Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the fourth week of September.

Market Action

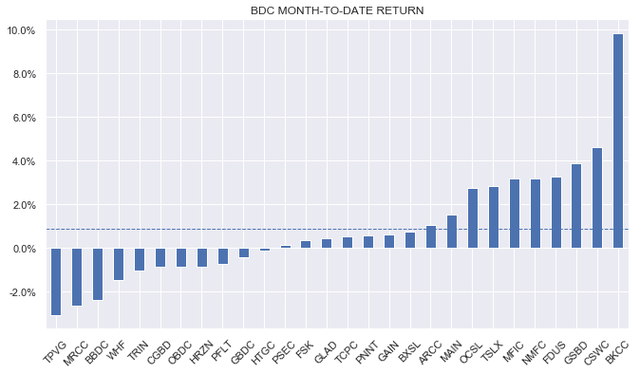

BDCs were down on the week as a higher-for-longer Fed message soured risk sentiment across the income market. Month-to-date, however, the sector remains in the green by around 1%.

Systematic Income

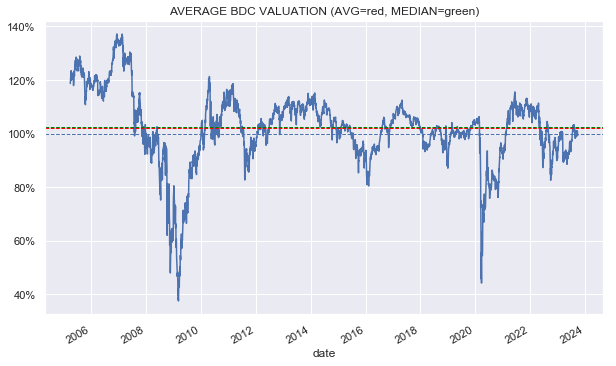

Sector valuation is trading around 100% or slightly below its historic average level.

Systematic Income

Market Themes

While many investors are expecting a regional bank lending pullback and the opportunity it might provide to BDCs, the real action has been in debt refinancings with the larger Wall Street banks.

A case in point is the Thoma Bravo-owned Hyland Software which refinanced about $3.2bn of maturing debt with a private lender group led by Golub Capital. The refinancing included a $2.5bn first-lien loan, a smaller second-lien loan, and a revolving credit facility.

An even larger deal was led by Oak Hill and Blue Owl and provided a $5.3bn loan package to refinance the debt of Finastra Group, another software firm. The company had its ratings cut and was facing difficult refinancing negotiations with its existing creditors.

Typically, private lenders like BDCs tend to focus on deal-related lending such as leveraged buyouts, M&A, and others. However, as deal flow has been relatively light in the last 18 months private lender dry powder has found its way into more prosaic lending like loan refinancing, typically dominated by the larger banks.

While borrowing from private lenders does typically carry a higher rate of interest, it has some advantages for borrowers. One, private lender deals are less likely to be impacted by market volatility and more likely to close even when public lending markets are shut. And two, private deals involve fewer lenders and, hence, quicker negotiations than public loans where many more parties need to be consulted on pricing, security, and other terms.

This encroachment of private lenders onto traditional public lender turf will likely continue as the private credit sector grows and matures and as borrowers become more familiar with its value proposition.

Market Commentary

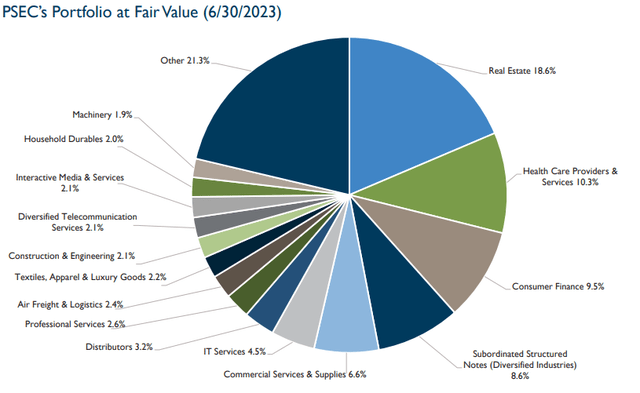

With Prospect Capital (PSEC) finally releasing its annual report we updated its Q2 earnings numbers. We often get questions about whether PSEC looks like a slam-dunk BDC holding given its large discount to book. Our view has been that PSEC does not look like a traditional BDC and so should be approached with care.

