Healthcare Realty Trust (NYSE:HR) is a REIT primarily focused on outpatient healthcare services in the United States. The company was established in 1992 and its shares have been publicly traded since 1993. The very long-term stock chart shows how actually the stock is trading in the red since its IPO, which is obviously not good, but that is before taking into consideration the dividends that have been paid since then.

After decades of boring, stable, and slow growth, the company went through a transformative move last year when it merged in July 2022 with Healthcare Trust of America (HTA). That was a huge acquisition as it effectively doubled the portfolio of properties and created a whole lot of new problems, which have been the main reason for the stock crash. Big acquisitions in the real estate sector have often underperformed because straight-up buying entire portfolios usually leads to the acquisition of a chunk of underperforming assets as well.

Macro headwinds, rising costs, and merger-related, self-inflicted pains are the culprits for the current stock price of $14.53, basically at an all-time low. As a result, the current dividend yield sits at a very enticing 8.5%. I think the current price can deliver relatively stable returns once the legacy HTA portfolio fully recovers to 2019 levels, which seems to be a matter of time.

COVID pain seems to be going away

The whole healthcare space was taken by storm by the COVID pandemic, which added unique challenges to an already somewhat troubled sector. In particular, one of the most impacting factors has been the soaring cost of personnel: during the pandemic, work became unbearably hard for many healthcare professionals, who decided either to retire early or to change their careers. The result was structurally lower demand for specific jobs (such as nursing), which forced employers to offer higher wages. On top of that, some healthcare providers (hospitals in particular) suffered from the weakening of fiscal support by the government. The result was that a number of healthcare providers had difficulties paying their rent which is obviously a big problem for REITs.

