About eight months ago, I hailed Columbia Care as a bargain, saying that the stock could do well if the merger with Cresco Labs (OTCQX:CRLBF) failed. The stock, then $0.73 with a low of $0.60, fell afterward, but I stuck with it in my model portfolios at my investing group. Now, the stock, which is known as The Cannabist Company (OTCQX:CBSTF), is higher, but it dropped a lot very recently. I sold out of it in my model portfolio in August, after the deal to merge had terminated, and added it back on the last day of September.

In this piece, I discuss the recent failure of the merger to close, review its year-to-date financials, explain why the stock got hammered very recently, share the analyst outlook, assess the valuation and look at the chart.

The Merger Fails

In February, the company was trading at a big discount to the price implied by the then-pending Cresco Labs acquisition at .5579 shares of Cresco Labs for each share of Columbia Care. The discount was a stunningly large 30%, which actually ended up widening out to more than 50%. That deal was originally announced in March 2022, and it required several asset dispositions to satisfy state regulators. I pointed out that if the deal were not to go through, then there was less upside to investors, but that it would probably go through, perhaps at a lower ratio. The companies mutually agreed in late July to end the planned merger.

I had thought that the discount to the deal price was excessive and that even if the merger failed, Columbia Care could go up. It did! Here is a chart of the ratio of the price of the two stocks:

TradingView

Again, the deal was set to be done at .5579 shares of CRLBF for each share of Columbia Care, but the ratio of the stocks began to break down in December 2022, falling from 0.54 to as low as 0.23. In August, after the deal had been terminated, that ratio moved much higher, though still at a discount to the deal ratio. In September, the stock actually traded at a premium to the deal ratio! Now it has pulled back, currently at .4433.

2023-H1 Financials

The company was still known as Columbia Care when it reported its Q2 financials on 8/14 after the merger had been terminated. It had been expected, according to Sentieo, to report revenue of $125 million with adjusted EBITDA of $18 million. The company generated Q2 revenue of $129.2 million, down 0.3% from a year ago and up sequentially by 3.8%. Adjusted EBITDA of $20.3 million was also higher than expected, up 69% from a year ago and 24% sequentially. The company ended Q2 with net debt of $290 million and tangible equity of $3.3 million. The company used just 0.3 million to fund operations in Q2.

For the first half of the year, revenue of $253.8 million was up slightly from the first half of 2022. Gross profits fell slightly, but operating expenses fell substantially. The operating loss fell from $36.7 million to $8.2 million. The company used just $3.7 million to fund operations in H1, a dramatic improvement from a year earlier when it used $99.8 million. Adjusted EBITDA improved from $29.0 million to $36.7 million.

Stock Sale

The world changed for Columbia Care in late August, after it reported its Q2. On 8/30, the news that the Department of Health & Human Services had asked the DEA to reschedule cannabis from Schedule 1 to Schedule 3 broke. If this plays out, then the onerous taxation of 280E, which forces cannabis companies to pay tax on gross profits rather than net income, would go away. Of course, this may not play out. The DEA could decide to do nothing or go to Schedule 2, which would leave that tax in place. They could take a very long time as well. Finally, the government could impose another tax. Investors are very excited, though the stocks have pulled back from the recent peaks in mid-September.

On September 18th, still before its recent change of name, the company was the first MSO to sell some stock. I thought the deal was brilliant, as the stock had increased so dramatically. Columbia Care sold 22.24 million units at C$1.52. Each unit included a share of stock and a warrant at C$1.96.

Outlook

Despite the potential ending of 280E, not yet a done deal, the analysts have not changed the forecasts for CBSTF or any MSO. The adjusted EBITDA, which excludes taxes, won’t change, but the cash flow will be much higher if 280E goes away.

For CBSTF, analysts were expecting ahead of the Q2 report for 2023 revenue to be $515 million with adjusted EBITDA of $82 million. Now, they expect revenue to be slightly higher at $519 million, up about 1%, with adjusted EBITDA growing 23% to $83 million.

For 2024, the analysts project that revenue will increase 10% to $571 million with adjusted EBITDA of $113 million, up 37%. For 2025, there are just three analysts providing outlooks, and they expect revenue to be $633 million with adjusted EBITDA of $144 million.

Stock Is Reasonably Valued

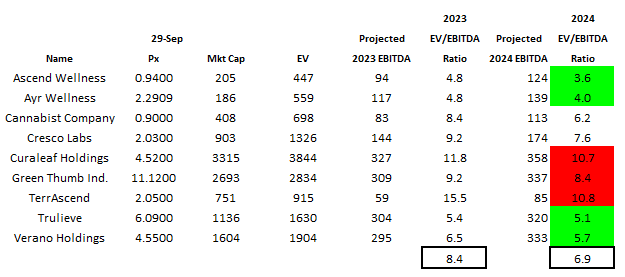

I am concerned that CBSTF and all of the MSOs face downside risk if 280E doesn’t go away, but the MSOs can still rally if it does go away. Looking at CBSTF compared to its peers, it does seem somewhat cheap. Here is a table that gives the enterprise value to projected adjusted EBITDA for 2024 for the Tier 1 and Tier 2 names:

Alan Brochstein, using Sentieo

There are some cheaper names (in green), and there are some more expensive ones too (in red). At 6.2X, CBSTF is below the average for the nine largest MSOs by revenue and market cap.

Ahead of the Q2 report in mid-August, my year-end target for the company was $0.74 based on a very low enterprise value to projected adjusted EBITDA for 2024 of just 5X. I have not yet formally changed my targets, but I consider this the downside now with 280E possibly going away. The recent capital raise also took place after this target that I shared.

As I look out a year, incorporating 75% of the 2025 estimate and 25% of the 2024 projection, I get a one-year out target if 280E fails of $681 million enterprise value based on 5X. This works out to $0.92, which is slightly higher. While I am not yet officially targeting based on 280E going away, I do think that an expansion to 8X is very possible. This would lead to the recently issued warrants being exercised and yield a target of $2.00, more than 100% upside.

Chart Looks Like This Is a Dip to Buy

Cannabist has pulled back very sharply from its recent peak, which was ahead of the equity offering:

Charles Schwab

The stock’s 50-day moving average, currently at $0.72 and rising, could provide support, and I see $0.75 and $0.60 as support levels too. The consolidation a year ago suggests the stock could run into trouble at $1.85.

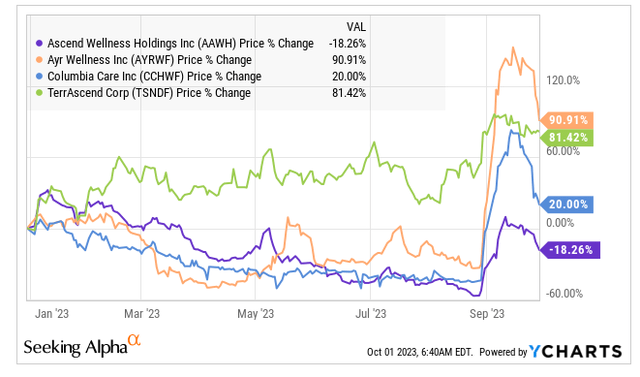

I compared the valuation to its peers, but let’s look at the chart compared to the other three Tier 2 names:

YCharts

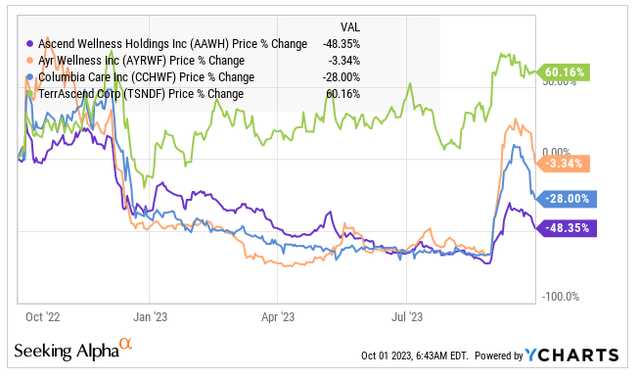

In 2023, Cannabist has gained 20%, well below the returns of Ayr Wellness (OTCQX:AYRWF) and TerrAscend (OTCQX:TSNDF). Ascend Wellness (OTCQX:AAWH), which I like more and which I own more of in my model portfolios, is still down. Over the past year, CBSTF looks like it has performed worse than average too:

YCharts

Conclusion

I liked Cannabist Company a lot right before the merger failure announcement, and I had the right call that failure of the merger would not hurt the stock. I exited a bit prematurely, but I like this pullback after the company sold stock. I think that the move to sell stock after the massive rally made a lot of sense, and I expect other MSOs to address their balance sheet issues with stock sales.

My ownership in my model portfolios is slightly higher than the company’s exposure in the indices. In the Beat the Global Cannabis Stock Index model portfolio, I added a 5% position on Friday, and it was added to the index on Friday with a weight of 3.6%. I am very underweight MSOs in this portfolio, with a total exposure of 14.4% in three names. In the Beat the American Cannabis Operator Index model portfolio, the Cannabist Company’s position size is 10.6%. The index weighting is 7.7%.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply