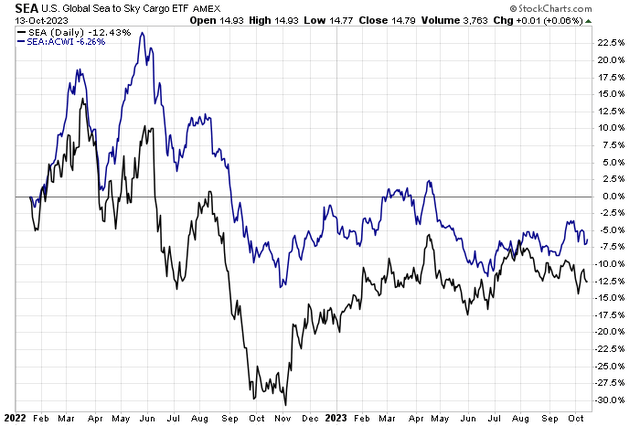

Following a solid bull market in early 2022 amid higher global shipping rates and geopolitical tensions, the oil transportation industry has been less stellar in the past year. I track absolute and relative performance trends in the U.S. Global Sea to Sky Cargo ETF (SEA). It underperformed over the final three quarters of 2022, but shares have merely traded sideways after rising impressively from November last year through mid-April.

I reiterate my buy rating on one of the ETF’s holdings: Teekay Tankers (NYSE:TNK).

Materials & Energy Transport Stocks Higher In 2023

Stockcharts.com

According to Bank of America Global Research, Teekay Tankers is one of the world’s largest tanker owners and operators. It owns 44 mid-sized tanker vessels, and is a 50% joint-owner of one VLCC, charters-in 9, for an operational fleet of 54 tankers. The company offers voyage and time charter services; and offshore ship-to-ship transfer services of commodities primarily crude oil and refined oil products, as well as liquid gases and various other products.

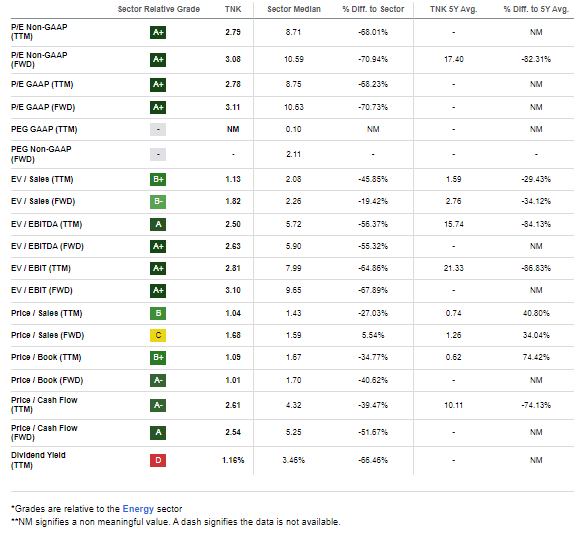

The Canada-based $1.5 billion market cap Oil and Gas Storage and Transportation industry company within the Energy sector trades at a low 2.8 trailing 12-month GAAP price-to-earnings ratio and pays a small 1.2% dividend yield. Ahead of earnings due out in early November, shares trade with a high implied volatility percentage of 45% while short interest on the stock is modest at 3.0%.

Back in August, Teekay reported a slight EPS miss. Per-share profits verified a $4.38, a $0.07 miss, while revenue of $370.6 million was 53% higher than year-ago levels, a $113 million beat. That was a near-term peak for the stock, though, as profits were taken with shares hitting resistance. The management team noted that quarterly free cash flow was better than $170 million and a $0.25 quarterly fixed dividend was announced.

