Tesla, Inc. (NASDAQ:TSLA) shares got slammed after the market digested the company’s Q3 2023 earnings call on October 18th, 2023. TSLA shares were doing okay in the aftermarket until CEO Elon Musk started talking off-topic about everything from the economy to weight loss.

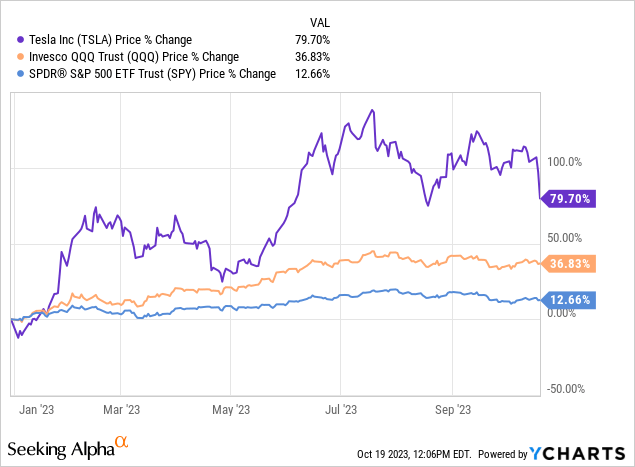

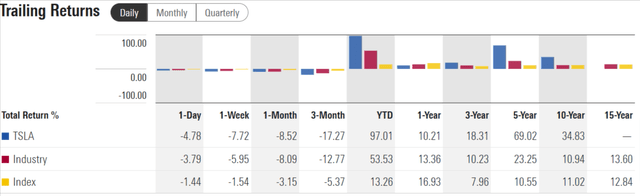

Despite the pullback, TSLA shares have greatly outperformed the Nasdaq (QQQ) and S&P 500 (SPY) YTD.

I always listen to Elon Musk’s remarks on Tesla’s performance to gain key insight into the entire EV industry and the overall global economy.

I listened to the entire Tesla Q3 2023 earnings call and thought it was by far the worst call I’ve ever heard from the company. Former Tesla CFO Zachary Kirkhorn’s presence was greatly missed and I had trouble understanding the new Tesla CFO Vaibhav Taneja due to his thick accent.

Elon Musk acted out of his character and seemed overly concerned with the global economy, interest rates, inflation, etc. I don’t think TSLA stock is a bad investment, but it makes you wonder if the downside risk is much greater in the short run than I thought.

Q3 2023 Update

Tesla’s Q3 2023 numbers weren’t that bad, and I believe most of the negativity surrounded Elon Musk’s remarks instead of the underlying business.

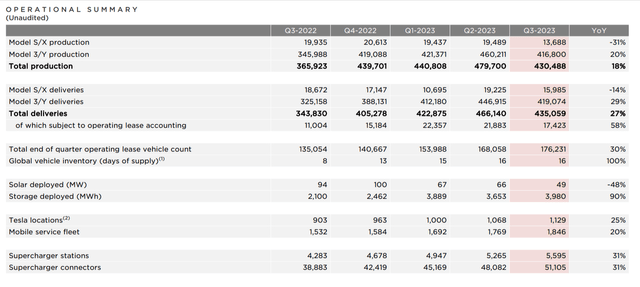

Tesla Q3 2023 Company Highlights (tesla.com)

Tesla’s total revenue reached $23.3 billion (Up 9% YoY) with the majority of revenue coming from the EV segment ($19.6 billion).

The company generated $1.8 billion in net income (Down 44% YoY) while EPS shrank to 53 cents per share.

Free cash flow decreased to $848 million (Down 74% YoY) and the company finished Q3 2023 with $26.1 billion in cash on its balance sheet. Tesla’s Bitcoin (BTC-USD) holdings remained steady at $184 million worth of BTC.

The company lowered its average cost of goods sold per EV to $37,500 in an effort to remain the market leader after several quarters of declining market share (more on that later).

As for deliveries, Tesla is still on pace to hit 1.8 million in 2023. Q3 2023 deliveries were down due to updates at Tesla’s factory.

TSLA Q3 2023 deliveries (tesla.com)

Tesla Solar suffered from rising interest rates just like the EV business, but Tesla Energy Storage actually outperformed the rest of the company’s revenue producers.

Tesla Energy storage increased 90% YoY to 4.0 GWh while Tesla Solar declined to 49 MW during the quarter.

Lastly, the Supercharger network continues to grow at a pace reaching 5,595 Supercharging stations (Up 31% YoY).

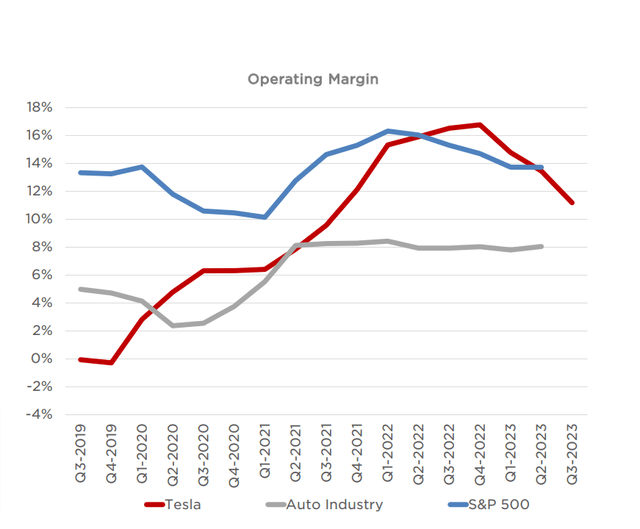

Much of the selloff was caused by the company’s failing operating margins, shrinking net income, and rising operating expenses.

Shrinking Operating Margins is a Major Concern

Elon Musk once bragged that Tesla’s operating margins were the best in the auto industry, but that may change if the company doesn’t stop lowering the cost of its EVs so aggressively.

Operating margins crashed to 7.6% in Q3 2023. This is putting a lot of pressure on Tesla’s bottom line as the company tries to slash prices to stir up demand.

Tesla Q3 2023 Operating Margins (tesla.com)

Tesla has cut the price of its EVs several times in 2023 to stir up lagging sales but I believe there is a deeper problem here.

In a tough economy where cash is king, there are too many EVs for sale and not enough buyers.

A poll by the Energy Policy Institute at the University of Chicago and the Associated Press-NORC Center for Public Affairs Research found out that nearly half of Americans have no plans to purchase an EV in the future.

Many Americans consider EVs “too expensive and out of reach,” according to car buying platform Autolist.

Other issues are finding places to charge and loyalty to ICE vehicles even though EVs are more eco-friendly.

CNBC posted an interesting video discussing the growing problem of EV oversupply that explains the problem in depth.

Tesla’s U.S. Market Share is Falling

Tesla’s U.S. EV market share fell to 50% in Q3 2023 (down from 64% in Q1 2023) as more legacy automakers and EV companies produced EVs, which added a lot of competitors to the mix.

Tesla is currently fighting a price war to maintain market share by lowering prices and sacrificing operating margins.

There is an avalanche of EVs on the market or soon to hit the market, including:

- Lucid: The Lucid Air.

- Rivian: The R1T and R1S.

- Ford: The F-150 Lightning.

- Mercedes: The Mercedes EQ Class.

- Volkswagen: The Volkswagen ID Class.

- Porsche: The Porsche Macan and Taycan EVs.

- Fisker: The Fisker Ocean.

- BYD: The BYD EV Line (Chinese competitor).

- Nio: The Nio EV Line (Chinese competitor).

- Once considered the “King of EVs,” I think Tesla showed signs of vulnerability and fatigue in its Q3 2023 earnings call.

Elon Musk’s behavior reminded me of an aging NBA star who struggled with the fact that younger, more agile NBA players were coming for his throne.

Tesla had a target on its back for YEARS while the rest of the EV industry played catchup. Now, the company lost one of the best executives (Zachary Kirkhorn) and exhibited a lot of uncertainty and lack of confidence in the company’s ability to maintain its aggressive 50% CAGR goals.

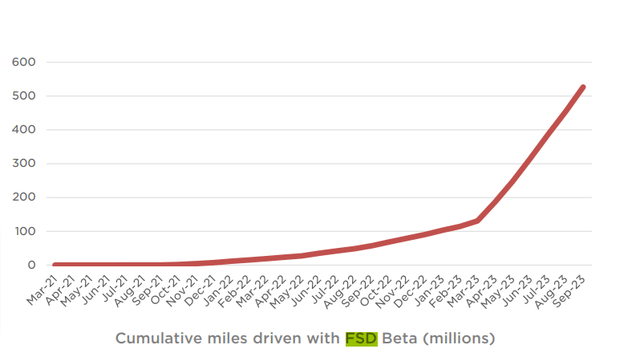

FSD is Tesla’s Bet on the AI Boom

During the call, Elon Musk referred to full self-drive (“FSD”) as the “Future of AI” and could help the company recover a lot of the lost revenue after price cuts. The company lowered the price of FSD to $12,000 in Q3 2023 and remained bullish despite all of the near-term headwinds.

Tesla FSD Q3 2023 Growth (tesla.com)

FSD is approaching exponential hockey stick growth and gives Tesla a strong USP as an AI-first technology company.

Tesla Cybertruck Launch Event Happens on November 30th

During the Q3 2023 earnings call, Elon Musk called the “Cybertruck” the company’s best product ever. According to Teslarati, Tesla had over 1.9 million reservations for the car as of July 21th, 2023.

Elon Musk seemed uncertain about the ability to reach profitability with the Cybertruck in the short run and emphasized that it’s really difficult to produce and sell a “revolutionary product”.

He hinted that Cybertruck production could reach 250,000 EVs by 2025 but didn’t seem too confident about that number.

Tesla is expected to start selling the Cybertruck at $50,000 for the base version. That could add $12.5 billion in additional revenue by 2025 if Tesla hits its conservative marks.

Expect the Cybertruck to hurt operating margins in the short run while the company figures out how to scale production at a profit.

Tesla will unveil the Cybertruck during a launch event on November 30th, 2023 so mark your calendar for that date.

Tesla Continues to HOLD Bitcoin

On the bright side, I’m happy to see that Tesla hasn’t sold any of its 10,725 Bitcoin holdings. The April 2024 Bitcoin halving is only 6 months away, and many crypto experts such as BitMEX co-founder Arthur Hayes believes Bitcoin could reach $750,000 in the next bull run.

If Tesla HOLDs Bitcoin through the next upcoming bull run then that alone could add up to $6.4 billion in digital assets to the company’s balance sheet.

Tesla will need that extra liquidity if operating margins continue falling in the future.

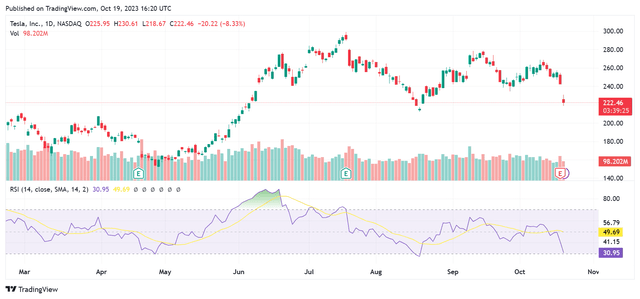

Tesla Daily RSI Chart Shows Potential Buying Opportunity

From a technical standpoint, Tesla looks like a good buy at the current daily RSI level. TSLA’s daily RSI sits at 31 with short-term support at $210 per share.

TSLA Daily RSI Chart (tesla.com)

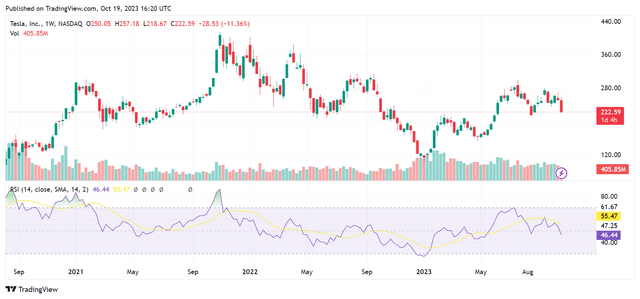

However, the TSLA weekly RSI chart shows there could be more downside risk in the near future.

TSLA Weekly RSI Chart (tesla.com)

It’s likely that technical analysts will buy the recent TSLA selloff to keep it from crashing below $200 in the near term.

Tesla’s key support level of $200 and resistance level of $300 is a decent range for traders to pay attention to. If TSLA stock breaks down below $200 then $150 is the next key support level to watch out for.

Risk Factors

- Shrinking Operating Margins: Operating margins are the key metric for EV makers and I didn’t expect Tesla’s margins to continue falling so quickly. At this rate, Tesla could begin losing money in 2024 if this downward trend continues. It’s extremely important for the company to reduce the cost of its EVs to maintain at least 5% operating margins. Perhaps removing non-essential components is the only way to cut costs without sacrificing quality.

- More Competition: I mentioned earlier that there is an abundance of EVs entering the market despite the fact that many consumers are struggling with inflation and debt. Too much EV supply hurts sales growth and I think Tesla is experiencing a ton of these supply-demand issues.

- Loss of Former CFO Zachary Kirkhorn: Let’s not downplay the loss of Zach in August 2023. He spent an astounding 13 years with the company and rose through the ranks during an extremely tough period for the company. He studied at the Wharton School of Business just like Elon Musk and put his Harvard MBA to good use for the benefit of Tesla shareholders. His resignation was probably a canary in the coalmine and I shouldn’t have ignored his contributions to the company. We’ll miss you, Zach!

- Inflation, Interest Rates, and Debt: Elon Musk showed a lot of frustration with the macro-economy and he made a good point: people can’t buy Teslas if they are broke. Tesla’s target market is dealing with high inflation, climbing interest rates, student loan debt, and a bunch of other negative factors that aren’t good for EV companies. Experts predict that Fed Chair Jerome Powell will lower interest rates in the 2nd half of 2024 but don’t expect a lot of bullish TSLA momentum until that happens.

- Slowdown on Gigafactory Mexico: Elon Musk hinted that Tesla is moving forward cautiously with Gigafactory Mexico due to the high inflationary environment. This would hurt Tesla’s growth in the short run because the company wants to keep control of costs to remain stable and well-capitalized.

What’s Next for Tesla Stock?

Despite the ongoing FUD, I will continue to hold TSLA stock and resist the urge to panic sell.

I understand many analysts are placing a sell rating on Tesla, Inc. stock, but that’s too shortsighted in my opinion. Tesla continues to maintain strong EV production along with a massive $26 billion stash.

Tesla’s forward P/E of 55 is more aligned with reality and seems like a better price for future earnings growth.

In terms of P/S ratio, Tesla is well positioned amongst Rivian, Lucid Group, and Fisker.

P/S Ratios of Top EV Companies

| Company (Ticker) | P/S Ratio |

| Tesla (TSLA) | 8.95 |

| Rivian (RIVN) | 5.49 |

| Lucid (LCID) | 11.99 |

| Fisker (FSR) | 1502 |

The company also holds nearly 10k Bitcoin on its balance sheet and should perform well during two separate Bitcoin tailwinds: the potential for several Bitcoin spot ETFs and the April 2024 Bitcoin Halving.

Elon Musk is the longest-tenured CEO out of all auto companies in the entire world with 15 years of hands-on experience. If anyone can pull Tesla out of this mess then he is the guy.

Many of you reading this are up big on your TSLA shares and I don’t like selling a winner just because things get rough in the short run.

TSLA’s 69% CAGR over the last 5 years is remarkable and deserves a major shoutout to Elon Musk and his team because they made us a lot of money since 2018.

TSLA Trailing Returns (morningstar.com)

I’m placing a HOLD rating on Tesla stock for now and don’t see any reason why investors should dump TSLA stock at the moment.

If interest rates reverse, then TSLA shares could soar again to new all-time highs. It’s hard to predict exactly when this will happen so I’m just holding for now.

Tesla has struggled in the past but always figured out a way to survive and come out stronger. I’m not betting against Elon Musk or Tesla right now but don’t expect Tesla stock to soar anytime soon.

Read the full article here

Leave a Reply