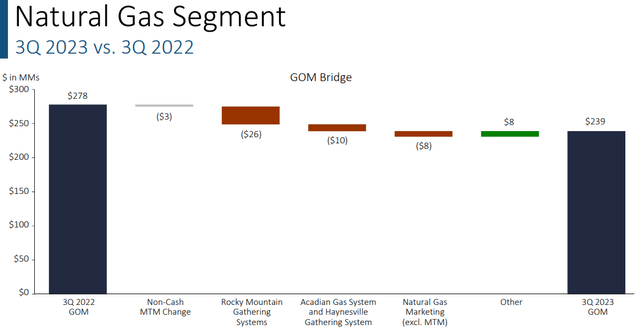

This had a negative impact on the company’s gas processing business’s revenue. This comes from the fact that this business operates much like a refinery in that both revenue and cost of goods sold increase or decrease with resource prices. Enterprise Products Partners’ margin is the difference between these two figures. Normally, we look at the company’s margins to measure its performance for this reason. After all, the company’s margin tends to be much more stable over time than the price of natural gas. Unfortunately, the company’s margins decreased year-over-year as well. As we can see here, the company’s natural gas unit reported a gross operating margin of $239 million in the third quarter of 2023. This represents a 14.03% decrease over the $278 million gross operating margin that the company had in the prior year quarter:

Enterprise Products Partners

Enterprise Products Partners provides two major reasons for this:

- The Rocky Mountain Gathering System had lower volumes than during the equivalent quarter of last year. In addition, some of the fees that the company collects from this system are indexed to local natural gas prices, which were lower year-over-year.

- Natural Gas Marketing activities experienced lower average margins due to differences in regional price differentials.

The most important factor here is the first one. As noted, one of the causes of the year-over-year decline in the company’s gross operating margin in the Rocky Mountain region is that it collected a lower volume of resources. As these are gathering pipelines, which collect the resources at the wellhead and then transport them to a processing facility or larger long-haul pipeline, that almost assuredly means that natural gas production volumes in the region were down year-over-year. This fits in with some comments that I made earlier this year. In short, American producers have been cutting production of natural gas in an attempt to reduce the oversupply of natural gas that has been plaguing the market for longer than a year now. The fact that Enterprise Products Partners experienced a decline in gathered resource volumes suggests that it may be impacted by this.

The fact that a lower volume of gathered resources would have an impact on Enterprise Products Partners’ gross operating margin may seem to be at odds with the comments that I made earlier about the company’s contracts with its customers including minimum volume commitments. This is not the case though, as these commitments only require a certain minimum volume to be transported. It is certainly possible for volumes to decline during a given period and still remain above the minimum, which would have an impact on the company’s cash flows. In addition, not all of its contracts necessarily have a minimum volume commitment. Thus, the only real protection that these commitments provide to Enterprise Products Partners is that its volumes will not fall below a specified level. There is no guarantee that its volumes (and by extension operating margin and cash flow) will not fall at all.

As we already saw though, Enterprise Products Partners only saw volume declines in a few certain areas. Overall, the company’s volumes increased year-over-year. Jim Teague, chief executive officer of Enterprise Products Partners, pointed this out in the earnings press release:

We handled record volumes across our midstream system including our liquids pipelines, natural gas pipelines, NGL fractionators and marine terminals. In total, our pipelines transported 12.2 million equivalent BPD and our marine terminals handled 2.1 million BPD of NGLs, crude oil, refined products and petrochemicals. These record volumes offset the impact of lower natural gas gathering and processing margins due to a decrease in natural gas and NGL prices compared to the third quarter of 2022.

This essentially sums up exactly what I have illustrated so far throughout this article. Enterprise Products Partners’ natural gas operations generally struggled as lower prices have prompted producers in certain areas to cut back on production and lower sales prices pushed down revenue (and cost of goods sold) from the company’s processing plants. However, it was generally able to offset the poor performance of this business unit with strength elsewhere. Overall, the company did okay during the quarter, but it seems likely that low natural gas prices will weigh on its performance for a little while. This is particularly true if the National Oceanic and Atmospheric Administration is correct about the winter of 2023 to 2024 being warmer than normal, as that will suppress natural gas consumption and keep prices down.

