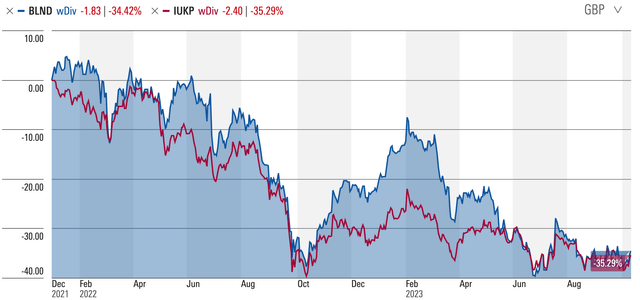

In a tough environment for REITs, shares of British Land (OTCPK:BTLCY)(OTCPK:BRLAF) have largely tracked the misfortunes of the wider domestic space since the Bank of England kicked off its hiking cycle at the end of 2021.

British Land Total Return vs iShares UK Property UCITS ETF (Source: Morningstar)

Rapidly rising interest rates and office exposure have been two particular points of market concern. The former is obviously a sector-wide issue, with yield expansion having the predictable effect on property and REIT stock valuations, while on the latter, British Land does also skew quite heavily to central London offices (~64% of its overall portfolio valuation). Retail parks (~22%), shopping centers (~8%), London-based logistics (~3%) and other retail (~3%) account for the remainder.

Where British Land and its peers go from here is the million-dollar question. Buying REITs at peak interest rates and just before economic troughs has traditionally been a good idea, though of course that is something easier said than timed. The Bank of England’s recent pause has given fuel to the idea that we are at, or at the least near, the top in terms of the current hiking cycle, while those bullish on UK REITs will also be hoping that Q3 represents a low point in terms of the country’s economic performance. If so, these shares could hold a good deal of value potential given their current discount to NAV and high dividend yield, albeit that is admittedly a very big ‘if’ at the moment.

The Main Headwinds

British Land has come up against two big headwinds recently. Firstly, the non-specific issue of rising interest rates throws up the usual well-known issues for REITs, including yield expansion (lower property and share valuations), higher financing costs and expanding loan-to-value ratios. At the same time, the work-from-home and hybrid-work trend that took off during COVID is causing a lot of consternation in the office space.

British Land is right in the thick of things given the skew of its portfolio. Office performance is admittedly uneven, with vacancy rates in Canary Wharf (20%-plus) landing around 10-13ppt higher than the City and West End, but the fact remains that London office vacancies are at levels not seen since the early-1990s property crash. Occupancy levels across two of the company’s three campuses – Broadgate JV (94.9%) and Regent’s Place (96.0%) – remain a couple of points below pre-COVID 2019 levels, and in a sign of the times tech giant Meta (META) has recently paid several years’ worth of rent to break from one of its British Land-owned offices in Regent’s Place. On the flip side, there has been brighter performance in the company’s retail parks (22% of property value but over 30% of gross rents), with occupancy of around 99% representing a circa 12-year high. Footfall and sales have finally hit their pre-COVID marks, though release spreads continue to be negative.

Higher interest rates represent the more general problem right now. Downward revisions to property valuations saw EPRA net tangible assets fall around 20% last year (FY2022/23), with British Land’s LTV ratio inching up to around the 36% level. That makes it more geared than Diversified REIT peer Land Securities (~31.7% LTV) and London office-focused Derwent (OTCPK:DWVYF) (~25%) and Great Portland Estates (OTCPK:GPEAF) (~20%). More positively, committed development CapEx of £490m looks very manageable (~5.5% of the current portfolio value), and £1.8 billion in untapped credit facilities means British Land shouldn’t face any refinancing requirements over the next couple of years.

No Shortage Of Risk, But Reward On Offer Also

At this point I believe it is fair to say that British Land faces no shortage of potential risks. Sticky inflation leading to higher for longer interest rates depressing property values further; a more severe than expected economic slowdown/recession hitting occupancy levels and rental income; and long-term downward pressure on office occupancy and rents from WFH/hybrid-working trends are the ones that immediately come to mind.

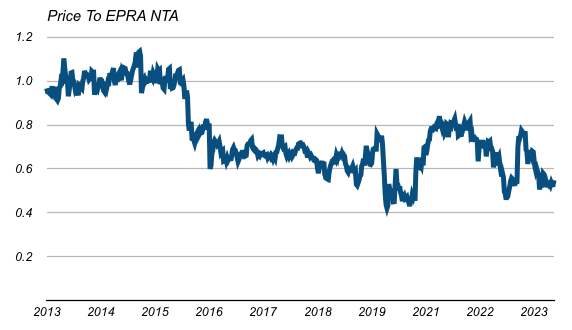

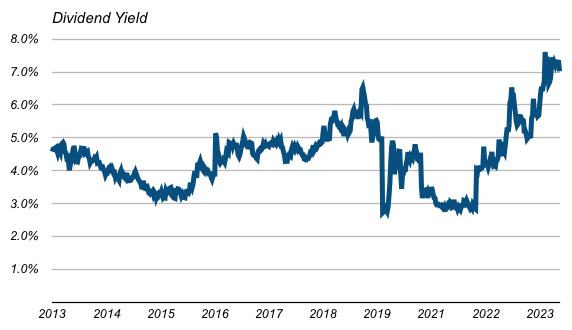

While those represent real risks here, I would argue there is a lot of potential reward on offer also. British Land shares trade for GBX 316 ($3.77 per ADS) at time of writing, putting them at around 0.53x FY2022/23 EPRA NTA per share and on a circa 7.2% dividend yield. Those look pretty attractive compared to valuations seen over the past decade or so. I would also note the valuation discount to selected peers, with British Land looking attractive against Land Securities (0.64x, 6.4% DPS yield), Great Portland Estates (0.55x, 3.1% DPS yield) and Derwent (0.55x, 3.2% DPS Yield).

Data Source: Yahoo Finance, British Land Annual Reports

Data Source: Yahoo Finance, British Land Annual Reports

The big open question is on the macro timing. Typically, buying REITs near the top of hiking cycles and a quarter or so before the economy bottoms has been a good entry point. In terms of the former, the Bank of England’s recent pause has led a number of analysts to think that we may have reached the peak, while the optimist in me hopes that Q3 could tentatively mark the low for the UK economy. If so, NAV per share should bottom this year (i.e. the company’s FY2024), while the current historically high dividend yield would likewise point to upside for the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply