Editor’s note: Seeking Alpha is proud to welcome KD Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Introduction

After acquiring 24 of Euronav’s very large crude carriers (VLCCs), Frontline plc (NYSE:FRO) became the leader in the oil shipping segment. The company is now the largest operator of VLCCs globally, and 35% of its ships have scrubbers to comply with the new MARPOL Annex VI amendments regarding air pollution. Having VLCC equipped with scrubbers gives Frontline a great advantage due to its higher day rates.

I believe the market values Frontline at a 30+% discount based on NAV. The price action though appears overstretched to me, so I expect a correction soon. That dip is an opportunity to buy more or open a position in the FRO stock. Frontline pays dividends with generous yields, which makes it an attractive investment with adequate upside potential. For these reasons, I believe the FRO stock is worth having in an income-focused portfolio.

Why tankers?

The shipping industry is the blood of the global economy. Since the Age of Discoveries, ships have become integral to world trade. Marine transport is the cheapest and most convenient for bulk products. Even though we live in a digital world, the importance of shipping will not diminish any time soon. The shipping industry is highly cyclical following economic cycles. Since the collapse of the Soviet Union, we have lived in a unipolar world based on the Washington Consensus. However, globalization has been challenged by the Global South and primarily by China. That has led to deglobalization or a gradual fragmentation of the existing economic regime.

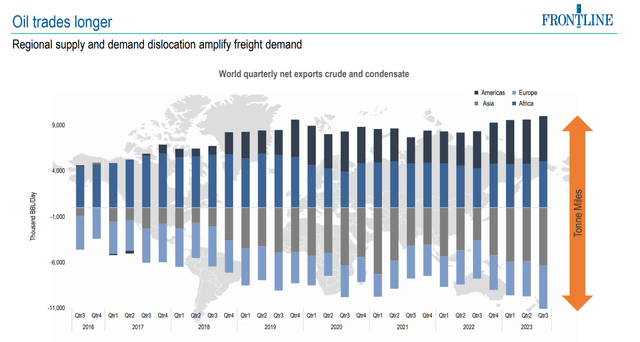

So, how does that affect the shipping industry? The chart below from Frontline’s presentation is the answer:

Frontline presentation

It shows the average duration of the oil trade measured in tons per mile. That extension is caused by the geopolitical fragmentation mentioned earlier. In other words, the shipping industry is not only a function of the economy, but it depends heavily on geopolitical dynamics. Geopolitics changes existing logistics routes, thus extending the duration of the trade. The latter means longer time charter contracts and higher fleet utilization. Simply put, shipping companies will benefit from this fragmentation.

What does the company do?

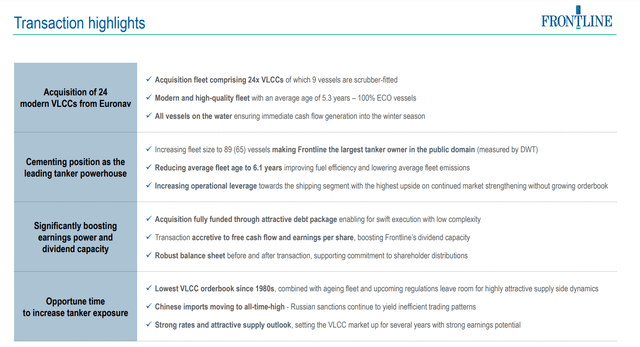

Frontline owns and operates VLCCs. Simply put, it moves astounding amounts of oil between sellers and buyers. The company has acquired 24 VLCCs from Euronav, thus becoming the largest owner of the VLCC fleet on a global scale. The image below illustrates the synergies between the two entities.

Frontline presentation

Frontline’s fleet age profile will improve after its acquisition of Euronav vessels. That has a few implications/advantages. First, newer vessels are more efficient – in simple words, they will use less and cleaner fuel to cover the same distance. Strict air pollution restrictions put limits on shipping companies regarding the fuel they use. The older the ship, the more modifications are required to modify its equipment to meet regulatory requirements.

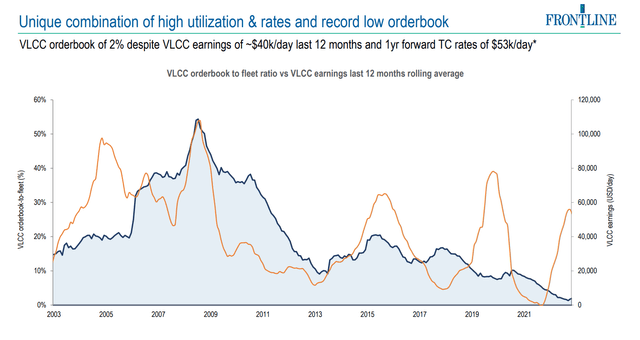

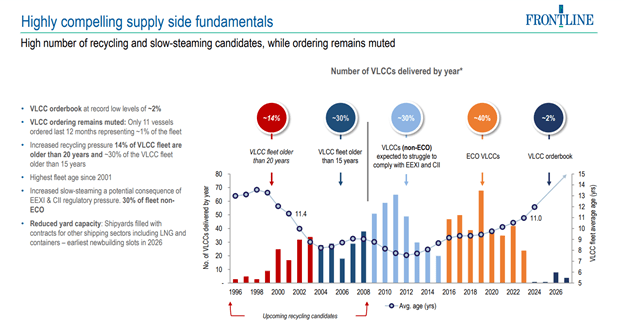

The second advantage is that the company is not forced to order new ships. This will significantly reduce its CAPEX. Besides, it is worth mentioning that shipyards have their books filled with orders for all types of vessels except VLCCs for the next few years. The chart below shows how the order book compares to the current VLCC fleet globally.

Frontline presentation

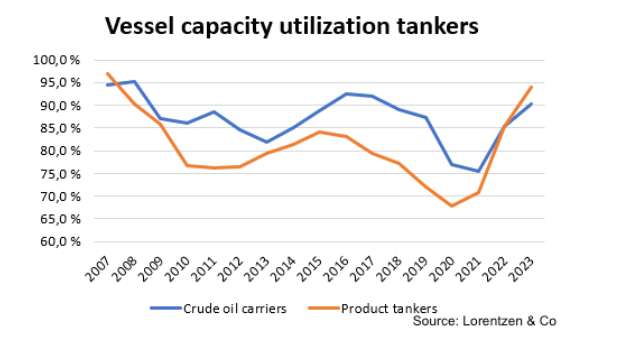

The blue line represents the order book to fleet ratio. The new orders are a mere 2% of the total fleet. Conversely, the utilization rate for products and crude tankers is above 90%, as shown in the chart below.

Lorentzen and Co

Those two charts illustrate the supply constraints. First, the global tanker fleet is almost fully utilized, and second, a record-low order book means no new vessels are coming soon. The chart below gives more details on the subject.

Frontline presentation

The average age of the global VLCC fleet is a record high: 14% of the vessels are older than 20 years, while 30% are older than 15 years. Sooner or later, those ships will have to be recycled. One-third of the fleet will struggle with CII (carbon intensity indicator) and EEXI (energy efficiency index) requirements, thus putting pressure on shipowners to retrofit scrubbers if they want to remain competitive. On the other hand, the supply of new VLCCs is limited by shipyard capacity. As mentioned earlier, the yards have filled order books with LNG and container vessels for the next few years. Enough tanker slots are not expected to come soon, given those limitations.

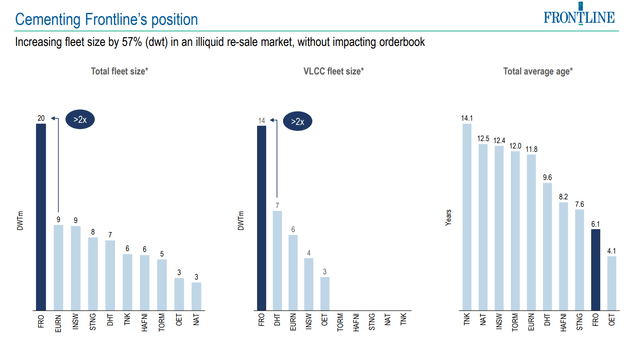

Frontline is ahead of its competitors, given the acquisition of Euronav vessels. With new additions to its fleet, Frontline doubled its fleet measured in deadweight and VLCC numbers while also reducing the age of its vessels. The chart below gives an overview of the new Frontline fleet.

Frontline presentation

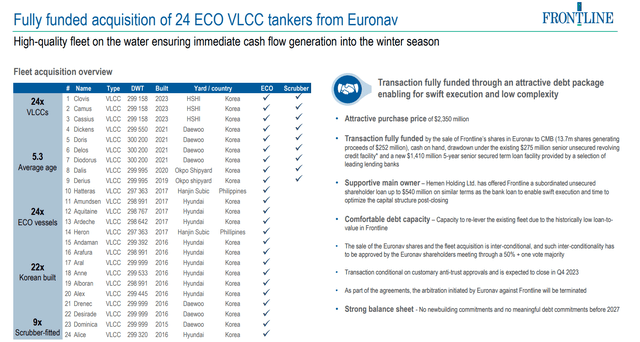

Usually, when we talk about asset-heavy businesses, we pick only one: quality or quantity. We rarely have both due to the exuberant cost of new investments. Frontline is an exception. The company offers size and quality at a great price. The table below gives a more detailed look at the company’s fleet.

Frontline presentation

Earlier, I mentioned the importance of air pollution regulations. Seven of Frontline fleet’s ships are equipped with scrubbers. The latter is a device installed on the exhaust side of the ship engine designed to reduce sulfur emission.

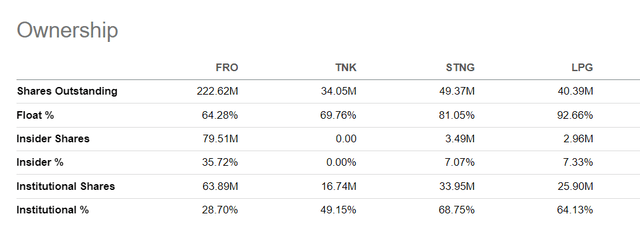

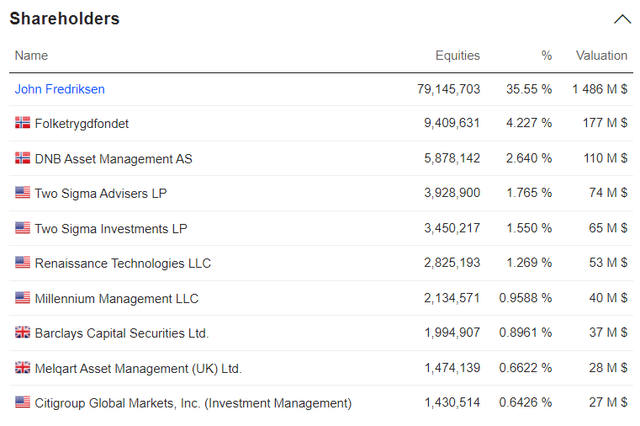

Ownership

It’s worth mentioning the company’s shareholder structure compared to its peers. The image below shows the ownership composition of Frontline and a few other tanker companies.

Seeking Alpha

Frontline has 35.72% insider ownership and a relatively lower float (64.28%) than its competitors. John Fredriksen owns 35.6% of the company’s shares. He is the president and director of the company. Folketrygdfondet, the Norwegian government pension fund, is another major shareholder. The list of key shareholders is shown below:

Market Screener

Company Financials

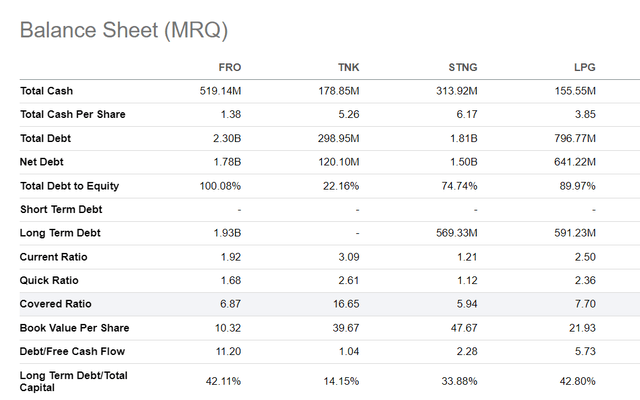

Balance sheet

The shipping business is a challenging and expensive endeavor. Frontline has a solid financial position, looking at its last financial report. Below, I compare the company with other tanker businesses.

Seeking Alpha

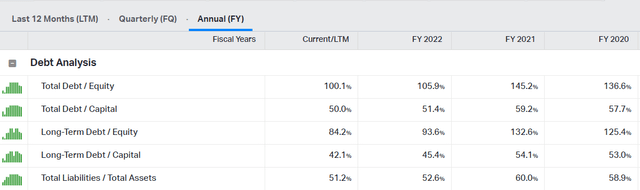

Frontline has the highest debt-to-equity ratio at 100%. However, its liquidity ratios are solid. The company has reduced its debt in the last three years. Its current total debt is $2.3 billion, and its cash is $519 million. Frontline has increased its cash reserves from $115 million to $519 million over the last three years while reducing its debt by $100 million. The graph below shows the company’s capital structure since 2018.

Koyfin

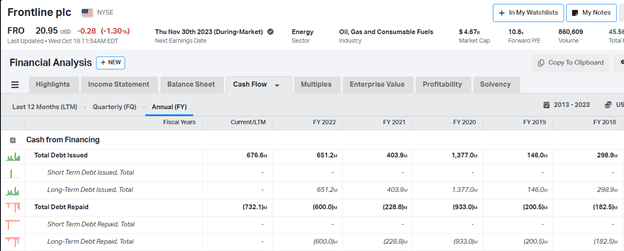

All ratios based on debt and equity have dropped, meaning the company’s solvency has improved. EBIT/interest expense remains stable, too. In 2021, it was 0.1, while today (LTM) it is at 6.9. The table below shows Frontline’s cash from financing activities, emphasizing debt issuance/repayment.

Koyfin

Frontline repaid $732 million while issuing $676 million of new debt for the last 12 months. The deal with Euronav will add debt to the company’s balance sheet; however, as mentioned earlier, it will improve its fleet and, eventually, its profitability. The acquisition of Euronav VLCCs will change the balance sheet composition. The cost of the 24 vessels is $2.35 billion. The acquisition is funded by selling Frontline’s 13.7 million Euronav shares, using $275 million from an unsecured revolving credit facility, $1.41 billion secured bank credit, and its cash.

The Euronav shares will generate $252 million in proceeds. The buyer is CMB NV and will own 49.05% of Euronav, with 53% of the voting rights. The unsecured debt has been extended till January 2026 with an interest rate of 10%.

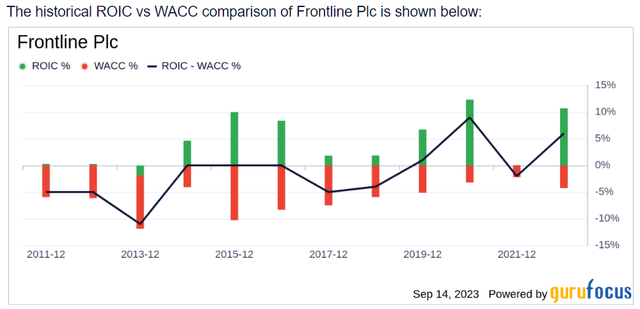

Before analyzing Frontline’s profitability and efficiency, I like to mention the company’s ability to generate excess return (ROIC – WACC). This differential has improved, as seen in the chart below:

Guru Focus

A wider spread between ROIC and WACC is crucial for any enterprise’s long-term growth. One of the primary inputs into ROIC is the day rates. I believe the day rates growth rate will exceed the cost of financing growth rate, eventually boosting more company`s profitability.

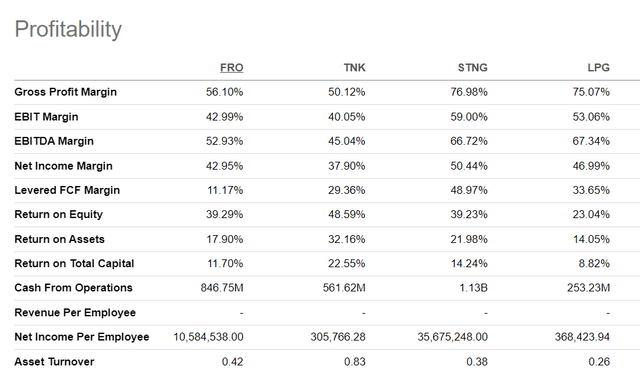

Profitability and efficiency

Frontline’s performance is above average when compared to the industry. The chart below shows the company’s profitability metrics.

