Post Q3 results, today we are back to comment on Idorsia (OTC:IDRSF). Since the beginning of the year, the company’s stock price has declined by 87.62%, and we followed up with two publications called Dilution Risk Causes Downgrade To Hold and Restructuring In Place to encourage investors to remain cautious in evaluating a potential investment. There are many moving parts to consider and two essential pieces of news to report that explain the Q3 analysis. In late July, Idorsia communicated “a complete restructuring with a cost reduction target of 50%. Looking at the press release, up to 500 positions could become redundant out of 1300 employees. This will be mainly related to the R&D team and support functions. This initiative will be effective in early 2024; however, we already see lower R&D costs.” Secondly, in Q2 results, the company announced the details of the Sosei Heptares deal.

Starting with the one-off events, the company announced it had cut 475 jobs and up to 300 terminations in the R&D area. Cost reduction was painful; however, it protected the company’s long-term projection. Redundancy procedures were booked with a negative charge of CHF 11 million.

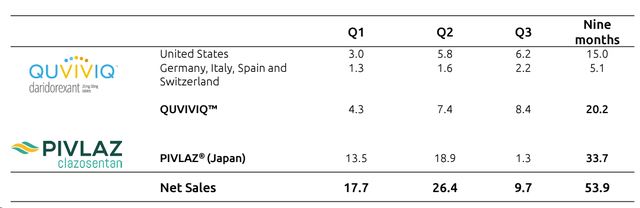

As a reminder, Idorsia sold its APAC operations (ex-China) to Sosei for a total consideration of approximately CHF 400 million. As a consequence, the company is no longer reporting PIVLAZ sales. In numbers in Q3, PIVLAZ’s net revenue line was only at CHF 1.3 million. For a better top-line sales picture, we should say that Idorsia reached CHF 131 million in the first nine months; however, we should only consider (for our visible period calculation) QUVIVIQ sales, which reached CHF 20 million. Aside from the PIVLAZ and Sosei deal (positive for CHF 68 million), other revenue lines are coming from Neurocrine (CHF 2 million), Johnson & Johnson, and Mochida for an equal amount of CHF 4 million, respectively.

Idorsia sales development

Source: Idorsia Q3 results presentation – Fig 1

Last time, we emphasized how QUVIVIQ’s commercial success was Idorsia’s only key value driver. QUVIVIQ sales are not picking up as expected. In Q2, we reduced QUVIVIQ sales projections from CHF 95 million to CHF 65 million in 2023, including a ramp-up in the EU. Today, post Q3 results, we decreased the target from CHF 65 million to CHF 30 million. Looking ahead, we also lowered Idorsia’s revenue line to CHF 150 and 280 million in 2024 and 2025, respectively. On a positive note, the CEO Jean-Paul Clozel mentioned three vital considerations for 2024:

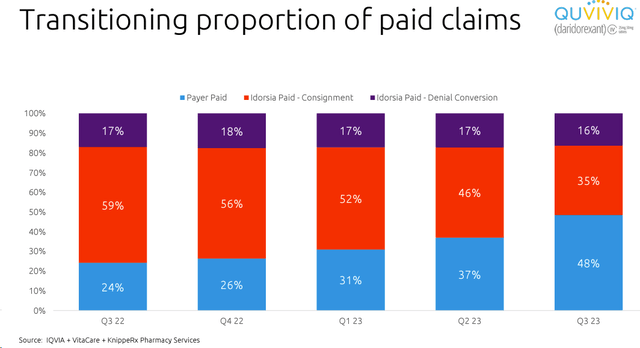

- QUVIVIQ commercial was successfully adjusted, moving to a payer-paid model from free prescriptions (implemented to drive higher sales volume);

- Looking at the evolution, paid prescriptions reached 48% in Q3 with an increase of 11% points from Q2 (Fig 2);

- Starting in September, QUVIVIQ was included in the US CVS national formulary, covering 20 million people. Additionally, in the Q&A call, Idorsia anticipates being in Medicare Part D starting January 2024. This should help the company improve QUVIVIQ access and, consequently, increase top-line sales through paid prescriptions.