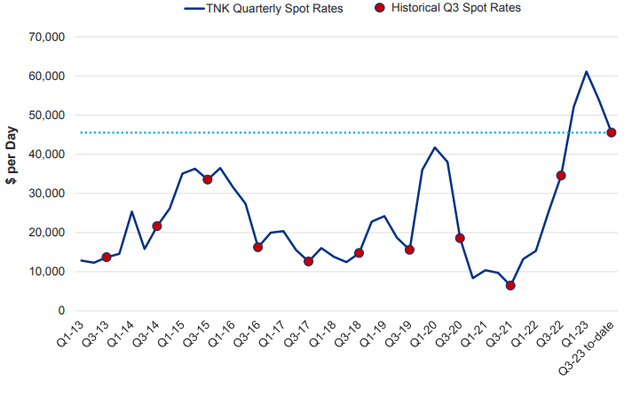

Spot tanker rates fell in the operating period but remained high compared to the range of the previous 10 years. The company mentioned record-high crude oil imports into India and China while Russian crude exports rose to a 3-year high.

TNK Quarterly Spot Rates (Average of Aframax and Suezmax Rates)

Teekay IR

Teekay is usually a volatile stock given its industry which is highly susceptible to changing shipping rates, often fluctuating based on geopolitical events. The management team has been focused on operating in the spot market while mitigating risks through debt repayments, which investors should appreciate. Key risks include macroeconomic ebbs and lower global shipping rates in the spot market. In general, lower oil prices tend to hurt the stock and any further production cuts out of OPEC+ could negatively affect shares.

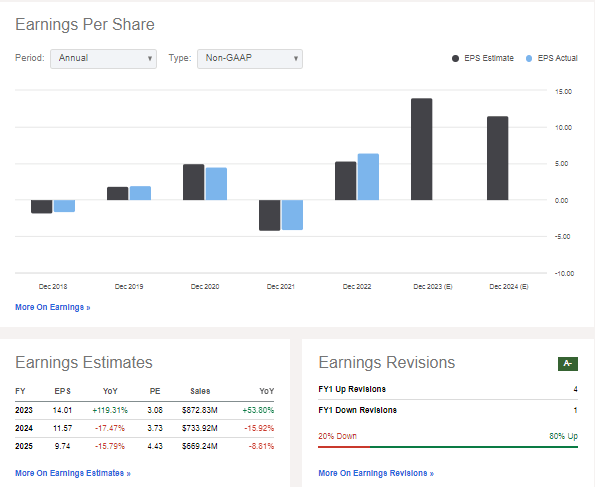

On valuation, analysts at BofA see earnings having risen sharply this year while the consensus outlook, per Seeking Alpha, shows $11.57 of expected EPS in 2024 and $9.74 for 2025. With out-year estimates showing less profitability compared to recent quarters, the low valuation partly makes sense. Dividends are expected to be $1 on an annual basis over the next several quarters while top-line numbers are seen as declining. Still, the firm is easily free cash flow positive.

Teekay Tanker: Earnings, Valuation Forecasts

Seeking Alpha

If we assume a roughly 7x normalized EBITDA multiple, about where shares have been in recent quarters, then the stock should be in the low $50s. There is a lot to weigh on the valuation considering the exceptionally low P/E and a modest P/S ratio. If we assign an industry average P/S, then that puts the stock about 20% above current levels, also in line with that low $50s target.

TNK: Compelling Valuation Metrics

Seeking Alpha

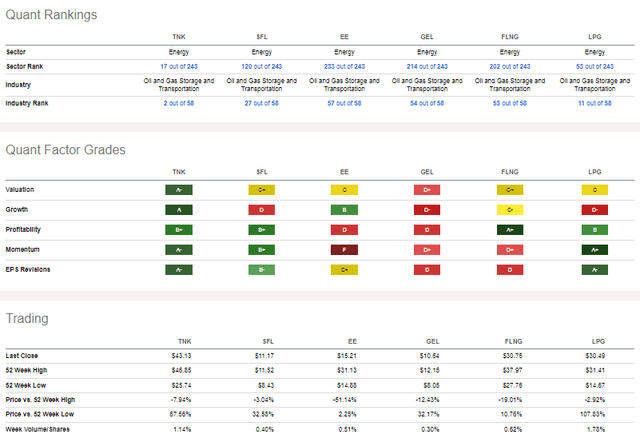

Compared to its peers, TNK features strong quantitative grades. Its valuation is attractive, but again that must be taken with a grain of salt given the soft growth trajectory (despite ample EPS growth in the last several quarters). Profitability is robust while stock price momentum is decent (though it has paused which I will detail later). Finally, earnings revisions have to the good side following a solid EPS beat rate history.

Competitor Analysis

Seeking Alpha

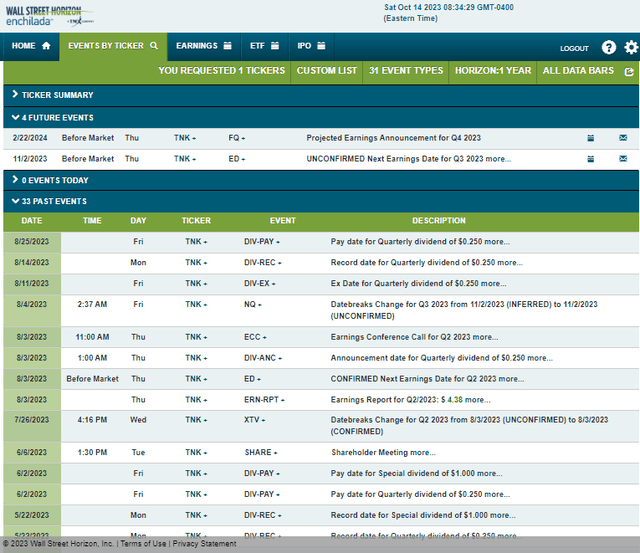

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3 2023 earnings date of Thursday, November 2 BMO. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

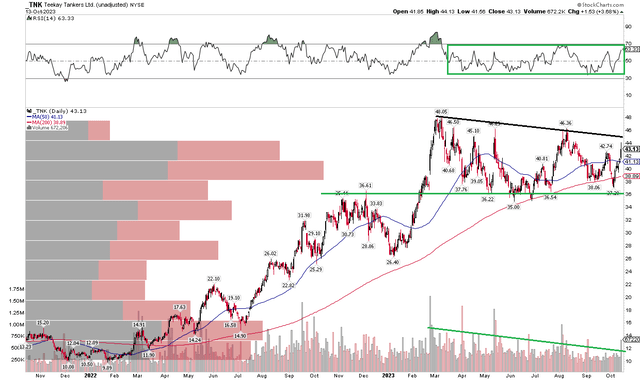

The Technical Take

Teekay is currently in a consolidation pattern. Notice in the chart below that shares reached a high of $48 back in March, shortly after I initiated coverage with a buy rating. With more than seven months of sideways price action, I found that volume trends reflect the price consolidation. Take a look at the volume bars at the bottom of the graph – generally-falling shares traded is actually something you want to see in a correction. The trend of larger degree is higher, and volume has been on the rise in the last few days with TNK up seven sessions in a row.

Still, I see resistance at the downtrend line off the 2023 peak while support is seen in the mid-$30s. I recommended readers buy a dip into the upper $30s in the first analysis, and that proved to be a solid play. For now, with a rising 200-day moving average indicating that the long-term trend is up, buying dips and getting bullish on a breakout above $48 should be the play. Finally, the RSI momentum indicator at the top of the chart underscores the notion that the bulls remain in control – TNK has never hit ‘oversold’ levels in this bullish consolidation price pattern.

Overall, a continued long position makes sense with a stop under $34.

TNK: Bullish Consolidation & RSI Range, Eyeing a Breakout, $35 Support

Stockcharts.com

The Bottom Line

I reiterate my buy rating on Teekay Tankers. The valuation is reasonable while the long-term price uptrend remains intact despite the months-long consolidation.

Read the full article here

Leave a Reply