Introduction

The last quarter showcased a significant beat on the bottom line for Erie Indemnity Company (NASDAQ:ERIE), but the fact of the matter remains that the valuation is too high to justify a buy case. The jump in price greatly increases the downside risk if there is a broader market correction.

However, holding shares still seems like a reasonable approach to take when the yield is over 1.6% right now and it has been growing for the last 12 years consecutively. I like the business and how it operates, the large amount of retention they can have speaks volumes about the quality they provide. For the moment though it remains to be a hold.

Company Structure

ERIE founded in 1925 and based in Pennsylvania, operates as the attorney-in-fact for policyholders at the Erie Insurance Exchange. The Erie Insurance Exchange, a Pennsylvania-based reciprocal insurer, specializes in underwriting property and casualty insurance policies. ERIE plays a crucial role in managing policy issuance and renewals for the subscribers at the Exchange. Additionally, the company is responsible for claims processing, and investment management, and offers administrative services to all claim holders, ensuring efficient and comprehensive support for its clientele.

ERIE safeguards the Exchange’s financial well-being, which is instrumental in propelling the prosperity of Indemnity. The dynamics of their partnership are delineated within the subscriber’s agreement, which also delineates the structure of management fees. In adherence to this agreement, the management fee is subject to a cap, ensuring it does not surpass 25% of the premiums written by the Exchange.

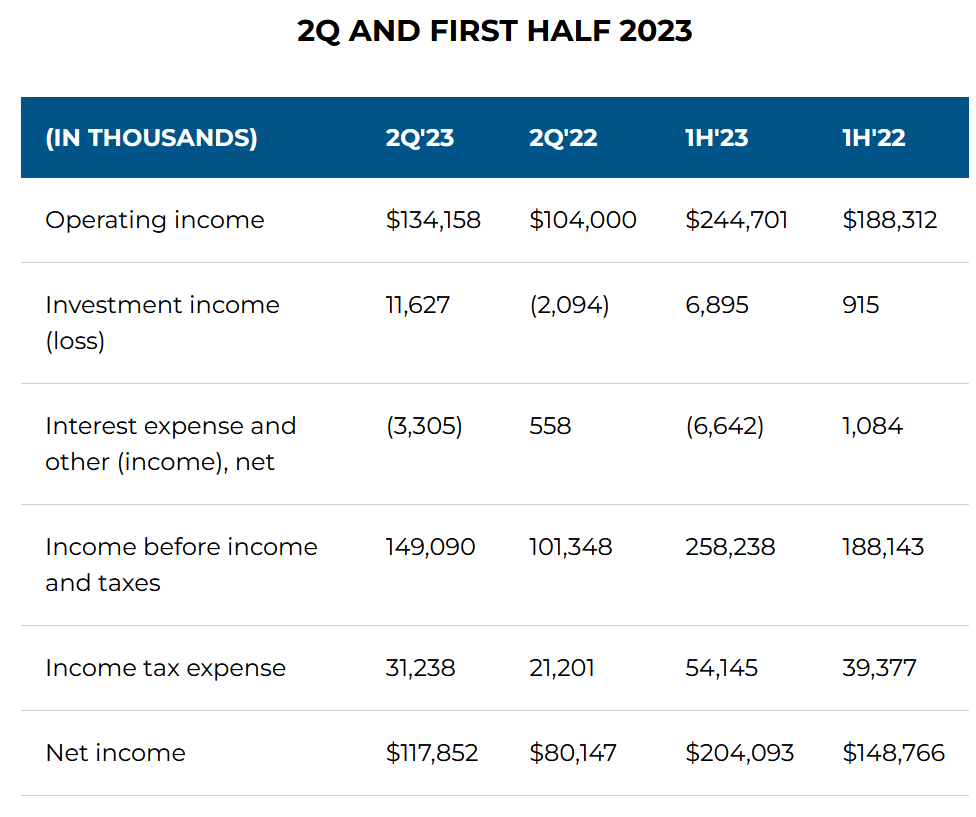

Income Statement (Earnings Report)

Going off the last income statement from the business there was strength across the board, I think. The bottom line managed to grow very well up to $117 million for the quarter, as opposed to $80 million in Q2 FY2022. This has been largely possible thanks to the higher investment income the company can generate. Last year they posted negative investment incomes, but this year around it was $11 million positive instead.

Pennsylvania stands out as one of the states with relatively high home and car insurance costs. However, despite these elevated premiums, there continues to be a substantial demand for insurance within the state. If ERIE can continue to drive significant growth thanks to the large market opportunity I think that the market will continue to reward the company with the large premium it currently trades at. With rising home prices and car prices, the cost of insurance goes up and so does the revenues of ERIE as a result.

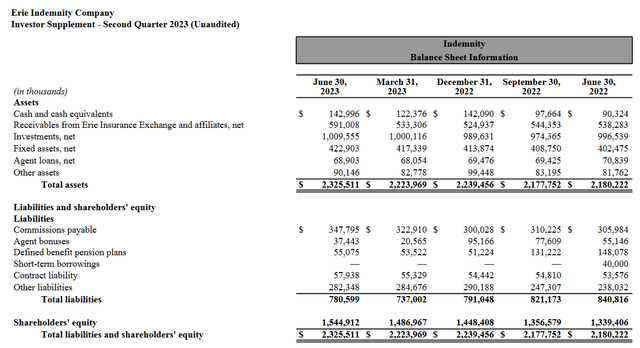

Balance Sheet (Earnings Report Q2)

Looking at the financial health of the company I think it looks quite decent right now. The cash position has risen very well to over $142 million, up from $90 million a year earlier. But what I am more looking at is the investments the company is making, right now boasting over $1 billion. A steady increase here should underscore the financial position of ERIE and should enable the business to maintain a similarly high ROE as the 24% TTM has been.

This I think is making investors more bullish on the company and has been cause for the rapid rise in share price the last few months. The financials of the company are solid I think but even with that, the valuation has somewhat gotten out of control, and a pullback could occur in the near term, which makes a hold the most reasonable rating here.

Looking at what the investments are composed of, the 2022 year report mentions both fixed-income securities, equity securities, and limited partnerships. The emphasis is mostly on fixed-income securities which has helped drive steady and reliable earnings growth over the last few years. The majority of the investments the company has sits in corporate debt securities right now at $569 million as of their latest 10q. The second largest portion of investments are in residential mortgage-backed securities at $158 million. I find these to be quite stable sources of investment income for the company and the last quarter it netted them around $13 million. On an annual basis that is just over $50 million. If this can be sustained it can prove to be a stable backbone for the company’s earnings and should enable ERIE to maintain an ROE of around 24%. Even now, the company is slightly below its 5-year average ROE of 26%. Going forward, I think the relatively safe and reliable areas that ERIE has invested in should yield them a strong amount of net investment income and ultimately lead to a sustainable 22 – 24% being achievable for ERIE.

Earnings Transcript

I have discussed that the last report from ERIE showcased a strong beat on the top line for the business which ultimately led to the rising share price in the following weeks afterwards. Let’s take a closer look at the earnings call that was held and get some comments from the management, more specifically the CEO of ERIE Tim NeCastro.

-

“A frequent topic of discussion at these recent gatherings has been the challenges the industry continues to face. Inflation, supply chain issues and an increase in severe weather are among the most pressing, and we’re certainly feeling the effects of them so far in 2023. That’s reflected in our combined ratio, which now stands at 120.8% compared to 113.7% for the first half of 2022”.

Going into the next few quarters there really needs to be improvements on this front for the company. If the combined ratio remains above 100% for too long I think that the market will turn sour on the prospects of ERIE as expenses are too much and the efficiency of the business is deteriorating.

-

“Overall, policies in force are up 5.2% with personal lines reaching its highest growth in 20 years at 5.5%. Retention is also strong at 90.8% for personal and commercial lines combined, with retention for personal auto, which stands at 92.3%, approaching an all-time high. This impressive growth and the loyalty demonstrated by our policyholders is a testament to the strong value proposition we offer”.

Despite the challenges the company is facing the fundamentals and core parts of the business remain very strong. The rise in inflation and interest rates is creating short-term difficulties for the company, but I don’t think it’s indicative that ERIE won’t be able to deliver strong growth over the coming decades. The fact that they have such a high retention rate I think speaks volumes about the base and clients they are serving and the quality of the business.

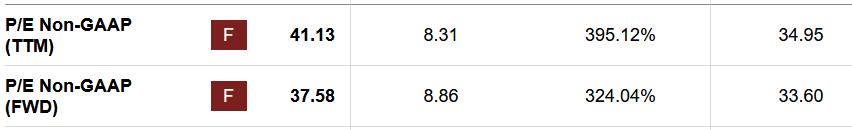

p/e (Seeking Alpha)

But when looking at the valuation of the company I think it becomes quite absurd right now. There may be a significant amount of growth happening, but it’s not being showcased well enough to justify an FWD p/e of 37. Even though it’s decreasing, the current share price will have to stay stagnant for the valuation to catch up. With higher weather and catastrophe-related events happening the losses of ERIE could increase. This risk more than diminishes the buy case right now I think.

As for what I think will be a fairer valuation of the business, well it comes down to similar numbers as the rest of the sector. ERIE has been growing but I don’t necessarily see any qualities to suggest that a near 350% premium based on p/e should be applied here. The company has grown, that is true, but even with double-digit EPS growth in the coming several years, I think investors are stuck with little appreciation for their position. I find a fair value to be around 1 for the p/b and 10 – 12 for p/e, which leaves quite a lot of downside risk here still.

Risk Associated

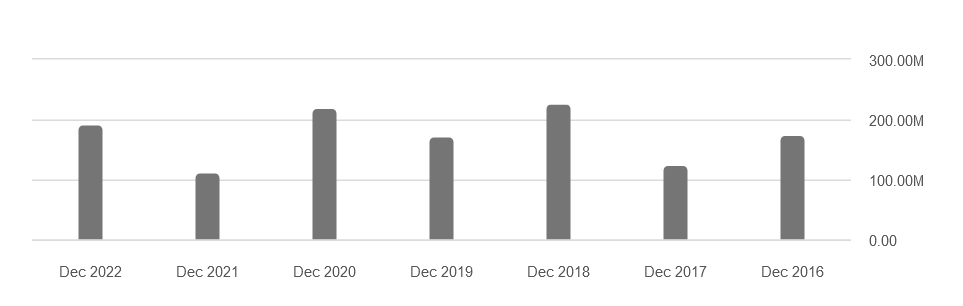

ERIE’s financial performance is intrinsically linked to the fortunes of the Erie Insurance Exchange. Any developments that hinder the Exchange’s capacity to expand or maintain its financial stability will inevitably impact ERIE as well. It’s worth noting that the Exchange has demonstrated robust premium growth over the past six years, which serves as a positive indicator and helps mitigate some associated risks. Nonetheless, it remains important to closely monitor this key performance indicator to ensure the continued health of ERIE’s operations. The key figure I am watching though with ERIE is the bottom line and the retention of margins. The last quarter offered a significant beat on the bottom line and this sent the share price upwards significantly. Looking at the bottom line of ERIE it sits at 11.66% right now, just in line with the historical 5-year average of the business. I think that going forward we are likely to see improvements on this front.

Net Income (Seeking Alpha)

ERIE’s CEO has emphasized the company’s strategic goal of enhancing profitability by harnessing the power of data. Nevertheless, any delays in achieving these improvements carry substantial risks for the company. Failure to demonstrate tangible enhancements in margins over time could lead to investor dissatisfaction and potentially result in a stagnant share price. Thus, the successful implementation of data-driven strategies remains critical for ERIE’s prospects. Furthermore, the valuation of ERIE is quite high right now following the significant jump in price after the last report was released. This puts ERIE at an FWD p/e of 37, a number I am not comfortable paying for almost any company. Even if there is double-digit growth for a prolonged period there is still a massive premium you have to overcome. This leaves in my opinion too much immediate downside risk for the company and investors ultimately making the buy case nonexistent and the only reasonable rating is a hold right now.

Investor Takeaway

The insurance space can be difficult to navigate but it seems that ERIE has done a decent job so far as the bottom line is up over 30% YoY. If this is something that can be maintained then perhaps the high premium could be justified on some basis. However, I am worried that the recent increase in weather and catastrophe events is raising the losses of the company and suppressing some of the earning potential. This additional risk along with a large amount of regularity impacts is weighing on the investment thesis and ultimately leading to a hold being the most reasonable right now in my opinion.

Read the full article here

Leave a Reply