Specifically, about 30% of its portfolio is allocated to non-typical sectors like CLO Equity and Real Estate. This means the company has a more cyclical and higher-risk portfolio than the average BDC, all else equal. And while its leverage is low, there is a kind of sleight of hand here since PSEC has chosen to finance itself with a big slug of preferreds. This means that the usual debt/equity definition of leverage (used by BDCs) sends the wrong signal in terms of its overall exposure. Using the CEF definition, its leverage is not far off the broader sector. It is also more expensive than it would be otherwise had PSEC relied more on debt than preferreds.

PSEC

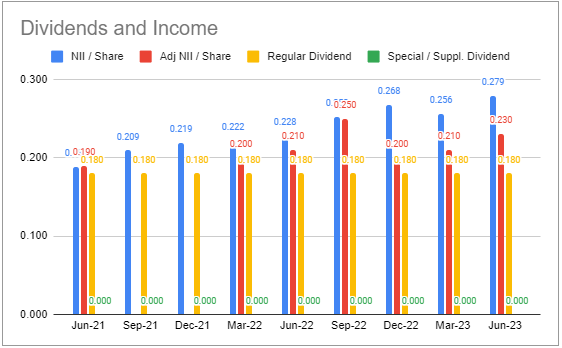

Over Q2, net income rose slightly. Adjusted net income which takes preferreds dividends into account provides 128% coverage for the dividend which leaves room for dividend hikes.

Systematic Income BDC Tool

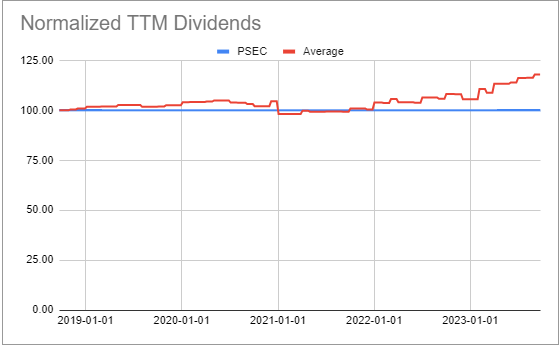

PSEC dividends have not moved in the last few years even as the broader sector has generated significant raises.

Systematic Income BDC Tool

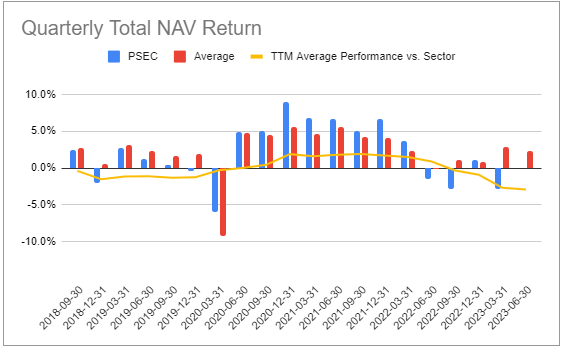

Most important, however, is the company’s performance, which remains worrying. Over the past year, it underperformed the sector by 13.3% – only one other company in our coverage did worse. The performance trendline (yellow line) has fallen precipitously.

Systematic Income BDC Tool

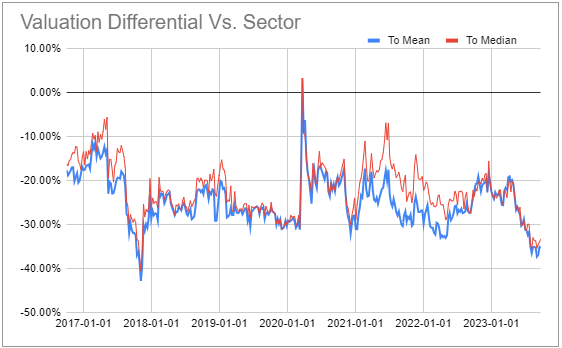

The company’s valuation has cheapened even further relative to the sector – now at a 36% discount to the sector average which is quite a bit weaker than the previous 20-30% historic range.

Systematic Income BDC Tool

Ultimately, while PSEC can be an interesting hold tactically or for its senior securities, the common shares remain a difficult proposition as a strategic hold.

Read the full article here

Leave a Reply