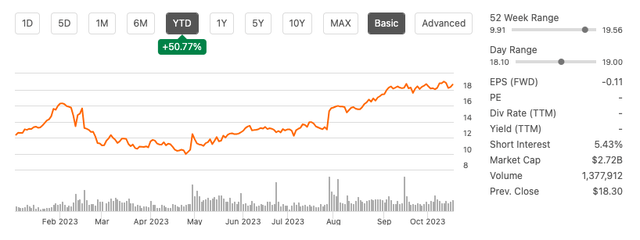

The fast-evolving world of technology is working in favor of online education firms like Coursera, Inc. (NYSE:COUR). This is because there is a growing demand for learning new skills or improving existing ones, which is driving the growth of Coursera’s online education services. Although the company’s stock value dropped by 65% since its initial public offering (IPO) in 2021, it has shown significant improvement this year, with a year-to-date return of 50.77%. This turnaround can be attributed to the increasing awareness of AI among the general public.

Stock trend year to date (Seeking Alpha)

The company is benefiting from the growing recognition of micro-credentials, the shift to digital higher education, and international growth opportunities. However, I previously suggested a “hold” rating due to declining profitability, tough competition, and economic uncertainties. While the company has adjusted its 2023 forecast, it still expects negative earnings. Despite impressive revenue growth, it lags behind its peers in terms of growth and profit margins. While I see growth potential, the stock is trading near its target price, and investing in a yet unprofitable company carries risk. Thus, I still recommend a “hold” position.

Company updates

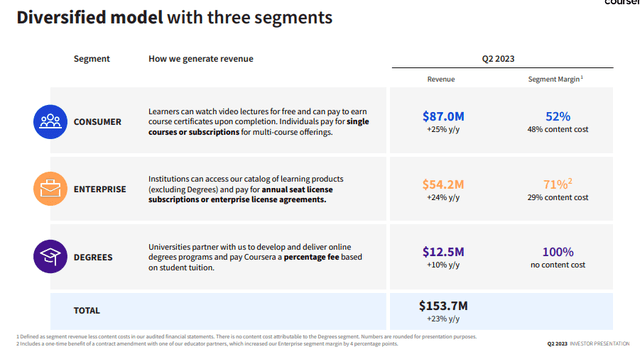

In my earlier article, I provided an overview of the company. The company’s business model revolves around attracting learners through free offerings and then encouraging them to explore various paid options. Its revenue is derived from three primary segments, and in the last quarter, all of them experienced double-digit growth. In the consumer segment, there was a notable addition of 5.7 million new registered learners during the quarter, bringing the total to 129 million. Additionally, the total number of paid enterprise customers increased by 35% year-on-year, reaching 1,291. The count of degree students also rose to 19,068.

Diversified model growth (Investor presentation 2023)

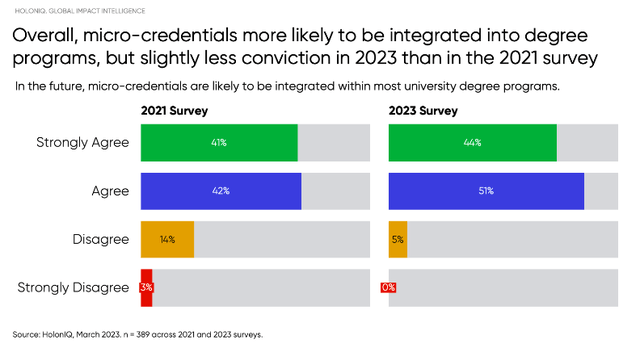

The company has experienced substantial revenue growth, with a 41% compound annual growth rate (CAGR) from 2017 to 2022. Management’s projections indicate a 19% CAGR in their total addressable market, estimated at $309 billion by 2026. Several significant growth drivers are contributing to the company’s success. Firstly, there is increasing recognition of micro-credentials and a growing belief that these credentials are or will be integrated into degree programs.

Micro-credit integration (Holoniq.com)

Secondly, the ongoing digital transformation within higher education is proving advantageous for online education services as it fosters partnerships and collaborations. Coursera, for instance, offers professional certificate programs developed in collaboration with industry leaders such as Google and IBM. These programs, along with new job training initiatives in partnership with Microsoft, are in high demand, especially for job-related skills. Thirdly, the company is capitalising on a growing number of international opportunities. Currently, the majority of its learners are situated outside of the United States. Fourthly, the role of AI in education and upskilling is in its early stages but holds significant promise. AI can personalise and enhance the learning experience, making it a positive development and opportunity for Coursera.

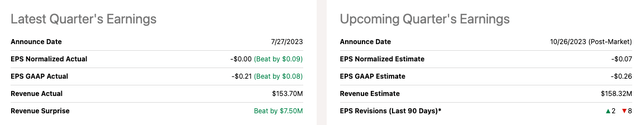

Upcoming earnings

Coursera has beat EPS expectations for the last four consecutive quarters, although EPS remains negative. Coursera will release its Q3 2023 Earnings report on Thursday, October 26, 2023.

Upcoming quarterly results (Seeking Alpha)

For Q3, the company anticipates revenue in the range of $156 million to $160 million and an adjusted EBITDA loss between $9 million and $14 million. Looking ahead to FY2023, the company’s revised outlook expects revenue to fall within the range of $617 million to $623 million, indicating an approximately 18% growth at the midpoint of this range. Notably, the full-year revenue outlook has increased by $20 million since the start of the year and by $15 million since the previous quarter. This reflects the company’s increased confidence in sustained demand within the consumer segment. As for adjusted EBITDA, the company foresees a loss ranging from $19 million to $24 million, corresponding to a negative 3.5% adjusted EBITDA margin at the midpoint of the revenue and EBITDA guidance ranges.

Balance sheet and cash flow

In Q2 2023, Coursera maintained a strong financial position with $717 million in total cash and no debt. Its trailing twelve-month (TTM) free cash flow was positive at $11.5 million, a substantial increase from the previous year’s $3.2 million. When we examine the liquidity ratios, we find a current ratio of 2.94 and a quick ratio of 2.78, both of which indicate the company’s ability to comfortably cover its short-term obligations. Moreover, investors can take confidence in the fact that the company has initiated a share repurchase program, with $54.5 million worth of shares bought back in Q2 2023.

Valuation

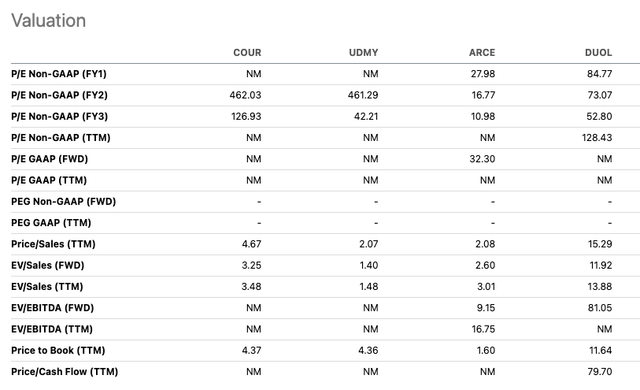

Coursera has garnered positive recommendations from various analysts, including a Buy rating from BMO, primarily attributed to the expanding education market. Wall Street analysts have also assigned it a Buy rating with a score of 4.2. However, investors should exercise caution as the stock is currently trading close to its average price target of $19.46. It’s noteworthy that the company has not reported profits, and its net losses have been increasing for four consecutive financial years. In a comparative analysis with some of its online education peers such as Udemy (UDMY), Arco Platform (ARCE), and Duolingo (DUOL), Coursera stands out with the highest price-to-sales ratio among companies that have yet to achieve positive earnings, registering at 4.67.

Relative peer valuation (Seeking Alpha)

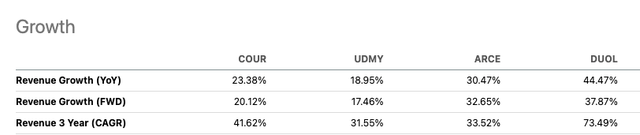

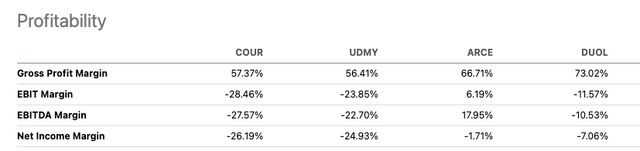

Additionally, when we examine the company’s year-on-year (YoY) growth, it stands at 23.38%, which is somewhat slower in comparison to Arco, reporting 30.47%, and Duolingo, which reported an impressive YoY growth of 44.47%. If we turn our attention to the gross profit margin, it’s noted at 57.37%, falling below that of all its peers, excluding Udemy, which stands at 56.41%. Moreover, the EBITDA margin, at a negative 27.57%, lags behind its peers in this regard.

Revenue growth versus peers (Seeking Alpha)

Profitability versus peers (Seeking Alpha)

Risks

Investing in Coursera involves several risks. Firstly, the company’s persistent lack of sustained profitability is a financial concern, marked by increasing losses over the past four years. Secondly, Coursera’s partnerships with universities, companies, and institutions are critical to its success. Any deterioration in these relationships or the loss of key partners could have adverse consequences. Additionally, the fiercely competitive nature of the online education sector presents a significant risk, as Coursera competes with numerous well-established and emerging players. Lastly, Coursera, as an online education platform, manages a substantial volume of user data. Potential data breaches or privacy issues may result in legal and reputational challenges.

Final thoughts

Coursera’s revenue growth and enhanced FY 2023 forecast are noteworthy. Nonetheless, the company’s persistent unprofitability, marked by increasing losses over the past four years, is a concern. Although it benefits from surging international student enrollment, a rising appetite for online upskilling, and increased recognition from traditional educational institutions, its adjusted 2023 forecast still points to negative earnings. Coursera also falls behind industry peers in terms of growth and profit margins. Given its stock’s proximity to the target price and the inherent risks of investing in an unprofitable entity, therefore I maintain a “hold” position.

Read the full article here

Leave a Reply