Warren Buffett has, from time to time, likened investing to baseball. The one big difference, he has asserted, is that you can choose to not swing the bat as many times as you would like. The beauty of this is that you can wait for that perfect swing, the swing that is likely to give you a home run or a grand slam. When I think about companies that look fundamentally attractive but that have some issues, I often think back to this concept. It’s better to miss out on a company that ultimately achieves significant upside than to swing the bat when the moment isn’t right and strike out. It is with this in mind that I have decided, fundamentals notwithstanding, to downgrade ASGN Incorporated (NYSE:ASGN) from a ‘buy’ to a ‘hold’. Although the company looks cheap, current market conditions are worsening and I believe that there are better opportunities that can be had for long term, value-oriented investors.

A downgrade makes sense here

Back in February of this year, I wrote an article that took a rather bullish stance on ASGN. In that article, I talked about how well the company had done in prior years. At that time, data extended through the third quarter of the company’s 2022 fiscal year. Unfortunately, there was some volatility at that time. But the overall picture looked positive to me. Relative to similar firms, shares were not exactly cheap, nor were they cheap on an absolute basis. This combination of cheapness and generally positive results led me to rate the business a ‘buy’ to reflect my view at that time that the stock should outperform the broader market for the foreseeable future. Unfortunately, the market has had other plans in mind. While the S&P 500 has popped up 6% since this last article was published, shares of ASGN have seen downside of 12%.

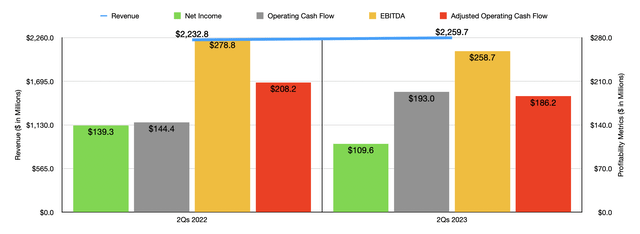

Looking at recent fundamental data, some investors would likely understand why the stock has underperformed. But at first glance, the fundamental data has not been bad enough to justify significant underperformance. Take revenue as an example. During the first two quarters of the 2023 fiscal year, sales came in at $2.26 billion. That’s 1.2% higher than the $2.23 billion generated the same time last year. Although I wouldn’t classify this as great, it is positive enough to warrant some optimism. But this is where looking at surface level data can be an issue.

Author – SEC EDGAR Data

The fact of the matter is that, even from a revenue perspective, the operations under the ASGN entity are not a monolith. Consider commercial revenue that falls under the assignment category. Revenue under this category is generated by the company when it contracts out IT and creative digital marketing professionals to its customers for temporary assignments and project engagements. During the first half of this year, sales in this category totaled $1.09 billion. That’s 13.2% lower than the $1.26 billion the company generated one year earlier. This drop, according to management, largely was attributable to an 18.2% plunge involving creative digital marketing and permanent placement divisions. In its investor call covering the second quarter, management indicated that weakness in this side of the business is typical when economic conditions worsen. But they also said that it is this side of the company that should rebound most when economic conditions reverse.

Fortunately, this weakness was offset by strength elsewhere. Still on the commercial side of things, consulting revenue actually jumped 29.5% from $426.9 million to $552.8 million. Continued strong investment in IT projects, led by AI investments, fueled at least some of this upside. And investors should expect this to continue even given the weakness that might face this industry before too long. I say this because, in the second quarter alone, the company won an AI/Machine Learning contract to support a Fortune 500 company as it seeks to leverage these new advanced technologies to create additional product offerings and improve customer experience. And finally, federal government revenue for the company popped from $549.3 million to $616.3 million. Almost all of this increase came from the federal civilian category.

On the bottom line, the picture has been less optimistic. Due to the decline in high margin assignment revenue that is highest with creative and digital marketing activities, the company saw its net profits drop from $139.3 million to $109.6 million. Other profitability metrics largely followed suit. The one exception was operating cash flow, which rose from $144.4 million to $193 million. But if we adjust for changes in working capital, we would get a decline from $208.2 million to $186.2 million, while EBITDA for the company fell from $278.8 million to $258.7 million.

All things considered, these results are not exactly horrible. However, management expects weakness to continue. The only guidance provided by the company involves the third quarter of the 2023 fiscal year. They expect revenue for that quarter to come in between 6.5% and 8.2% lower than what was achieved last year. Net income should be between $56.4 million and $60.4 million. To put this in context, in the third quarter of 2022, it totaled $73.2 million. And finally, EBITDA is expected to be between $130 million and $135.5 million. In the third quarter of 2022, it came in at $136.6 million.

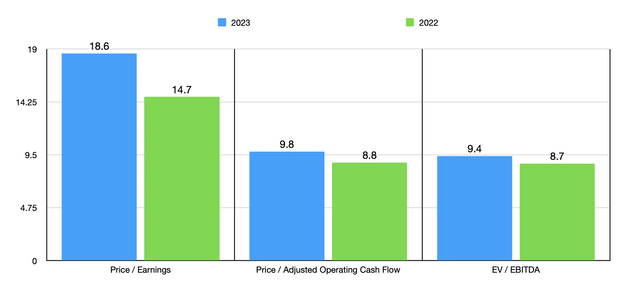

Author – SEC EDGAR Data

If we assume this trend of weakening results continues, which given the broader economic uncertainty caused by higher interest rates that should eventually lead to a reduction in demand for these types of services, then shares will ultimately be more expensive on a forward basis. By annualizing the results experienced so far for the year, I ended up with net income of $210.9 million, adjusted operating cash flow of $401.1 million, and EBITDA of $519.1 million. Using these figures, I was able to create the chart above. As you can see, the stock does look a bit pricier on a forward basis. But then, in the table below, I compared the company to five similar firms. Using both the price to earnings approach and the EV to EBITDA approach, I found that two of the five companies ended up being cheaper than our prospect. Meanwhile, using the price to operating cash flow approach, I found that only one of the firms ended up being cheaper.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| ASGN Inc. | 18.6 | 9.8 | 9.4 |

| Insperity (NSP) | 20.7 | 14.8 | 11.4 |

| ManpowerGroup (MAN) | 12.5 | 10.2 | 7.1 |

| TriNet (TNET) | 21.6 | 14.7 | 11.1 |

| Kforce (KFRC) | 18.7 | 19.8 | 11.2 |

| Korn Ferry (KFY) | 14.5 | 8.4 | 6.8 |

Takeaway

At this time, I still consider ASGN to be an interesting company. In the long run, I suspect it will turn out to be a good investment. But right now, I don’t like some of the areas that we are seeing weakness in. On top of that, it’s clear that management expects this trend to continue in the near term. And in the event that the Federal Reserve gets what it wants with a weaker labor market, I would expect the picture to worsen even more. Because of these developments, I’ve decided to downgrade the company from a ‘buy’ to a ‘hold’ until such time that it looks as though the storm has passed.

Read the full article here

Leave a Reply