Back in February, I thought CVR Partners (NYSE:UAN) looked appropriately valued in the face on falling nitrogen fertilizer prices. With the stock down over -25% and its overall return about -5%, let’s catch up on the name.

Company Profile

As a quick reminder, CVR Partners owns two fertilizer plants: Coffeyville and East Dubuque. The Coffeyville facility upgrades most of its ammonia production to UAN and uses pet coke as its feedstock. The East Dubuque facility is in the heart of the Corn Belt and uses natural gas as its feedstock.

Q2 Earnings

For the quarter, CVR Partners recorded revenue of $183.0 million, down -25% year over year.

Product pricing at gate for ammonia fell -40% year over year to $707 per ton, while UAN pricing dropped -43% to $316 per ton.

Ammonia production jumped 13% to 219,000 tons, while UAN production rose 2% to 339,000 tons. Plant capacity utilization was 100% for the quarter compared to 89% a year ago.

Adjusted EBITDA plunged -41% to $86.5 million. Cash available for distribution sank -59% from $106.2 million to $43.8 million. The company reserved $3.3 million for future turnarounds in the quarter, as well as $20 million for future operating needs. The year-ago number took out $9.9 million in future turnaround costs and $15 million for future operating needs.

The company declared a variable distribution of $4.14 per common unit. That is pretty much in line with the just above $4 quarterly distribution I thought was possible in a July write-up ahead of its Q2 earnings report.

Overall, it was a solid quarter for CVR Partners, with another strong quarter of 100% utilization for its plants. Not surprisingly, lower fertilizer prices weighed on the company’s results, but that is largely beyond the company’s control. It does tend to pre-sell production, which does help in a falling price environment like we’ve seen this year.

Outlook

Looking forward, CVR Partners is looking for utilization of between 95-100% from both its facilities in Q3. The company is expecting between $50-55 million in direct operating expenses and between $14-16 million in CapEx.

At the end of quarter, the company noted that Ammonia prices for the Southern Plains was $435 a ton, down -65% compared to where it was a year ago at $1,241 a ton.

Ammonia in the Corn Belt was $472 per ton, down -66% from $1,405 a ton a year ago. UAN prices at the end of June were $298 per ton, -53% below the $632 a ton it traded at a year earlier. Natural gas prices, meanwhile, were -69% lower to $2.33.

Discussing the current state of the nitrogen fertilizer market on its Q2 earnings call, Pytosh said:

“Given the significant drought conditions in the Midwest, we think there is a risk to the USDA’s most recent yield estimates for both corn and soybeans. Grain prices remained strong with December corn at $5.15 per bushel and November soybeans at $13.30 per bushel. Strong grain prices coupled with lower fertilizer prices support attractive farmer economics, which should bode well for nitrogen fertilizer demand for the fall application season. We believe that the length of this upward demand cycle will, in large part, be driven by grain prices staying at elevated levels, and we see fundamentals for grains remaining strong. We think that spring nitrogen demand was lower than the amount implied by an estimated 94 million planted corn acres in the U.S. as we think the additional acres of corn were in fringe areas where yields are lower. We also believe demand was impacted by a large drawdown of inventories at the dealer level and lower than normal application rates per planted acre. Customers have shared with us that their inventory levels were the lowest they have seen in recent years and will need to be replenished in the coming months. With the increase in carrying cost over the past year, we see customer purchasing behavior shifting to a more ratable pattern rather than purchasing larger volumes further into the future. We think this matches well with our production pattern.”

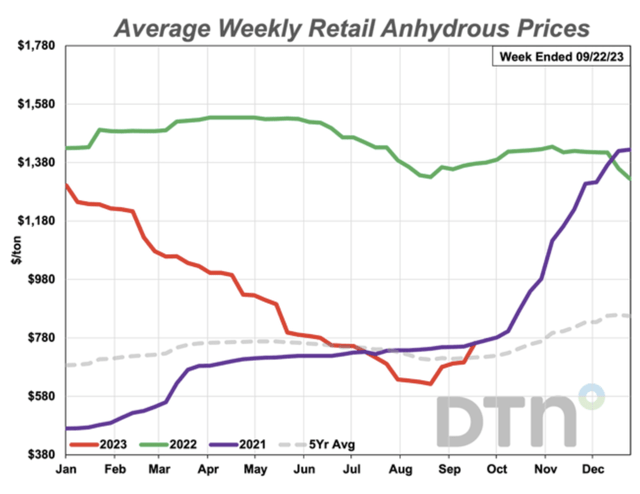

CVR Partner management projected prices to increase into the fall, and that has happened, although maybe not at the rate it has expected, dipping more into late August before heading upward.

Fertilizer prices remain well below a year ago levels, with UAN prices down -40% and ammonia prices about -45% lower. UAN28 prices are around $352 a ton, similar to a month ago, while anhydrous ammonia prices have been strong recently, up to 21% versus a month ago to $763 a ton.

Anhydrous ammonia Prices (DTN)

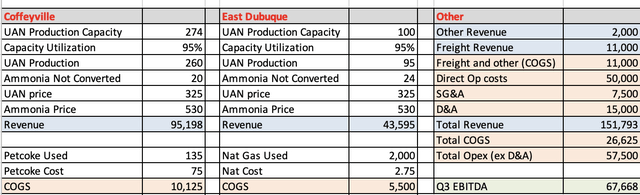

Modeling CVR Partners isn’t easy, as little changes to the model in prices can lead to some pretty big differences versus actual results. Also NOLA prices and the pricing it gets can be different, and it also tends to sell forward a bit. Nitrogen fertilizer prices have also been pretty volatile in the quarter.

That said, using $325 UAN prices and $525 ammonia, I can get to around $68 million in Q3 EBITDA. Take out $7 million in interest expense and $5 million on maintenance capex, as well as $5 million in turnaround and other future costs, and you get an over $4.75 distribution. If the company reserves more for future operating needs it will be less.

CVR Partners Q3 Estimate (Self and Company Filings)

Conclusion

While fertilizer prices are materially lower versus a year ago, CVR Partners should see a nice year over year increase in EBITDA in Q3, as it had turnarounds at both its plants during the same period in 2022. The company should be able to maintain its around $4 quarterly distribution this quarter or maybe have it even higher, depending on realized gate prices and how much it reserves for future operating needs. Of course, the model remains very sensitive, so small input changes can move the needle a lot. However, I don’t think it will take a big reserve this quarter like it did in Q2.

Seasonally, fertilizer prices tend to start to rise in the fall after the summer season, so prices may have hit a trough in the near term. If the company produces at least $200 million in EBITDA, it would trade at around 6.5x EBITDA, which is a fair price in my view, perhaps even a bit low. Its yield on a $4 quarterly dividend, meanwhile, would still be a robust 19%.

That’s an attractive return in my book. As such, I’m going to upgrade the stock to “Buy.”

The biggest risk to CVR Partners is the price of nitrogen fertilizer, which can be volatile. This is a global market with lots of players, including China, Russia, and the Middle East as exporters, as well as countries like Brazil and India as importers. Predicting where prices head is not easy, and is one of the biggest factors impacting nitrogen fertilizer producers like CVR Partners. A sudden jump in regional nat gas prices can also impact results on the cost side, at least for one its plants. While commodity prices are tough to predict, China recently stopped urea exports, which should bode well for nitrogen prices in the near to medium term.

Read the full article here

Leave a Reply