Seeking Alpha

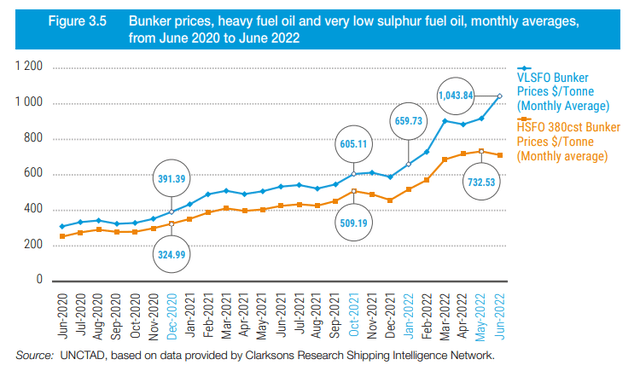

The top performer based on ROI and ROE is Teekay Tankers (TNK) while FRO lags by a wide margin. Improved fleet quality and size will contribute to higher returns. More than 30% of Frontline’s fleet have scrubbers. Simply put, those vessels command much higher day rates. For example, Teekay’s tankers fleet operates on low-sulfur fuel instead of heavy fuel with scrubbers. That has an advantage due to simplified engine auxiliaries. Conversely, VLSFO commands higher prices per ton, as seen in the chart below.

Clarksons Research

Installing scrubbers is justified when their total costs (CAPEX + sustain) remain lower than the difference between VLSFO and HSFO. Simply put, the lower the scrubber costs and expenses, the better it is to install them. Frontline maintains ships with scrubbers long-term because it is cheaper than operating on VLSFO. The profit margins will remain growing, improving the company’s net results.

Let’s dig deeper into Frontline’s profitability. To assess how efficiently the enterprise utilizes its capital, I use two approaches:

- FCF/EV yield vs CAPEX as % of revenue

- ROIC vs Total Debt/Capital

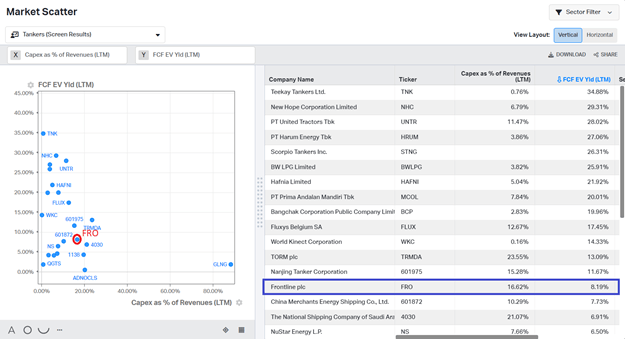

The chart below shows the free cash flow yield on EV versus capital investments as a percentage of the revenue.

Koyfin

Teekay has the highest FCF yield. However, it spends a mere 0.76% of its revenue at CAPEX. Frontline is the opposite: lower FCF yield and higher CAPEX as a percentage of revenue. In the long term, such a combination is more desirable. Growing CAPEX investments sow the seeds of future growth. Given the tight market for VLCCs, Frontline’s capital investments will pay off well soon.

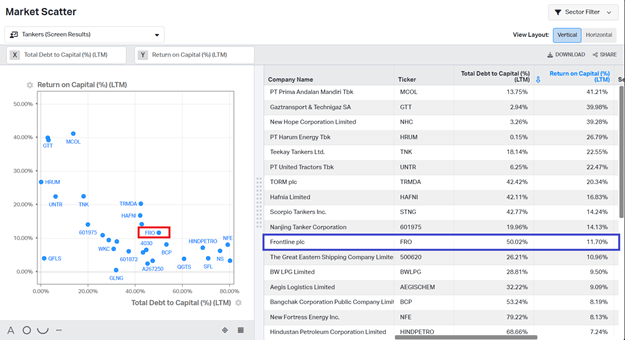

The last chart, analyzing the company’s efficiency, measures how well Frontline uses its capital. I compare its ROIC versus Total Debt/Capital.

Koyfin

Frontline holds the middle position. Its ROIC is not exceptional, though it is more than adequate, given Total Debt to Capital. Simply put, the company is not overleveraged to adequate return on invested capital.