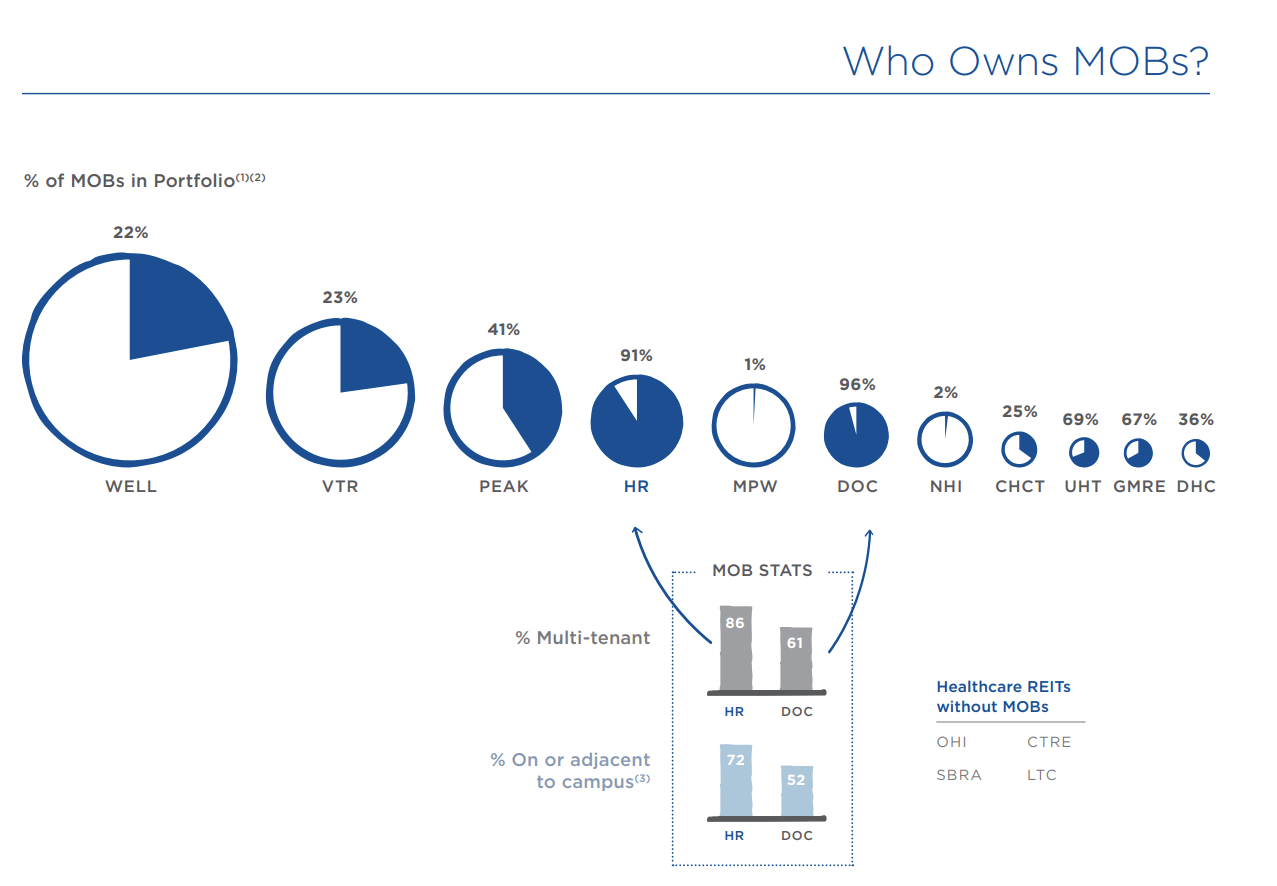

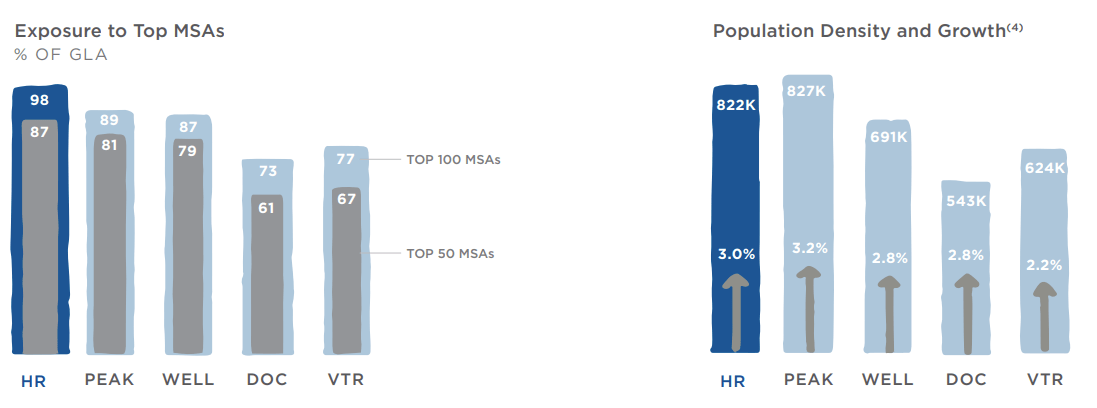

What is interesting about Healthcare Realty Trust is that it is the biggest US healthcare REIT among those that primarily focus on Medical Office Buildings. MOBs are one of the healthcare subsectors that actually came out from the pandemic in a better shape thanks to a higher insulation from the nursing scarcity and less reliance on governmental programs. COVID has posed challenges for them as well in the form of delaying exams and procedures, as well as the diffusion of telemedicine. However, although many people still take advantage of meeting virtually their doctor for simple diagnosis, MOBs are still the place to go for a large number of necessary procedures.

HR is the biggest REIT primarily focused on medical office buildings (HR Investor Presentation August 2023)

HR portfolio includes 714 properties distributed in 35 US states. 91% of the properties are focused on outpatient care and 72% of the portfolio is part of, or is at least adjacent to an actual hospital campus. The quality of the company’s assets is evidenced by their prime location as well. HR portfolio consists of properties clustered in areas with high population and good projected demographic growth. The company estimates that 98% of its Gross Leasable Area is located in the top 100 metropolitan areas of the United States, meaningfully outpacing the competition.

HR portfolio is located in big metropolitan areas (HR Investor Presentation August 2023)

What are the prospects in the short term?

As with many other REITs, at the moment the company is seeing muted activity. During the last several months HR has been a net seller, as management is actively disposing of non-core properties to consolidate the portfolio around the best-performing assets. The reason behind this strategy is that the real estate market at the moment is effectively frozen due to low cap rates: management has said that on the private market, they see properties being valued at cap rates between 5% to 6%, while the implied cap rate of HR portfolio based on its stock market valuation is nearly 7%. This disconnect does not allow the company, for example, to issue new shares to fund acquisitions as that would result in poor value creation.

Nevertheless, the company has achieved some growth in the latest quarter: Revenue grew 3.2% while same-store NOI grew YoY 2.9%, thanks primarily to rent growth and occupancy gains. The company signed new leases during the quarter that have a 3% yearly increase built in, bringing the annual contractual increase across the portfolio to an average of 2.71%.

Management is signaling some potential catalysts in the future as a few recent moves imply a positive attitude towards the business. Healthcare Realty Trust announced a $500 million shares repurchase plan in June 2023 as management believes the stock to be undervalued at the moment; in addition, some insider activity further emphasizes the stock potential as during 2023 two directors purchased $237,000 worth of shares at an average price of $19.14 and $539,000 at a price of $17.11 each. For context, shares have dropped significantly since then and the company’s stock is now trading at around $14.5 per share. Clearly, the value that insiders saw at higher prices is now even more appealing in light of further price discounting.

