Investment action

Based on my current outlook and analysis of Cintas Corporation (NASDAQ:CTAS), I recommend a buy rating. The company’s most recent quarter showed impressive results, underpinned by a significant uptick in organic growth. This momentum was driven by excellent performance across all business domains, marked by an increase in volume and pricing in line with historical trends. A key highlight has been the company’s forward-thinking adoption of technology, which has enhanced operational efficiencies and improved profit margins. The strength of its incremental margins has further elevated its operating margins, distinguishing it from peers. A comparative analysis with industry peers reveals CTAS’s dominant EBITDA margin and ROE, emphasizing its business quality. Given this strong performance trajectory and the company’s proactive strategies to drive future growth, I recommend a buy rating.

Basic Information

CTAS is a leading North American provider of business services. They specialize in designing and manufacturing uniforms, offering rental, leasing, and direct purchase options. Beyond uniforms, CTAS ensures businesses maintain a professional image with products like mats, mops, and restroom supplies. They also prioritize workplace safety, providing first aid kits, safety products, and training programs. Additionally, they offer fire protection services, encompassing fire extinguisher inspection, alarm monitoring, and sprinkler system maintenance. Their diverse offerings, commitment to customer service, and innovative approach position them as a trusted partner for businesses across various sectors.

Over the past five years, CTAS has experienced accelerating growth in revenue. In FY23, it reported a revenue growth rate of 12%, compared to 6% in 2018. This achievement is particularly impressive as it represents a doubling of its growth rate. Additionally, when considering the EBITDA margin, it has shown consistent improvement. In 2017, it reported a margin of approximately 20%, which has since expanded to 25% by 2023. In summary, CTAS’s historical financial performance demonstrates robust growth, with both revenue and margins consistently increasing over the last five years.

Review

CTAS reported strong first quarter results with a revenue of $2.34 billion, marking an 8.1% organic year-over-year increase. Strong momentum across all business sectors, which was evident in significant volume expansion and favorable pricing that was now in line with historical benchmarks, served as the driving force behind this growth. The First Aid and Safety Services segment led the growth, registering an 11% organic increase to reach $261 million. This was followed by the Uniform Rental and Ancillary Services segment, which grew organically by 7.6% to $1.82 billion. The All Other segment presented a mixed picture. Fire Protection Services surged by 14.2% organically to $174 million, and the Uniform Direct Sale business dipped by 2.7% organically to $81 million, bringing the total revenue for this segment to $254.8 million.

The First Aid segment was highlighted positively, driven by its compelling value proposition. The product assortment in this segment has now realigned with historical trends, emphasizing first aid and safety. Technological advancements have been pivotal for the company in enhancing efficiency, particularly in the first aid business, further complemented by effective sourcing strategies. In addition to the impressive quarterly results, the management is proactively strategizing for business expansion. This was evident in the earnings call, where they highlighted acquisitions in three of their operating segments that were route-based during the quarter, signaling a diversified growth approach.

Shifting focus to margins, the quarter’s gross margin reached a record high of 48.7%. This impressive margin was partly due to reduced energy costs year-over-year, a combination of decreased energy prices and the company’s innovative SmartTruck technology. Segment-wise, the First Aid and Safety Services segment stood out with a gross margin of 55.9%. Management is optimistic about maintaining this business’s gross margin consistently above 50%. Other segments reported the following gross margins: Fire Protection Services at 49%, Uniform Rental and Facility Services at 48.1%, and Uniform Direct Sales at 38.7%. The operating margin for the quarter also peaked at 21.4%. This robust margin performance was attributed to the company’s impressive incremental margin of 34% for the quarter, even though it was slightly offset by a rise in SG&A expenses, which constituted 27.4% of the revenue. While specific reasons for the elevated SG&A level weren’t highlighted by the management, given the company’s usual trends, this quarter’s SG&A percentage is expected to be the highest for the year. Segment-wise operating margins were as follows: Uniform Rental and Facility Services at 22.3%, First Aid and Safety Services at 22.9%, and the All Other segment at 32.2%. The company’s commitment to leveraging technology, especially in the First Aid segment, underscores its ongoing efforts toward operational efficiency and cost optimization.

Valuation

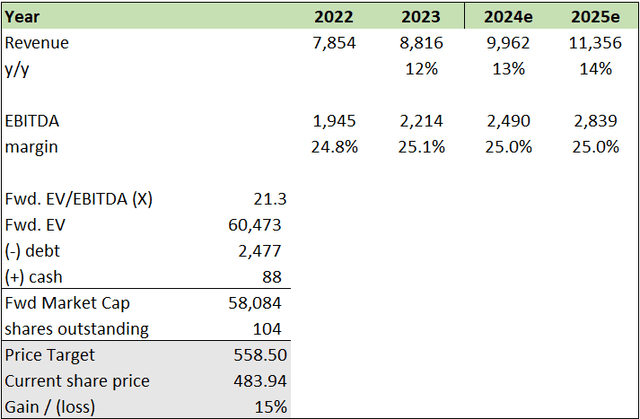

I believe CTAS can grow by 14% for FY25 because of the following factors: Firstly, the company shows impressive results for the first quarter, reflecting robust organic growth. This growth was fueled by strong performance across all business divisions, marked by a notable increase in volume and pricing that resonates with past trends. The firm’s technological strides have played a crucial role in boosting its operational efficiency. Historically, its revenue growth rate has been growing consistently, and I expect this to continue moving forward, driven by management’s active plans for future growth via acquisitions.

Turning to profitability, the gross margin for the quarter set a new benchmark, largely due to the company’s drive to leverage the benefits of technology. Furthermore, the operating margin for the quarter reached an all-time high, a testament to the company’s remarkable incremental margin performance. The firm’s dedication to harnessing technology highlights its relentless pursuit of operational excellence and cost management. I anticipate these advantages will positively influence the subsequent quarters.

Author’s work

CTAS is currently trading at a forward EV/EBITDA of 21.3x, while its peer, UniFirst (UNF), is trading at 10.3x. Considering that CTAS boasts a 24% EBITDA margin, surpassing its peer’s 11.39%, and a higher ROE of 37.8% compared to the peer’s 5.3%, the elevated multiple for CTAS seems justified.

My price target is ~$559, indicating a potential upside of 15%. Therefore, I recommend a buy rating for CTAS. My confidence stems from the company’s notable margins compared to its competitors. The sustained strength in these margins highlights CTAS’s dedication to leveraging technology. This commitment is clearly reflected in its impressive ROE.

Risk and final thoughts

One potential downside risk for CTAS, as hinted in the earnings call transcript, relates to the challenges associated with implementing new systems and technologies. Specifically, the company mentioned the ongoing implementation of SAP for their fire protection business. Such implementations can be complex and may lead to disruptions in operations, increased costs, or delays. While the company is optimistic about the long-term benefits of the system, the transition phase can pose risks in terms of operational efficiency and cost management, which will ultimately impact its impressive margins achieved this quarter.

In conclusion, the company’s first quarter results have proven to be highly commendable, reflecting a remarkable surge in organic growth. Outstanding performance across all sectors has driven this growth, which has also seen a sizable increase in both volume and price, in line with historical trends. Notably, the company’s embrace of technological advancements, particularly the innovative SmartTruck solution, has played a pivotal role in optimizing operational efficiency and bolstering gross margins. Moreover, the robustness of its incremental margins has been a driving force behind its impressive operating margin, setting it apart from its industry peers. When evaluating CTAS’s performance against its competitors, its superior EBITDA margin and ROE further underscore the company’s exceptional quality. Considering these compelling factors and the proactive strategies to ensure business expansion, I recommend a buy rating for CTAS.

Read the full article here

Leave a Reply