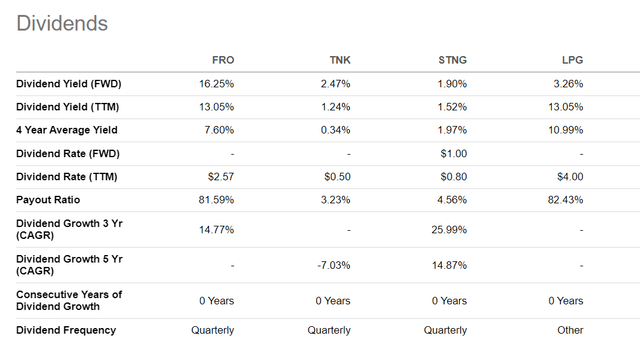

Dividends

Despite its average results, I expect Frontline to pay dividends with generous yields, as seen in the chart below:

Seeking Alpha

Frontline is the top performer with 13.05% (TTM) yields, or $2.57 per share. Improving profit margins will improve dividend safety in the long term. Nevertheless, I do not forget the inherent cyclicality of the tanker stocks. Hence, I will be more than happy with such dividend yields even for a few years.

Valuation

To value Frontline, I use the following multiples: Net Asset Value and Dividend Yield vs EV/EBITDA. To estimate Frontline net asset value, I use the formula below:

NAV = Fleet replacement cost + Current Assets – Total Liabilities

Frontline fleet consists (excluding Euronav vessels) of 22 VLCC, 25 Suezmax, and 18 Aframax vessels.

Replacement cost per type of vessel is:

- VLCC $116 million

- Suezmax $78 million

- Aframax $60.5 million

The figures are from 2022 for new vessels. Given the lack of new tankers coming in the following years, growing day rates, and creeping structural inflation, I am confident their current price is higher. I expect to reach a point when the old vessel available immediately will a command higher price than the new one but delivered in 12 months. The prevailing situation in the Middle East is placing additional pressure on shipping day rates. Due to the above reasons, I assume 50% higher replacement costs than the 2022 figures.

Fleet replacement cost = $8.386 billion

Current Assets = $0.897 billion

Total Liabilities = $2.405 billion

Market Cap = $4.69 billion

NAV = $6.878 billion

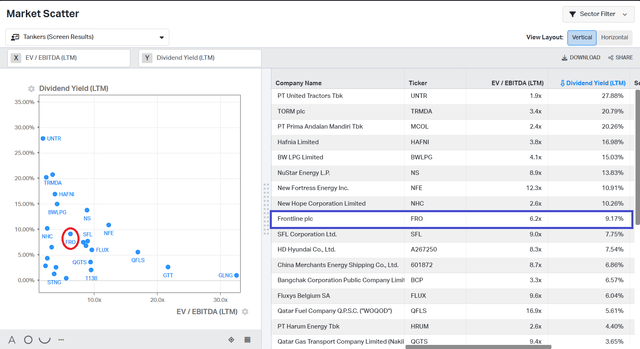

Thus, Frontline is undervalued by 32% based on NAV and Market Cap figures above. Now, let’s look at how it performs against peers. The chart below represents dividend Yield (LTM) on the Y axis and EV/EBITDA (LTM) on the X axis for major tanker companies.

Koyfin

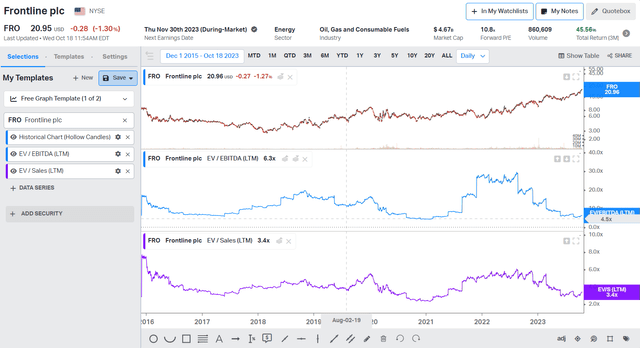

To obtain dividends with a yield of 9.17%, I must pay EV/EBITDA of 6.2x. Frontline balances well between value and price. Its dividend yields are among the highest in the industry, besides the higher EV/EBITDA ratio. There are cheaper companies with higher dividend yields. However, I believe that rising day rates and Frontline’s fleet quality and size will push the company’s stock price further. Looking at the past performance, the current EV/EBITDA is far below the previous peaks. The same is true for EV/Sales.

Koyfin

I expect Frontline shares to reprice and reach at least an EV/EBITDA of 20x, once the tanker stocks become a hot commodity.

Price Action

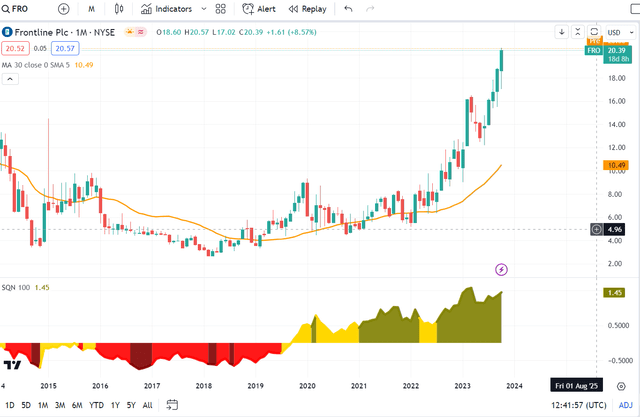

In the last several months, the FRO stock price has made an exceptional bull run despite choppy moves in the broad market, thus causing a higher valuation. Significant drivers are the increasing day rates and the acquisition of Euronav’s vessels. We can analyze the price action via two charts. The first will show the current situation and how extended the price is (in the short term). The second chart will give context: how far the price might go from here.

Trading View

I use the SQN indicator developed by Van Tharp. It indicates four market regimes: bull volatile (blue), bull quiet (green), neutral (yellow), bear subtle red), and bear volatile (dark red). Despite the extended price currently, we are in a bull-quiet regime. Given the price’s distance from 30WMA (weekly moving average), I expect a short-term correction due to overstretched price action.

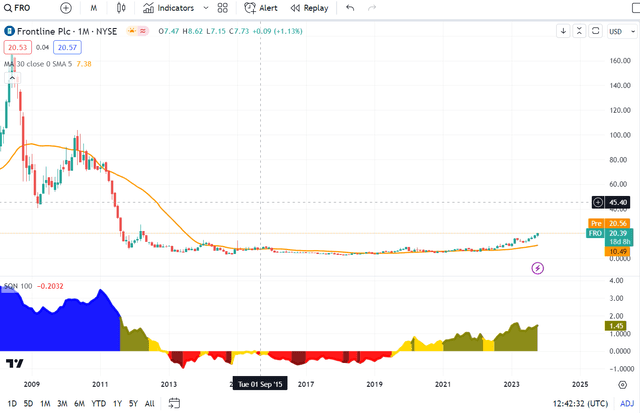

Now, let’s look at the bigger picture. The chart is still monthly but zoomed out.

Trading View

The previous peak was $168, and the price action was in a bull volatile regime. The latter is essential because bull runs always end up in a bull volatile market regime. The price must be much higher from here, although it will be volatile. I would wait for a correction before making the first entry, following the proverbial “buy the dip” rule. On the other hand, if you already own the stock, the dips are an excellent opportunity to add some size to the position.

Risks

The shipping industry is susceptible to the economy and geopolitics. As mentioned, the former means economic cycle dependency, while the latter is more nuanced. Being a tanker owner, Frontline’s profitability depends on the oil demand. We have had record high demand in the last few months, which is not expected to drop soon.

The geopolitical risk usually benefits shipping companies. A prime example is the Yum Kippur War when the Suez Canal was closed. Tanker day rates reached stratospheric levels in a short period. The war between Israel and Hamas raises many questions about energy prices. If Egypt or Iran enters the conflict explicitly, that will impact the global economy profoundly. Egypt is the gateway between the Mediterranean and Indian Ocean, while Iran is among the top five countries in terms of oil reserves and production.

The operational risk is another critical point. Running a complex business such as shipping requires experienced and dedicated teams. It’s mainly a qualitative measure based on managers’ expertise and the company’s ownership. In Frontline’s case, we have both.

Investors takeaways

Frontline owns the largest and the youngest VLCC fleet in the world. 35% of its ships have scrubbers to comply with the new MARPOL Annex VI amendments regarding air pollution. Shipping companies have two alternatives to run on fuel with less than 0.5% sulfur content (VLSFO) or on HSFO, but with installed scrubbers. Frontline has chosen the second option. In my opinion, in the long term, this is more economically viable, given the price gap between VLSFO and HSFO.

Based on my calculations above, the market values Frontline at a 32% discount based on NAV. The price action seems overstretched to me, so I expect a correction soon. That dip is an opportunity to buy more or open a position. Last but not least, Frontline pays dividends with generous yields. Frontline is thus an attractive investment with sufficient upside potential, and I believe it is worth having the FRO stock in an income-oriented portfolio.

Read the full article here

Leave a Reply