Industries fall in and out of favor with the market, and that makes it a market for stocks rather than the stock market. For value investors, buying solid dividend payers when they are trading below their historical average valuations can lead to outsized income and gains over the long run.

This brings me to Black Hills Corp. (NYSE:BKH), which I last covered here with a ‘Buy’ rating in January of this year, highlighting its strong fundamentals. While it’s ‘only’ been eight months since then, it seems much longer than that considering the number of economic events such as interest rate hikes that’s happened over this time frame.

As shown below, BKH now sits at its 52-week low, having fallen by 27% over the past 12 months. In this article, I discuss why value investors may want to consider the stock while it’s clearly unpopular at the moment.

BKH Stock (Seeking Alpha)

Why BKH?

Black Hills Corp. is a growth-oriented utility company that serves 1.33 million customers across 8 states, including Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming, providing both electric and gas services.

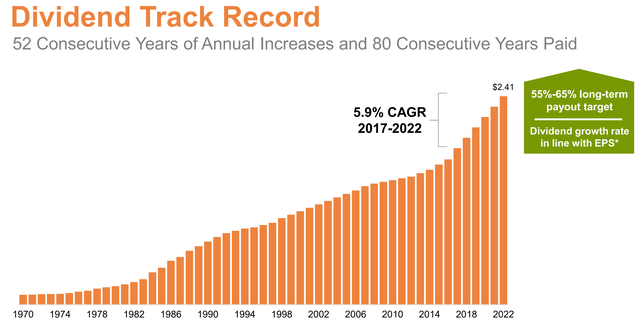

Notably, many dividend investors know BKH for its consistent track record of 80 consecutive years of dividends paid and 52 consecutive years of raising the dividend, qualifying BKH as a Dividend King. This multi-decade dividend track record includes countless recessions and interest rate environments. Dividend growth accelerated to a 5.9% CAGR over the past 5 years despite including the pandemic timeframe. The current dividend rate is well-covered by a 66% payout ratio, with management targeting a 60% long-term payout ratio.

Investor Presentation

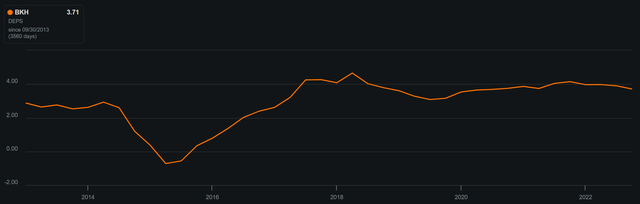

Those familiar utility companies know that the industry is undergoing a massive once-in-a-generation change with transition to cleaner energy. BKH is one of them, as it aims to cut down its electric emissions by 70% by 2040, and be net-zero in natural gas emissions by 2035. Since 2005, BKH has already reduced both forms of emissions by 33% due to retiring of coal plants and addition of renewable wind resources across the ample land resources BKH’s service territories, as well as replacement of aging pipeline materials across the natural gas system. These investments come at a cost to the bottom line, as EPS growth has been elusive since 2018, as shown below.

BKH EPS (Seeking Alpha)

This could be set to change for the better, as projects come online and, and management is targeting 4% to 6% long-term annual EPS growth off the 2023 base EPS estimate of $3.75 at the midpoint. Increases in rate cases could also benefit BKH’s bottom line. This includes $54 million worth of potential annual revenue increase through rate reviews around BKH’s Rocky Mountain, Colorado, and Wyoming gas deliveries with ROE in the 9.5% to 10.5% range.

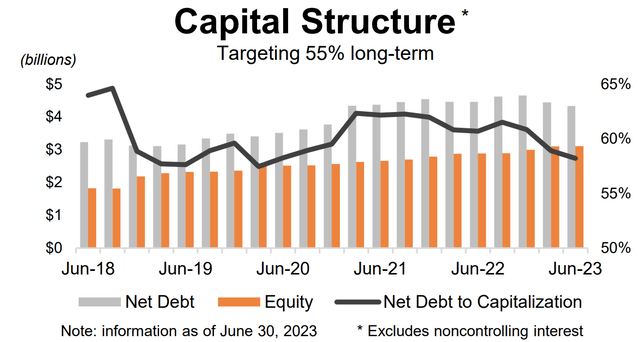

This is also on the back of disciplined capital management, as management plans to deleverage the balance sheet from around a 58% net debt to capitalization ratio to 55%, supporting its BBB+/Baa2 credit ratings from S&P and Moody’s. As shown below, BKH’s leverage ratio is already down from 63% in 2021.

Investor Presentation

Carrying reasonable leverage and having strong credit ratings can go a long ways in the current high interest rate environment, considering that BKH has $525 million and $600 million worth of debt maturities in November of this year, and August of next year, respectively. BKH has already made good progress around chipping away at its November maturity with the recent pricing of 10-year $450 million senior unsecured notes with a not too high interest rate of 6.15%. For reference, this sits just 156 basis points higher than the risk-free 10-year Treasury Bond rate of 4.59%.

Risks to BKH include having to issue around $150 million worth of equity to fund its projects and or use it for the remainder of its November refinancing. This equates to near-term dilution risk should BKH’s share price remain depressed. However, I would expect for management to remain prudent around issuing equity at unattractive valuations, considering that it already carries $153 million in cash on hand, plus another $260 million in accounts receivables. Another risk includes the potential for expense inflation to remain elevated, as Operating and Maintenance expenses grew by 8% YoY during Q2, which could put downward pressure on margins.

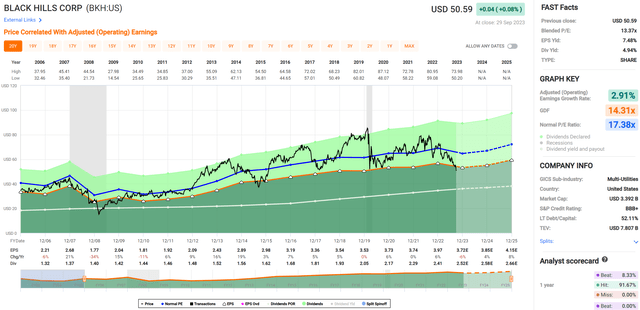

Lastly, I see much of the risks has having been priced into this Dividend King at the current price of $50.69 with a forward PE of 13.6, sitting well under its normal PE of 17.4, as shown below. This is especially considering BKH’s strong investment grade credit rating, dividend track record, and 5% long-term annual EPS growth guidance. With a 5% dividend yield and 5% annual EPS growth rate, BKH could deliver the long-term 10% annual return of the S&P 500 (SPY) with a far greater dividend yield and the stability of an underlying utility business, which income investors may find appealing.

FAST Graphs

Investor Takeaway

All in all, Black Hills Corp. is a Dividend King with attractive dividend characteristics that include 50+ years of consecutive raises as well as a healthy CAGR and payout ratio. While EPS growth has been elusive over the past 5 years, BKH may be turning the corner as projects come online, and rate case reviews work through the process. With a well-below average valuation, BKH appears to be an appealing income and value stock at present for conservatively-minded income investors.

Read the full article here

Leave a Reply