It’s been a rollercoaster ride of a year for investors in the precious metals sector, and while the royalty/streaming companies often offer somewhat of a sanctuary, this hasn’t been the case for all names. In fact, Wheaton Precious Metals (NYSE:WPM) will see a negative return for its second consecutive year if it can’t recover from its current correction, and Royal Gold (RGLD), running into stiff resistance at $145.00 and being unable to hold on to any of its gains since 2020. However, while Royal Gold (RGLD) has exposure to Penasquito (currently offline because of a strike) which explains some of its weakness this year, its percentage of revenue and NAV is much less chunky than Wheaton, with the mine translating to ~33% of attributable silver production and ~18% of cash flow last year. In this update, we’ll look at whether this headwind is priced into the stock and the outlook for its upcoming Q3 results.

All figures are in United States Dollars unless otherwise noted.

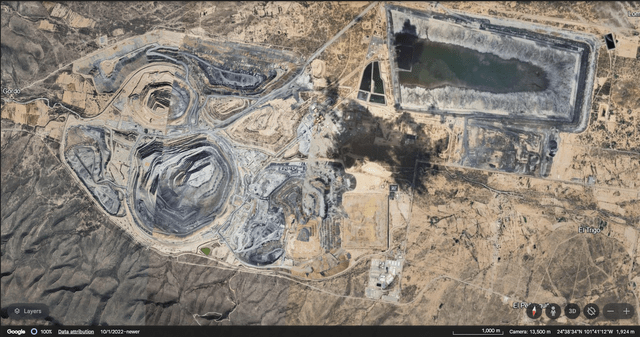

Penasquito Mine – Google Earth

A Softer Q3 On Deck

While the precious metals sector itself won’t see the strong Q3 that some were hoping for, if judging by where the metals started Q3, Wheaton’s Q3 results will be abnormally weak because of its heavy weighting to Penasquito. This is because of the strike that began in early June that will significantly affect Wheaton’s attributable production from this asset based on its 25% silver stream at the massive Mexican mine. And unfortunately, this is one of Wheaton’s largest contributors, as the chart below highlights, with average quarterly attributable production to Wheaton of ~2.4 million ounces on a trailing-twelve-month basis or ~$140 million in operating cash flow last year even during a disappointing year for silver prices.

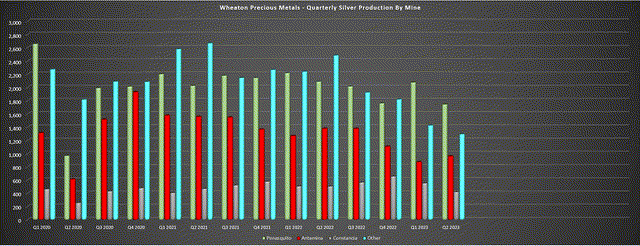

Wheaton Precious Metals – Quarterly Silver Production by Mine – Company Filings, Author’s Chart

If we adjust for the six to eight-week delay in production and sales at Penasquito, it looks like Wheaton will see production of ~400,000 ounces of silver at best in Q3, translating to less than one-fourth of this asset’s contribution in Q2 or a $25+ million gap in expected revenue in the upcoming quarter. This is not ideal when the company is also seeing much less revenue from its ‘Other’ silver category (no contribution from Yauliyacu where the stream was terminated vs. ~460,000 ounces of silver in Q3 2022) and softness in palladium prices, with the commodity continuing to sit near multi-year lows vs. a brief spike to ~$2,200/oz in Q3 2022 (current price: ~$1,200/oz). The result? Wheaton may only see a moderate improvement in revenue year-over-year despite being up against easy comps following the plunge in gold and silver prices in Q3 2022.

Palladium Prices – StockCharts.com

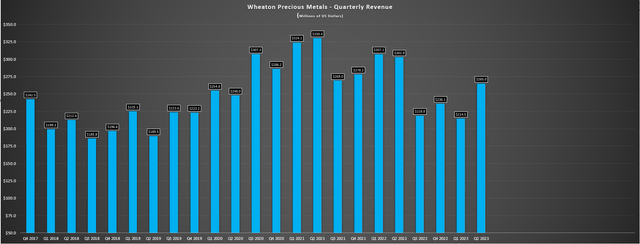

Looking ahead to Q4 2022, things aren’t looking much better, with the Penasquito strike still in place. This means that even if it were to come to a resolution next week, Wheaton is unlikely to see any contribution from the mine in Q4 given the six to eight-week delay in recognizing sales vs. when production is realized, not to mention the required ramp up to full production. This means that the year-over-year sales growth will be much softer than expected in Q4 2023 as well, with Penasquito otherwise set to contribute at least $40 million in revenue in the quarter if it hadn’t gone on strike. So, despite Wheaton once again coming up against relatively easy comparisons vs. Q4 2022 (revenue down 15% year-to-year), the company will now have to lap this with no help from Penasquito and the impact of the recent softness in precious metals prices. To summarize, there’s little hope in meeting annual guidance and if Penasquito isn’t restarted soon, we could be looking at an impact on Q1 results as well because of the time lag on production vs. sales.

Wheaton – Quarterly Revenue – Company Filings, Author’s Chart

The Bigger Picture

Although the Penasquito situation is certainly disappointing and costing Wheaton over $30 million in cash flow per quarter that it’s offline, the overall portfolio is stronger than ever, and the pipeline is also quite solid. For starters, the company has two massive streaming assets set to head into commercial production by 2025 with experienced operators, and these assets are in Tier-1 jurisdictions, which will improve the company’s revenue diversification with a significant portion of sales coming from Brazil (Salobo), Penasquito (Mexico), and San Dimas (Mexico), with these three assets contributing ~60% of sales in most quarters. These two new assets are Blackwater and Goose, and both have a significant upside above their planned production profiles, with the potential for Goose to be a 25+ year mine life given the size of the land package, satellite opportunities, and the possibility of a throughput expansion, and Blackwater being in Phase 1 of multiple phases, with production set to increase to over 430,000 ounces per annum in Phase 3.

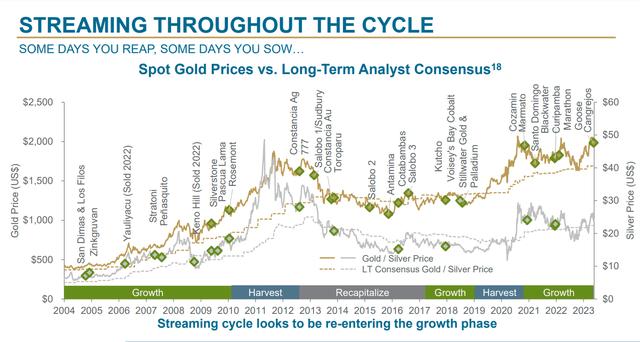

Outside of these key assets, Salobo will benefit from higher production starting next year with Salobo III set to increase Wheaton’s attributable gold production to 240,000+ ounces next year and 270,000+ ounces in 2025. This is a significant increase from the ~161,200 ounces produced in FY2022, and will help to offset any softness from Penasquito if the union and the operators aren’t able to reach a deal by year-end. Finally, with this being arguably the worst market for developers since 2018 and getting close to as bad as 2014/2015 and Wheaton sitting on over $800 million in net cash, the environment has never been better for deal-making if the company takes advantage of developers that would rather sell streams to improve their financial position vs. having to sell equity near multi-year lows. Hence, although the Penasquito situation is frustrating, this will pass, and WPM is certainly benefiting from offsets elsewhere.

Gold Price History & Acquisitions/Sales – Company Presentation

In fact, even if no new deals are completed (which seems highly unlikely given the cash Wheaton has to deploy and the favorable setup that favors stream/royalty sales vs. selling equity for those in a cash crunch) Wheaton expects its average production to average 810,000 gold-equivalent ounces in the 2023-2032 period. In reality, this figure is likely to be over 900,000 GEOs by 2030, with the cash Wheaton will deploy and assuming timely permitting at its development-stage assets or newly acquired streams, suggesting Wheaton could grow attributable production by 50% from FY2022 levels looking out towards the end of the decade. This is quite significant for a company of its size, and certainly better than Franco-Nevada (FNV) which has an incredible portfolio but is also having a tough time keeping up with its smaller peers from a growth standpoint. This is due to the fact that deals don’t move the needle like they used to at its size.

Valuation

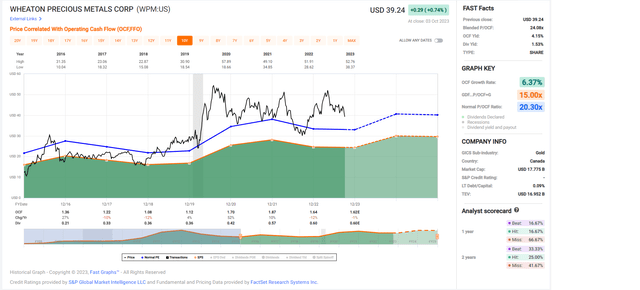

Following the sharp correction over the past six months, Wheaton Precious Metals has seen its market cap slide from ~$23.6 billion to ~$17.6 billion, and its enterprise value now sits at just ~$16.8 billion with over $800 million in net cash. This has left the company at a much more reasonable valuation than where it traded in April at over 26.0x forward cash flow. In fact, even with a drop in FY2024 cash flow per share estimates, the stock now trades at just ~20.4x cash flow, well below FNV, which trades at one of the highest multiples sector-wide at ~24.0x. However, if we look at where WPM has historically traded, it’s sitting just in line with its average cash flow multiple over the past decade, and only slightly below its 10-year average at ~25.0x. That said, the weaker multiple could be related to the underperformance of the stock until 2018 when the CFA dispute was resolved, so I would argue that a fair multiple for the stock is 25.0x, more in line with its 5-year average post-dispute resolution.

Wheaton Precious Metals – Historical Cash Flow Multiple – FASTGraphs.com

Based on the stock’s 5-year average multiple (25.0x) and using more conservative cash flow per share estimates of $1.90, which assumes a resolution in December for Penasquito and only three quarters of full production next year with a ramp up in Q1 2024, I see a fair value for Wheaton of $47.50. This points to a 23% upside from current levels or closer to 25% on a total return basis given the stock’s ~1.6% dividend yield. Although this is a solid upside case for one of the lowest-risk names in the sector, I am looking for a minimum 25% discount to fair value to justify starting new positions in large cap royalty/streaming names. And after applying this multiple, WPM’s ideal buy zone comes in at $35.60 or lower. So, although WPM is getting closer to becoming attractive on valuation, I continue to see more attractive bets elsewhere in the sector.

Summary

While the larger-cap royalty/streamers have been a relative shelter in the storm over the past few months and held up much better than the producers, WPM has underperformed its three closest peers since the Penasquito strike was announced, down ~15% vs. an ~11% decline for the peer average. This is certainly not surprising given that this is one of the company’s most important assets that won’t contribute much in H2-2023 even if the strike were resolved this week because of the ramp-up period and delay in shipments, hence why I warned against paying up for the stock at $45.00 in mid-August. That said, the stock is now moving closer to its buy zone, and it’s hard to go wrong paying $35.00 or less for WPM unless the entire market is going significantly lower. So, if I were looking to own WPM, I would keep a close eye on the stock if this weakness persists.

Read the full article here

Leave a Reply