Medical Properties Trust (NYSE:MPW) is currently trading at depressed multiples, but this is not enough to make it an interesting takeover target due to several fundamental issues that justify its ‘cheap’ valuation.

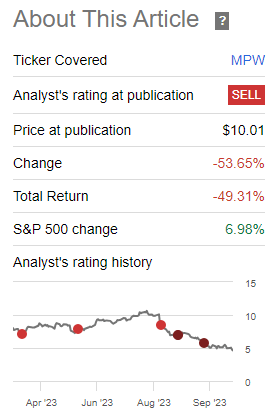

As I’ve covered previously, I have been quite bearish on MPW over the past few months, due to weak business fundamentals and serious concerns about its liquidity position. Since my first article on MPW back in March, its shares are down by some 50%, and further downside may lie ahead as the company’s cash position is expected to dwindle.

Article Performance (Seeking Alpha)

However, I’ve received some pushback that MPW’s valuation is too cheap and below its liquidation value, plus it has plenty of assets that it may monetize to boost its liquidity position. I see these facts as potential risks for my bear thesis, thus in this article I analyze if MPW could indeed be of interest to a potential buyer.

Takeover Target?

One bullish argument on MPW is that its current market value is too low and, probably, below its liquidation value. This means that if someone were to buy the whole company today, sell its tangible assets and pay down its debts, it would make money. For this to happen, its net liquidation value would be above the company’s current market value of about $2.9 billion.

This simple idea comes from the fact that MPW’s reported assets, at the end of last June, were $19.2 billion, while its liabilities were only $10.9 billion, thus its net book value was $8.3 billion. This value is way above MPW’s current market value, thus ‘bulls’ say that its stock is clearly undervalued and a potential buyer could make some good money buying the company and selling off all its assets to pay down debt.

Another possibility is that MPW is so cheap that a competitor could bid for it, refinance its debts and sell some assets, and have a good return on investment given that it’s buying MPW on the cheap side.

Moreover, with the share price down by some 80% from its peak at the beginning of 2022, this seems to be a compelling argument that MPW has become too cheap to ignore and a takeover is just a matter of time. Moreover, MPW is currently trading at some 3x FFO, thus its stock may appear at first glance a bargain, given that the REIT sector is currently trading at some 15x FFO.

However, the reality is not so simple and there are many issues that investors should take into account, justifying MPW’s current relatively low market value compared to its book value.

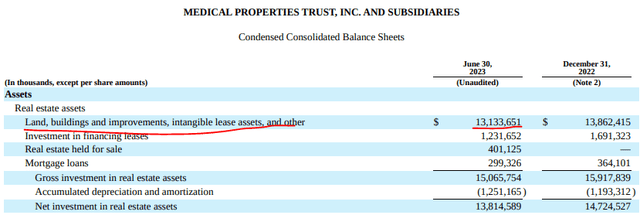

As shown in the next table, MPW’s assets include other lines beyond its real estate portfolio, including rent receivables, financial investments, and stakes in unconsolidated joint-ventures. Its real estate assets amounted to some $12.3 billion the end of 2022, including land and buildings, while in the Q2 2023 report the company also included intangible lease assets in the same reporting line, totaling $13.1 billion. Intangible lease assets were nearly $1.4 billion at the end of 2022, thus stripping out this amount of Q2 2023 assets, MPW’s land and buildings should amount to about $11.9 billion at the end of last June.

Real estate assets (MPW)

The company also had some $400 million in real estate held for sale, of which some $305 million was sold this month related to four assets in Australia. The company has used these proceeds, and previous sales of Australia assets, to pay down its AUD loan and now doesn’t have significant refinancing needs in 2024.

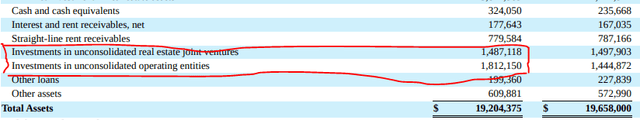

Regarding other assets, they are much harder to monetize given that, as I’ve analyzed in a previous article, MPW has, on several occasions, financed its tenants to keep them afloat, which may not be the best use of its financial resources. This means that a prospective buyer would require a deep discount to other assets and extensive due diligence to value those assets, thus investors shouldn’t use MPW’s accounting figures at face value.

Moreover, investors should not overlook short-seller allegations of malpractice at MPW that weren’t fully addressed by the company, raising several doubts about the true value of its stakes in real estate joint ventures and other operating entities. Note that these two lines were valued at $3.3 billion at the end of last June, thus it’s a significant amount that is not easily valued by external analysts or prospective buyers.

Other investments (MPW)

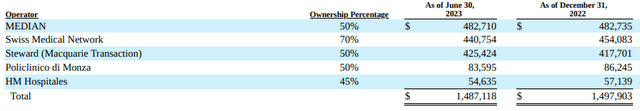

For instance, within the investments in real estate ventures there is $425 million related to the Macquarie transaction, related to eight hospitals operated by Steward. This is a tenant that is struggling financially, thus the value of this stake may be much lower from a prospective buyer’s point of view, justifying a discount to MPW’s book value.

Real estate ventures (MPW)

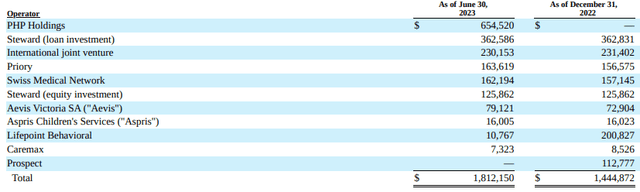

Moreover, within the investments in unconsolidated entities, there is an additional $487 million exposure to Steward related to loan and equity investments, which again a prospective buyer would require a significant discount, or full write down if Steward is in worse shape than what MPW is currently saying to its shareholders.

Investments in other entities (MPW)

Furthermore, while MPW has been reducing its exposure to Steward, it remains its largest tenant accounting for some 19% of its total assets. This is much higher than desired and leaves MPW heavily exposed to a struggling tenant, a profile that is not positive for a prospective buyer. In addition, Prospect Medical Holdings is another struggling tenant and represents about 5.5% of MPW assets, thus a good part of MPW’s assets are concentrated in problematic tenants.

Related to its exposure to financially struggling tenants, another issue is that MPW’s accounting value of its real estate may not reflect its current market value. While the company was able to sell its Australian assets over the past few months without incurring any losses, there has not been much more meaningful sales, which may be a sign that the market value of its properties is much lower than what MPW is reporting on its balance sheet.

Given that interest rates have been on a rising trend over the past eighteen months this is not a surprising outcome for real estate in general. However, MPW is significantly exposed to struggling tenants, which is another headwind for the value of its properties operated by Steward and Prospect.

While some investors think that if a tenant goes bankrupt, MPW will be able easily to find new operators for its property, eventually that may not be the case. The company highlighted this issue in its risk factors section of its annual report:

The transfer of healthcare facilities is highly regulated, which may result in delays and increased costs in locating a suitable replacement tenant. The lease of these properties to non-healthcare operators may be difficult due to the added cost and time of refitting the properties. If we are unable to re-let the properties, we may be forced to sell the properties at a loss. There can be no assurance that we would be able to find another tenant in a timely fashion, or at all, or that, if another tenant were found, we would be able to enter into a new lease on favorable terms. Defaults by our tenants under our leases may adversely affect our results of operations, financial condition, and our ability to service our debt and make distributions to our stockholders. Defaults by our significant tenants under master leases (like Steward, Circle, and Prospect) will have an even greater effect.

Due to this risk, a prospective buyer would certainly value MPW’s properties that are currently leased to Steward and Prospect at a significant discount, to accommodate the risk of potential bankruptcy from these tenants and its inability to find replacement operators to some, or all, of the related properties. This is, in my opinion, a key reason why MPW is trading much lower than its net book value, as MPW’s properties most likely don’t have much use beyond healthcare, thus in case of vacancy its remaining value may be very low.

Beyond these issues, there is also the issue of who would be willing to buy MPW?

As I’ve analyzed in a previous article, some of MPW’s main negative factors in the short to medium term are its liquidity position and refinancing needs, which are pressuring its share price negatively.

This would not be an issue for a larger REIT with good credit quality, like Realty Income (O) for instance, but the likelihood of a large REIT moving into the healthcare sub-sector seems to be rather low. Synergies and asset complementation is quite low, thus there doesn’t seem to be much benefit for a larger REIT to buy MPW and enter into the healthcare sub-sector.

Other healthcare REITs would be the most obvious potential buyers, and there are some large REITs in the sub-sector, such as Welltower (WELL) or Ventas (VTR). However, the business doesn’t seem to be a great complement, even though Ventas also owns hospitals and could eventually look at some of MPW’s assets, but I doubt it would be interested in the whole company.

Another possibility would be for a private equity company to buy MPW, but usually these companies buy distressed assets and would be more interested, in my opinion, during a bankruptcy proceeding rather than buying it on the stock market.

Conclusion

While MPW’s share price has collapsed over the past eighteen months and is currently trading at depressed multiples, this is justified by the company’s woes and questionable value of its assets, meaning perhaps is isn’t the bargain it appears.

I don’t think MPW is an interesting takeover target at this point, which means that most likely the company has to fix its woes on its own. Investors should be aware that MPW’s cash flow generation is weak and its ability to refinance debt or sell assets is also questionable, putting it in a potential financial distress position over the coming quarters.

MPW will report its quarterly earnings in a few days, and for me personally, I think it is more important to look at its operating performance to see how much cash the company burned through over the past three months. I also want to see what is its liquidity position is, and its plan to address bond and loan maturities over the coming months.

Read the full article here

Leave a Reply