Idorsia Paid claims

Fig 2

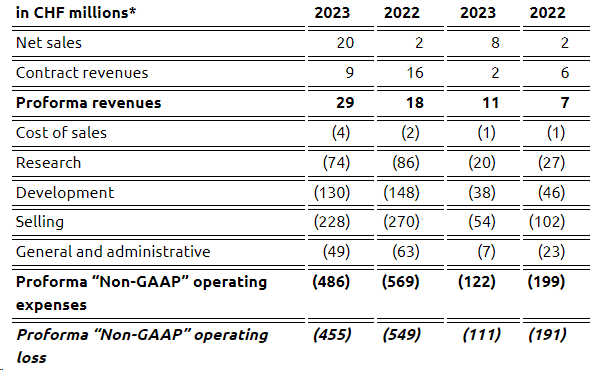

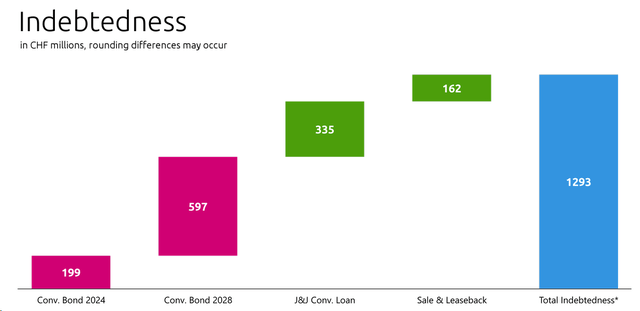

Excluding the APAC Sosei Deal, these below are the proforma financials. If we include the Sosei transaction in Q3, Idorsia recorded a loss of CHF 51 million. Here at the Lab, including the cost savings, we estimate a 2024 cash burn of almost CHF 500 million, equal to a daily loss of CHF 1.35 million. This does not include the CHF 200 million convertible bond that needs to be repaid in 2024 (Fig 4).

Idorsia Financials in a Snap

Source: Idorsia Q3 Press Release – Fig 3

Idorsia current Debt

Fig 4

Following the transaction, Idorsia’s cost reduction target, and the first nine months of operations, the company communicated an update on the full year 2023 guidance with a lower operating loss from CHF 735 million to CHF 670 million, already including the ongoing restructuring charge. Thanks to the Sosei deal, Idorsia concluded the quarter with CHF 255 million from CHF 33 million in H1.

In our analysis, it is critical to assess the potential funding options. In the call, Jean-Paul Clozel mentioned that they have arrows on the bow. However, we see limited optionality. In Q1 2024, Idorsia should find at least CHF 700 million, which might be generated from 1) an equity raise, 2) Aprocitentan sales, 3) Selatogrel’s new partnership, and 4) US QUVIVIQ sale. A new offering is unlikely given Idorsia’s current stock price, and even considering 100 million new shares, this might add only CHF 150 million in proceeds. Aprocitentan advancing in the FDA registration process might unlock more value. In detail, the FDA is moving on with a readout expected in March 2024 end, and the drug is also under review by the EU Medicines Agency. Looking at a recent deal from AstraZeneca with the acquisition of Cincor’s baxdrostat, in a downside case scenario, we might value Aprocitentan in a range between CHF 400 and CHF 600 million. Our estimates do not account for a potential QUVIVIQ US sale, given that they need to show commercial success, and Selatogrel clinical patient data are expected in H2 2025. Therefore, we believe that the Aprocitentan sale is the asset that Idorsia will use to extend its potential runway. In our estimates, we had an 85% probability of success for the Aprocitentan drug with a possible peak sales of more than $2 billion, which we confirm today. If we look at the AstraZeneca deal and payment, this sale might extend Idorsia runways expenses from 5 months (downside case scenario) to 15 months.

Conclusion and Valuation

QUVIVIQ sales need to pick up, and there was no relevant news on financing optionality. We believe that sell-side analysts are losing their grip and coverage on the company. Having scrutinized Idorsia Q3 results with the appropriate funding option, we suggest remaining on the sideline. The company is in a critical momentum, and despite the CEO’s confidence (given its sound track record), we believe Idorsia’s stock price might continue to decline. According to our estimates, Idorsia’s target price might reach CHF 1.2 per share. With our sales forecast at CHF 250 million in 2025, and considering an EV/Sales of 6x, we derive an enterprise value of CHF 1.5 billion, including the debt consideration (CHF 1.3 billion), our equity value is set at CHF 200 million vs a current CHF 300 million. Downside risks include QUVIVIQ’s sales momentum in the EU and the US, the chance of dilution given the depressed valuation, FDA Aprocitentan approval, and FX changes, given the solid CHF currency.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply