Investment Thesis

PENN Entertainment (NASDAQ:PENN) offers investors a rare opportunity to buy shares in an industry leader at a discounted valuation. PENN operates the largest regional casino footprint in the U.S. with 43 properties across 20 states and holds a dominant competitive position in most of its core regional markets like Michigan, Pennsylvania, and Mississippi. The company also boasts an enviable portfolio of recognizable consumer brands including Hollywood Casino, L’Auberge, and Barstool Sportsbook.

PENN’s national scale and regional dominance provide it with significant competitive advantages and operating efficiencies that are misunderstood by many investors. The market is overly focused on short-term issues like the current macroeconomic climate and small recent bad bets, ignoring PENN’s structural strengths and long-term growth prospects. At a Forward P/E of ~5.3x, patient long-term investors are being presented with a compelling opportunity to buy into this gaming juggernaut at a discounted valuation.

Dominant Market Position and Competitive Moats

As the largest regional casino operator, PENN owns over 40 gaming properties across 19 states and estimates it has 16 of the top 35 largest gaming facilities in the U.S. based on square footage. The company focuses heavily on regional casino markets rather than destination markets. On the Q1 2023 earnings call, CEO Jay Snowden noted “Our properties prove to be more resilient than initially anticipated, given the increased supply in a few markets and the ongoing uncertain macroeconomic environment.” This implies that PENN has established strong positions in its key regional gaming markets.

This market position provides PENN with considerable operating leverage, brand strength, and marketing synergies. For example, CEO Jay Snowden noted on the Q4 2022 earnings call that PENN’s database of over 26 million loyalty members gives it a significant edge: “Our deep customer database, retail footprint and powerful Barstool Sports marketing engine contributed to a record number of first-time depositors at launch despite minimal external marketing expense.”

PENN’s size also enables it to achieve greater operating efficiency compared to smaller peers. The company highlights its ability to maintain high EBITDAR margins through casino property operating expense control and reductions in marketing spending relative to pre-COVID levels. As CEO Jay Snowden stated in the Q4 2022 earnings call: “We continue to be impressed and very pleased with the industry and our approach to marketing. So we continue to envision a very rational marketing approach for all of us.” These structural advantages stemming from PENN’s national scale create a sustainable moat around the business.

In addition, PENN possesses a powerful portfolio of consumer brands. Barstool Sportsbook in particular gives PENN exclusive access to Barstool’s deeply loyal audience of 66 million monthly unique visitors. The recent deal with ESPN also provides a new avenue to acquire customers efficiently. As Snowden said, “we will be getting significant value for our marketing dollars by allocating those funds to the single best brand and platform in the U.S. to reach sports fans and potential betters.”

Shortsighted Bear Case

Despite PENN’s obvious strengths, the stock has languished over the past year primarily due to recession fears and Barstool write-down concerns. However, these bearish arguments ignore the resilience PENN has shown through past downturns and management’s disciplined capital allocation.

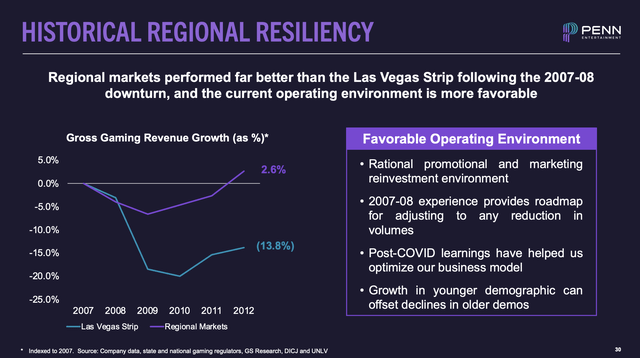

While consumers may pull back on discretionary spending in a recession, PENN’s core customer has historically been resilient. Regional casinos cater more to the middle class compared to Las Vegas, and customers view it as an affordable entertainment option rather than a luxury splurge. For example, PENN’s revenues remained virtually flat throughout the 2008 recession, unlike other recession-sensitive luxury casinos.

Regional resiliency (PENN)

Likewise, concerns over the Barstool investment have led to an overly pessimistic view. As CEO Jay Snowden acknowledged in Q2’23 earnings call, “it became obvious to both parties that there’s probably long term only one natural owner of Barstool Sports, and that’s Dave Portnoy and Barstool Sports.” While the investment didn’t pan out as hoped, it provided PENN with valuable lessons that will prevent repeating similar mistakes. Past performance is no guarantee of future results.

Attractive Valuation and Total Return Potential

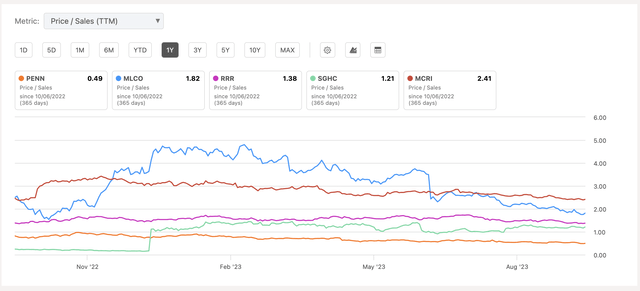

Seeking Alpha (Seeking Alpha)

At ~0.5x TTM Price/Sales, PENN trades at a substantial discount to historical averages and regional casino peers that fetch closer to 1.5x or more. This Valuation implies an overly pessimistic view. It also ignores the relatively better performance profile of PENN during economic downturns. A rerating of the stock seems imminent as the market appreciates PENN’s business fundamentals. I expect PENN to be awarded a premium multiple of 1.5x sales over the next few years as the market appreciates the company’s dominant market position and cyclical resilience. Assuming a modest 4% revenue GAGR and similar profit margins, my 2028 estimates are the following:

| Revenue | $7,900m |

| Price / Sales | 1.5x |

| Valuation Estimate | $11,850m |

| Annualized Return | ~29% |

Risks

While the risk/reward proposition is skewed positively at current levels, risks do exist. PENN has modest leverage with a net debt/EBITDA ratio of 4.4x. A severe recession could pressure free cash flow and make debt refinancing more difficult. The ESPN partnership entails execution risk, as PENN must still capture the intended audience and convert them into sportsbook customers. Delays in additional state legalizations also remain a headwind for online growth. Investors will have to stay patient.

Conclusion

PENN’s dominant position and brand strength provide the company with durable competitive advantages. While macroeconomic uncertainty has pressured the stock, the long-term growth story remains intact. With shares trading at a substantial discount to peers, PENN offers a compelling risk/reward opportunity at current levels for patient investors. The market is providing a margin of safety, and investors would be wise to take advantage. Upside potential appears significant as fundamentals reassert themselves over the coming years.

Read the full article here

Leave a Reply