Utilities stocks were getting hammered on Monday.

The S&P 500 utilities sector

XX:SP500.55

declined by 4.7% on Monday, closing at its lowest level since June 2020 as Treasury yields resumed their climb after the U.S. government averted a weekend shutdown.

Yields rose on expectations the Federal Reserve may still want to keep interest rates higher for longer over the coming years to curb inflation.

The utilities sector for the large-cap benchmark

SPX

also recorded its largest daily percentage decline since April 2020, when the onset of the COVID-19 pandemic caused stock markets around world to tumble, ushering in an era of fear and volatility, according to FactSet data.

Exchange-traded funds that target stocks in the utilities sector saw sharp drops with the Utilities Select Sector SPDR ETF

XLU

down nearly 4.7% on Monday to suffer its worst day since April 2020, according to FactSet data. The Vanguard Utilities ETF

VPU

and the iShares U.S. Utilities ETF

IDU

tumbled 4.6% and 4.3%, respectively, according to FactSet.

NextEra Energy Inc.

NEE,

led the declines on Monday, down nearly 9% after Goldman Sachs cut its target price for the energy producer, citing concerns about the company’s ability to find capital investment going forward and the prospects for renewables growth. The stock settled at its lowest since March 24, 2020, according to Dow Jones Market Data.

See: ‘The rubber band is so stretched’: Why this once-overlooked stock-market sector is sending a warning signal about the economy

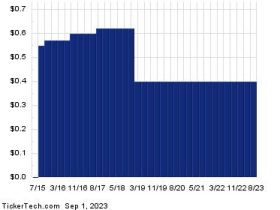

Unlike fast-growing technology stocks, utilities stocks are often considered dividend-income investments or defensive holdings, especially during economic downturns or recessions. The companies that provide electricity, water and gas utilities usually offer investors stable dividends, as well as less volatility compared with the overall stock market.

That’s why the S&P 500 utilities sector briefly stood its ground in mid-September as a batch of mixed economic data and fears of higher interest rates rattled financial markets, especially technology stocks.

However, utilities stocks became less attractive by the end of September when the yields of some risk-free assets resumed their rally, making the utilities sector less attractive compared with U.S. Treasury bonds and money-market funds.

For example, Treasury yields continued to rise on Monday with the yield on the 2-year

BX:TMUBMUSD02Y

up 6.4 basis points to 5.110%, while the yield on the 10-year Treasury

BX:TMUBMUSD10Y

jumped 11 basis points to 4.682%. The 10-year rate ended at its highest level since Oct. 12, 2007, according to Dow Jones Market Data.

See: Bond investors feel the heat as popular fixed-income ETF slumps toward lowest close of 2007

Overall, the utilities sector is the worst performer in the S&P 500

SPX

for the year, down more than 20% compared with the broader index’s 11.7% gains in 2023, according to FactSet data.

U.S. stocks finished mostly higher on Monday with the Dow Jones Industrial Average

DJIA

down 0.2%, while the S&P 500 ended flat and the Nasdaq edged up 0.7%, according to FactSet data.

Read the full article here

Leave a Reply