Growth Opportunities

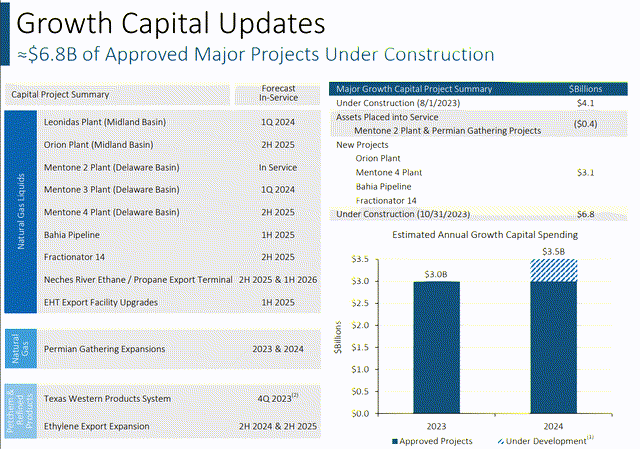

While Enterprise Products Partners may simply tread water for the next few quarters, it does still have some growth potential over the medium to long term. This comes from the fact that the company has a number of new growth projects that it will be bringing online between now and the end of 2025. In fact, the company has $6.8 billion worth of growth projects under construction:

Enterprise Products Partners

These provide the company with a solid pipeline for growth through the end of 2025. After all, Enterprise Products Partners has already received contracts from its customers for the use of these new projects. This ensures that the company is not spending an enormous sum of money to construct new infrastructure that nobody wants to use. It also ensures that the company’s new projects should be cash flow positive as soon as they begin operation. As such, we should expect that each of these projects will have an accretive impact on the company’s adjusted EBITDA and distributable cash flow during the quarter in which they start operating. Ultimately, this positions the company pretty well to deliver relatively consistent growth over the next two years.

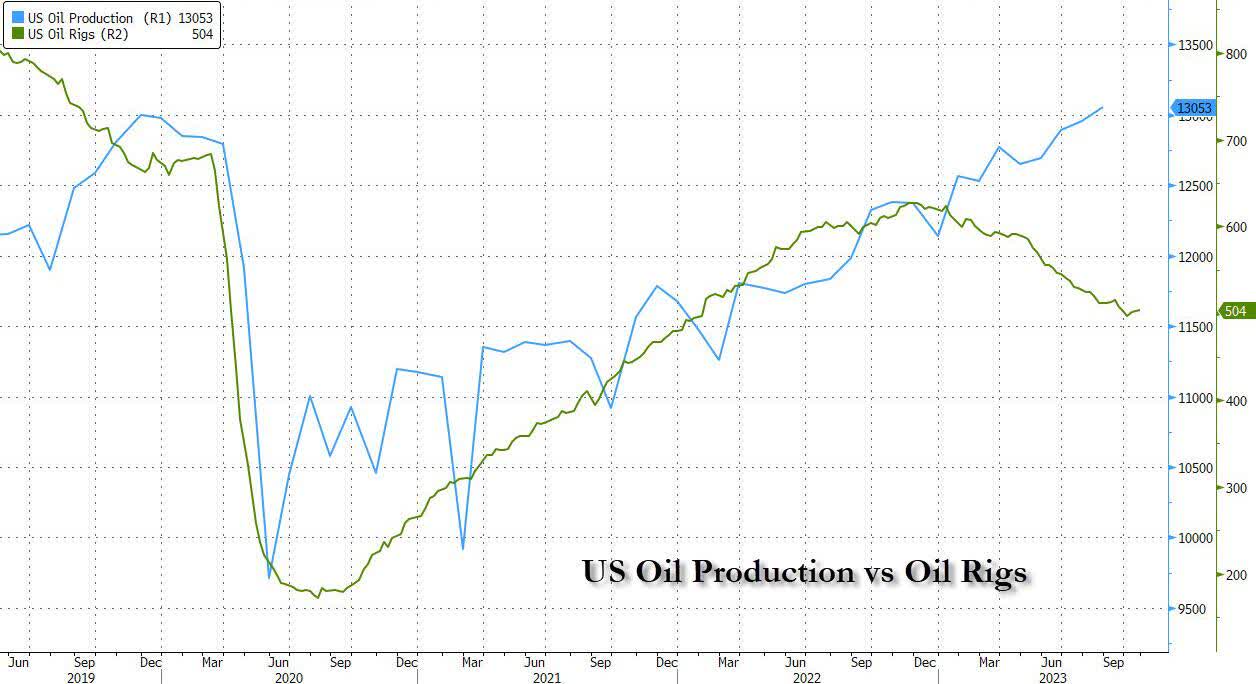

There may be some reason to expect that more opportunities for growth will present themselves at some point. In August 2023, U.S. crude oil production hit an all-time high of 404.6 million barrels, breaking the former record of 401.726 million barrels set in July 2023:

Zero Hedge/Data from U.S. Energy Information Administration

August 2023 represents the first month in which the United States broke its pre-pandemic production record of 402.391 million barrels, which was set in December 2019. That is not the story that we have been hearing in the media, but the fact is that American energy production has been lower than its pre-pandemic highs for nearly all of the past three years. The biggest reason for this is that American shale producers have been deliberately holding back on production growth in order to avoid oversupplying the market with oil and driving down prices as well as to provide their shareholders with a better return. After all, traditional energy was the worst-performing sector in the S&P 500 Index (SP500) over the 2010 to 2020 period and many investors have become somewhat irritated with the ability of energy companies to provide a competitive return.

It is still the case that energy companies are holding back production, despite setting new records this month. As we can see above, the U.S. oil drilling rig count is lower than it was during either 2022 or during the pre-pandemic boom. What has happened is that improvements in technology and other factors have caused wells to be much more productive than in the past.

We can see some potential for forward growth for Enterprise Products Partners if this continues. After all, there is no sense in producing crude oil or other hydrocarbon products if these products cannot be brought to the market and sold. The transportation of crude oil, natural gas, and other hydrocarbons is Enterprise Products Partners’ core business so it is reasonable to assume that it will be able to secure some contracts to transport the incremental production. That should have a positive impact on the company’s cash flow due to the business model that it employs. Thus, we may see the company announce some growth projects beyond the ones that it currently has in development before too long.

Financial Considerations

As I pointed out in a previous article:

It is always important that we analyze the way that a company finances its operations before investing in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. That is typically accomplished by issuing new debt and using the proceeds to repay the existing debt. As new debt is issued with an interest rate that corresponds to the market interest rate at the time of issuance, this can cause a company’s interest expenses to go up following the rollover.

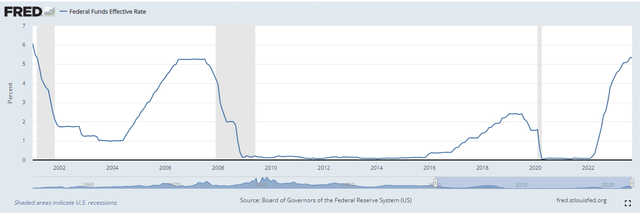

As of the time of writing, the effective federal funds rate is at 5.33%, which is the highest level that we have seen since early 2001:

Federal Reserve Bank of St. Louis

As such, it is essentially certain that any debt rollover today will cause a company’s interest expenses to go up. After all, most companies do not issue thirty-year bonds. Thus, a high debt load or especially a high level of maturing debt in the near future will almost certainly cause a company’s interest expenses to go up, which will pressure its cash flows and ability to reward its common unitholders.

Ultimately, though, it is a company’s ability to carry its debt that is most important. After all, in the absence of maturities, the company’s only real costs related to its debt are the regular servicing costs.

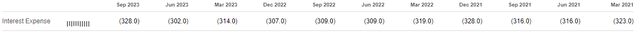

During the third quarter of 2023, Enterprise Products Partners had total interest expenses of $328.0 million. This is pretty much in line with what the company had over the past two years:

Seeking Alpha

Thus, it does not appear that the high interest rate environment is affecting this company very much. This is a good sign, and it is something that we expected. After all, one of the prevailing trends across the midstream sector over the past few years is for companies to reduce their debt and strengthen their balance sheets. This is mostly being done to reduce their dependence on the capital markets for financing and become fully self-sufficient, but it also has the positive effect of reducing their exposure to interest rate increases. This is something that most investors should find rather comforting.

The company’s interest expenses only represent 14.10% of its $2.327 billion adjusted EBITDA during the third quarter. Thus, it appears that Enterprise Products Partners should have no real trouble carrying its debt load.

The usual metric that we use to evaluate the financial structure of a midstream company is its leverage ratio. This ratio is also known as the debt-to-adjusted EBITDA ratio and it tells us how many years it would take the company to completely pay off its debt if it were to devote all of its pre-tax cash flow to that task.

As already mentioned, Enterprise Products Partners had an adjusted EBITDA of $2.327 billion in the third quarter, which works out to $9.308 billion on an annualized basis. The company currently has a debt of $29.2 billion. This gives it a leverage ratio of 3.14x based on its annualized adjusted EBITDA. This is a very reasonable ratio that is well below the 5.0x that Wall Street analysts typically find acceptable. As I have pointed out before, many of the best companies in the industry are now below 4.0x due to their efforts to reduce debt over the past three years. As we can see, Enterprise Products Partners easily fits into this category. As such, we probably do not need to worry too much about the company’s debt load.

Distribution Analysis

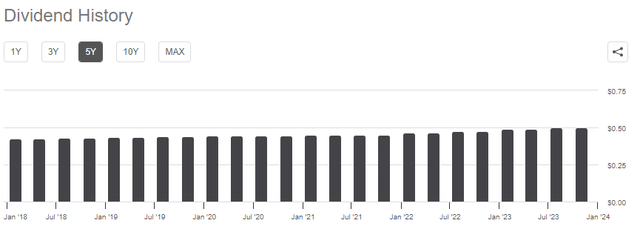

One of the biggest reasons why investors purchase units of master limited partnerships is because of the high yields that these companies typically possess. Indeed, Enterprise Products Partners is no exception to this as the company currently boasts a 7.68% yield, which is higher than many other things in the market. The company has also been quite good about growing its distribution over time, as we can see here:

Seeking Alpha

This is very nice to see right now considering that the high level of inflation in the economy is constantly reducing the purchasing power of the distribution. That is obviously a real problem for anyone who depends on the company’s distribution to pay their bills or finance their lifestyles, but fortunately, the regular distribution increases help to offset this decline of purchasing power.

As is always the case, it is critical that we ensure that the company can actually afford the distribution that it pays out. After all, we do not want to be the victims of a distribution cut that reduces our incomes and almost certainly causes the unit price to decline.

The usual way that we judge a midstream company’s ability to cover its distribution is by looking at its distributable cash flow. The distributable cash flow is a non-GAAP measure that theoretically tells us the amount of money that was generated by a company’s ordinary operations and is available to be distributed to the limited partners.

As stated in the highlights, Enterprise Products Partners reported a distributable cash flow of $1.869 billion in the third quarter of 2023. This was sufficient to cover the distribution 1.7 times over, which is acceptable. As a general rule, Wall Street analysts consider anything over 1.20x to be sustainable over the long term. However, I am more conservative and like to see this ratio above 1.30x in order to add a margin of safety to the investment. As we can clearly see, Enterprise Products Partners’ coverage satisfies even this more restrictive requirement so we should have very little to be concerned about right now.

Conclusion

In conclusion, Enterprise Products Partners reported results that were overall worse than the market wanted to see. The impact of lower natural gas prices and upstream production reductions had a negative impact on that aspect of the company’s business, although it was able to offset this by strong performance across the rest of its franchise. The company continues to be positioned for growth, but it may take a while for this growth to fully play out. Fortunately, the company boasts a very strong balance sheet and a high distribution that appears to be sustainable. As such, investors should still be reasonably well-rewarded while we wait for the company’s growth story to play out.

Read the full article here

Leave a Reply