Simple but effective growth strategy

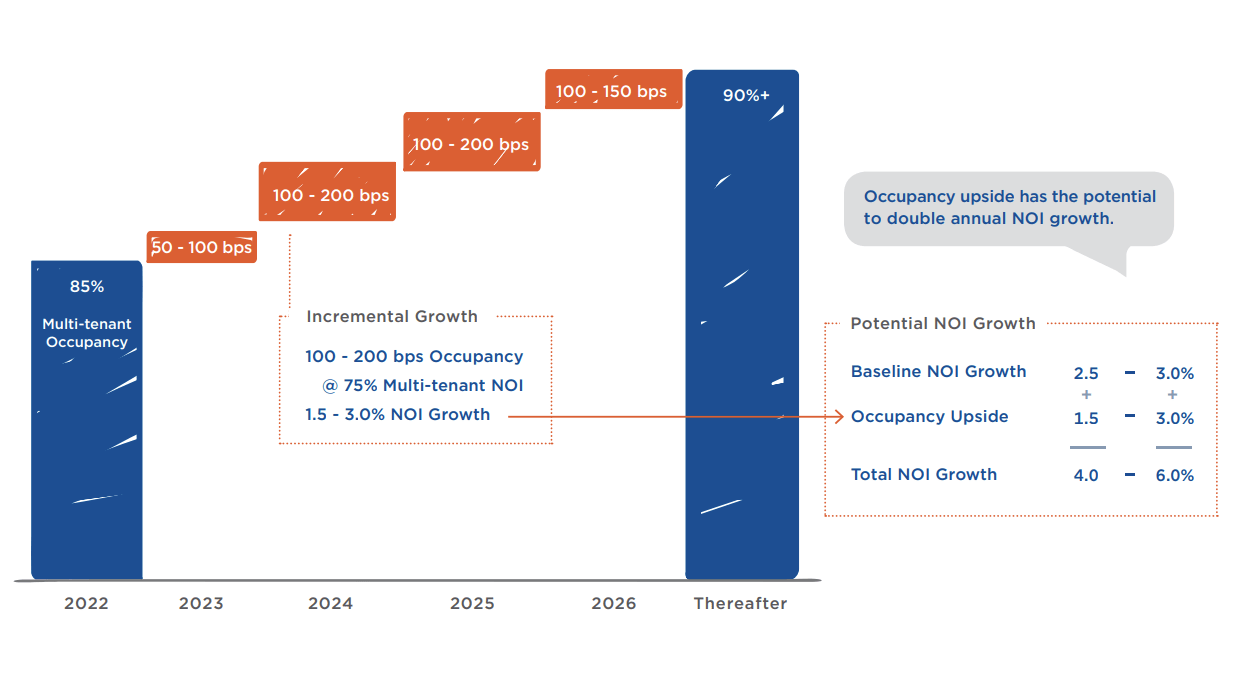

With the impossibility to grow by acquiring new properties due to the current high cost of capital and low cap rates, future growth will be muted. Nevertheless, as mentioned HR has a substantial level of automated rent increases built into their contracts, while a continuing improvement of occupancy rate, particularly concerning legacy HTA buildings could provide a further boost for the foreseeable future. From the latest earnings call:

The largest opportunity for occupancy gains is in the Legacy HTA multi-tenant portfolio where current occupancy is over 400 basis points below its pre-COVID levels. Returning this portion of the portfolio to pre-COVID levels is more than achievable. This is seen by the fact that legacy HR’s current multi-tenant occupancy of 87.7% is 100 basis points higher than Legacy HTAs pre-COVID levels. We’re already making progress with over 200 basis points of leases and build out across these HTA properties.

As a result, in a more optimistic scenario, the company is guiding to a potential future NOI growth up to 6% per year on the condition of an occupancy rate recovery, as exemplified by the following slide.

Future growth should be between 3% to 6% (HR Investor Presentation August 2023)

The risks: high payout ratio, high interest expenses

At the moment the main risk is a high dividend payout ratio. In the latest quarter, the company generated FFO per share (normalized to merger-related adjustments) of $0.39, while the dividend per share distributed to shareholders was $0.31. Although that would imply an FFO payout ratio of about 75% if we consider Funds Available for Distribution (FAD) the payout ratio was actually around 102%. Management was however optimistic that NOI growth will naturally bring down the payout ratio to more comfortable levels, all else being equal.

The macro environment is currently still a big headwind for HR and the REIT sector as a whole. The Federal Reserve is now abiding by the new mantra of “higher for longer”, meaning that interest rates might have peaked but they could potentially stay high for a relatively high long time. Management had to lower their guidance for the full year to FFO per share of $1.585 (at the midpoint) because the previous guidance actually implied a decline of interest rates by the end of 2023, which is obviously not going to happen.

