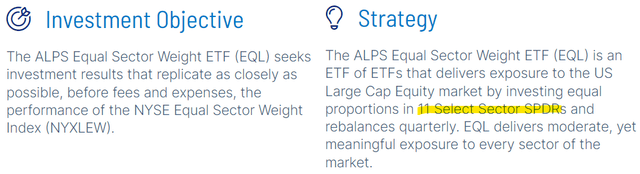

The ALPS Equal Sector Weight ETF (NYSEARCA:EQL) takes a unique approach to large-cap U.S. equities diversification. The fund invests across the 11 “Select Sector SPDRs”, which are the exchange trade funds covering the S&P 500 Index (SP500) in an equal proportion. By this measure, EQL is technically a fund of funds or “ETF of ETFs”.

This strategy differs from more commonly seen equal-weighting methodologies that are based on the actual underlying stocks. The result is that EQL skews the sector tilts compared to the S&P 500 because of the differences in the number of companies represented in each sector.

The fund’s distinct risk and return profile is a good option to complement a more traditional equities allocation. In our view, EQL can work as a portfolio diversifier to capture high-level themes in stocks with a balanced approach.

What is the EQL ETF?

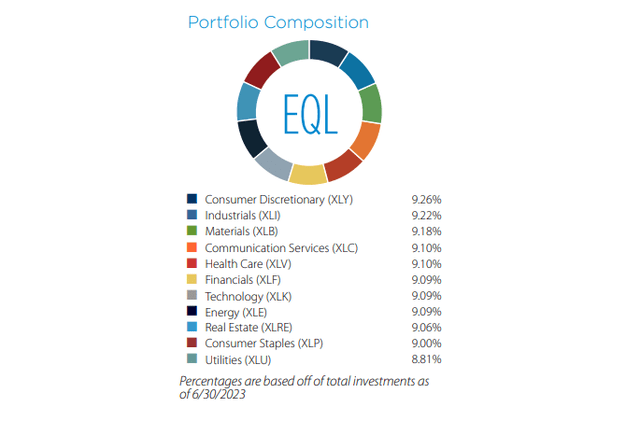

EQL is intended to track the “NYSE Equal Sector Weight Index”. As the name implies, the major market sectors are equally weighted which includes Consumer Discretionary, Industrials, Materials, Communication Services, Health Care, Financials, Technology, Energy, Real Estate, Consumer Staples, and Utilities.

source: ALPS

Notably, the fund and underlying index utilize the corresponding 11 Select Sector SPDR ETFs which are a family of funds that focus specifically on targeted exposure in those sectors. These are rebalanced every quarter to maintain an approximately ~9% weighting per ETF.

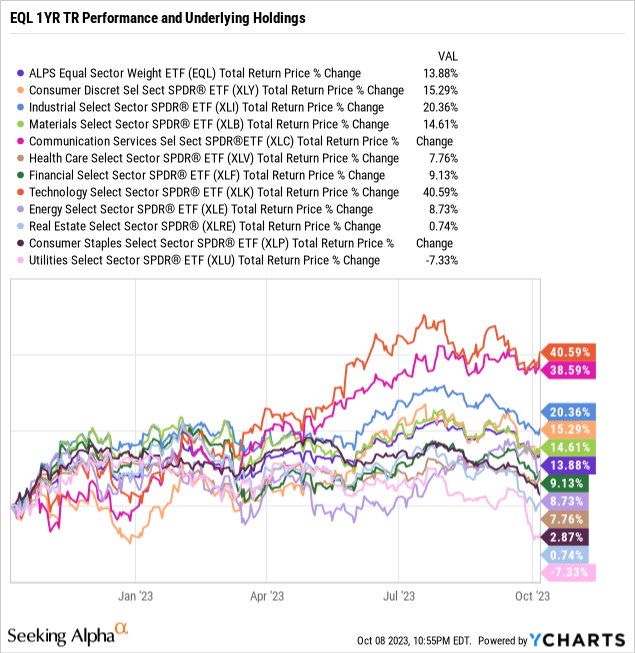

source: ALPS

The chart below shows the EQL ETF has returned 14% over the past year. The fund’s performance is the average between each of the SPDR holdings considering a 41% return in the Technology Select Sector SPDR ETF (XLK) as an outperformer against the -7% decline in lagging Utilities Select Sector SPDR ETF (XLU) over the period.

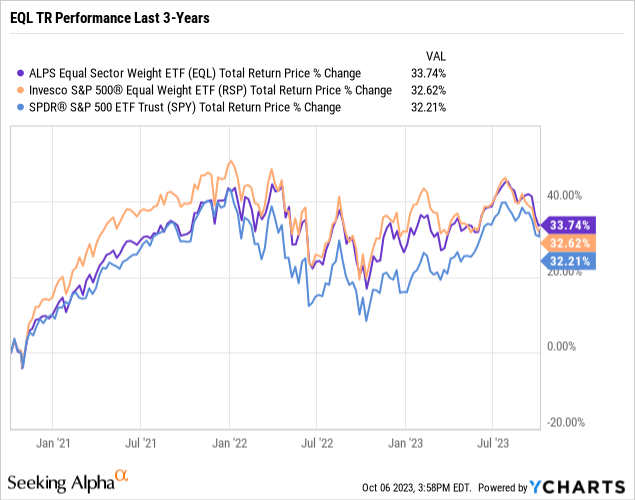

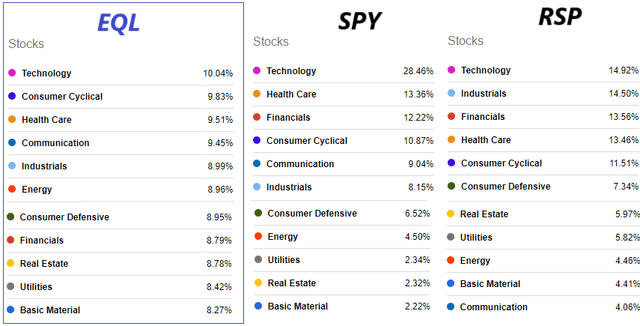

EQL vs SPY and RSP

At the same time, it’s important to point out that EQL has underperformed the SPDR S&P 500 ETF Trust (SPY) which has returned a stronger 16% over the past year. That spread is explained by the differences in sector allocations being that EQL is underweighting some of the top-performing groups while overweighting some of the laggards reflecting its equal-weight strategy.

Specifically, EQL with its current 10% allocation to tech is well below the S&P 500 benchmark where technology stocks comprise nearly 30% of the fund. On the other hand, EQL’s position in Utilities, Real Estate, and the Basic Materials sectors, with an 8-9% weighting, is well above their 2% position in SPY.

Seeking Alpha

Here, we can bring into the discussion the Invesco S&P 500 Equal Weight ETF (RSP) for comparison purposes. In contrast to EQL, RSP invests across all 500 stocks in the S&P 500 Index at an equal proportion.

The reason this approach is different is based on the wide range in the number of companies represented in each sector. For example, while there are 67 stocks in the Technology sector, only 32 companies are classified as in Communication. RSP’s sector tilts reflect the sectors with the most stocks.

What we find is that EQL sits between RSP and SPY in terms of having less exposure to certain sectors like Technology, Healthcare, and Financials but larger positions in the smaller groups.

The takeaway here is that EQL ends up being more different from the S&P 500 than what RSP achieves. We’re not suggesting one fund is better than another, but simply that their performance will vary depending on current market circumstances.

Again, the idea is not necessarily to outperform the S&P 500 in all timeframes, but to instead offer a form of diversification. Investors with an existing large position in an S&P 500 fund could allocate toward EQL to essentially increase their effective positions in the smaller sectors.

What’s Next For EQL?

What we like about EQL is that the equal sector weight strategy can proverbially wear multiple strategic hats in various market environments. Regardless of which sector is outperforming, the fund will always participate in a market rally while reducing the impact of a crash on a particular sector on the downside.

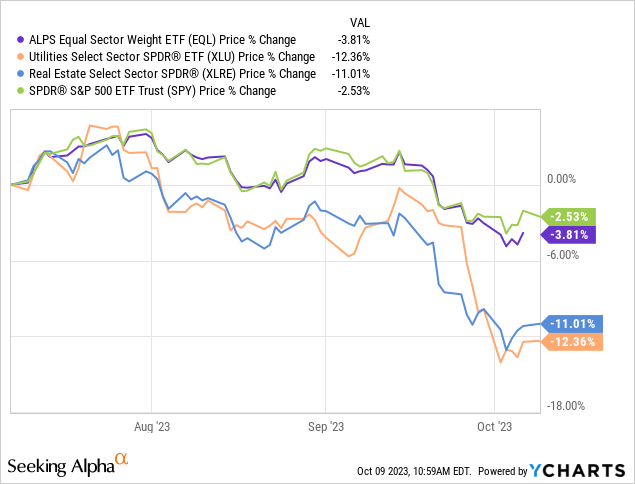

Currently, we’re looking at EQL as a sort of contrarian play given it is overweight some of the worst-performing sectors relative to the S&P 500.

A major market theme in recent months has been the surge of interest rates amid concerns inflation remains too high and the Fed may be forced to continue with monetary tightening. In this case, EQL could be well-positioned to outperform if some of the interest rate-sensitive sectors like utilities and real estate can make a comeback compared to their recent weakness.

This scenario could play out if interest rates pull back and defensive sectors receive a bid amid the possibility of a more concerning deterioration to the global economy. The latest development of geopolitical risks in the Middle East has added to market risks which could further force a broader rebalancing across sectors towards defensive names compared to tech which was a winner for most of the year.

Naturally, if we could say with certainty that a particular sector or even a single stock would lead higher from here, the aspect of a diversified ETF would be unnecessary. That measure of uncertainty is what makes EQL interesting because it removes some of that guesswork.

Final Thoughts

EQL is a high-quality fund that serves its purpose with a compelling diversification strategy and a reasonable 0.26% expense ratio. Overall, we expect the fund to deliver a positive return over the next year, capturing an improving macro backdrop.

Investors that are already overweight mega-cap technology stocks or with a significant position to traditional index funds may find some benefit in allocating through an equal sector weighting as a form of balancing risk.

In terms of risk, the caution here is that EQL would not be immune to a deeper broad market selloff. The particular sector tilts could also add to the volatility depending on the trading action.

Read the full article here

Leave a Reply