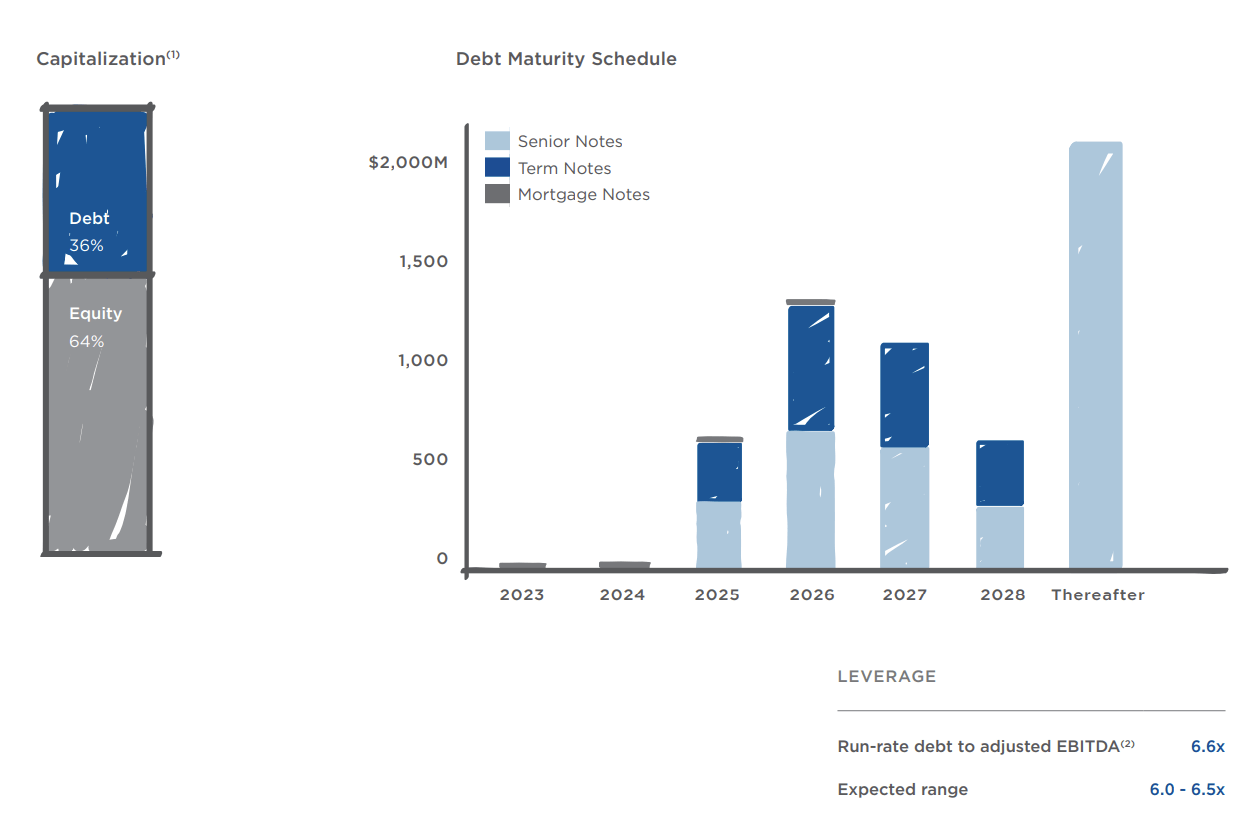

The company has also slightly higher debt than the average REIT, sitting at about Debt to EBITDA of 6.6x. About 14% of the company’s debt is floating rate, which will be reduced with the proceeds of asset dispositions (management is targeting between $350 to $450 million this year). The positive aspect is that Healthcare Realty managed to distribute its debt maturities quite well over time and virtually no debt will mature until the end of 2024

HR debt is well laddered over the next years (HR Investor Presentation August 2023)

Currently, the portion of floating rate debt has an effective rate of 6.21% which is quite punishing, but as mentioned before the company will drive it down by repaying some of these loans by selling underperforming assets. Overall the company has about $5.3 billion of debt with an effective rate of 5.03%. The rate is moderately high, which is normally not very good news but that means that future refinancing should not lead to a sudden jump in interest expenses as that already happened to HR during 2022 and the pain is already reflected in the current share price.

Valuation and key takeaways

Overall, I think the current price represents an interesting entry point for Healthcare Realty. As evidenced by the share price since its IPO, this company has never been a mega winner for shareholders but was nevertheless able to generate consistent and reliable dividend income. Opportunistic buys at the right time have, however, represented great value even on a capital appreciation point of view and the current levels might very well be yet another one.

Shares are trading currently for a Price to FFO of just 10.9x based on management guidance for the full fiscal year (at the midpoint). The company is targeting a yearly growth of at least 3%, which should also receive an additional variable boost based on the expected recovery of some of the legacy HTA properties. The current dividend yield is very high at 8.5% and although the payout ratio is high at the moment, management is convinced that it will normalize in the following quarters. For what is worth, Wall Street analysts have recently rated the stock favorably as both J.P. Morgan and Wedbush called out a very interesting valuation.

I like the risk-reward on an investment at this price because the bullish thesis does not need to be particularly exuberant for it to lead to a nice return. With an 8.5% dividend yield and an expected growth rate of at least 3% projected for the foreseeable future, a return to the classic boring, stable, typical medical office building REIT could potentially deliver around 10% yearly return.

Read the full article here

Leave a Reply