In this article, we provide an update on the PIMCO CEF suite. Specifically, we discuss the changes in leverage and distribution coverage for the month of August. We also highlight the key tidbits from the recently released shareholder report as well as the results of the ARPS tender offer.

Coverage Update

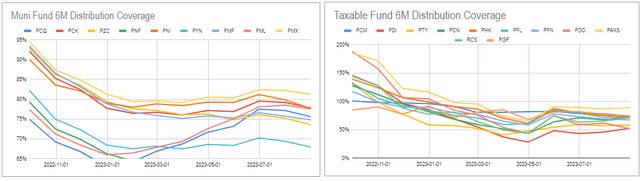

Coverage across taxable funds was fairly stable while tax-exempt coverage ticked lower in August.

Systematic Income CEF Tool

After climbing out of a hole, taxable coverage appears to have stabilized at around a 70% average level.

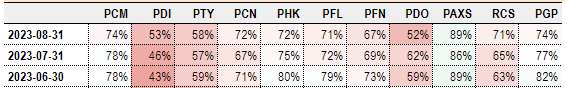

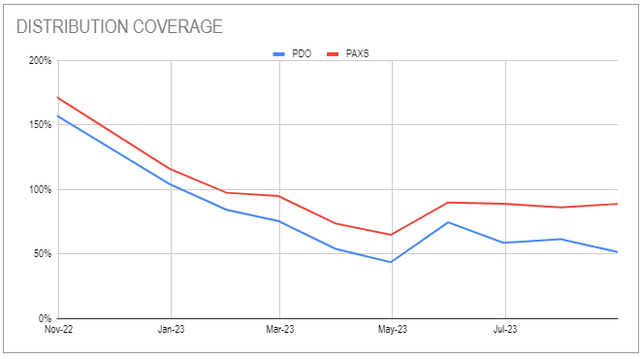

PAXS remains the highest-coverage fund while PDO has dipped to having the lowest coverage.

Systematic Income CEF Tool

These two funds used to enjoy the highest coverage level in the suite however their fortunes have recently diverged. This remains a puzzle as the two funds are quite similar. PDO does have a slightly higher NAV distribution rate however its fee is also higher which should roughly wash relative to PAXS in net income terms.

Systematic Income CEF Tool

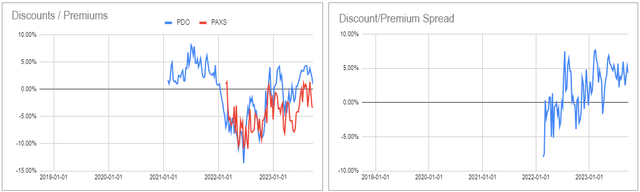

Interestingly, the market does not appear to have reacted to this shift and PDO continues to trade at a higher valuation to PAXS.

Systematic Income CEF Tool

Leverage Update

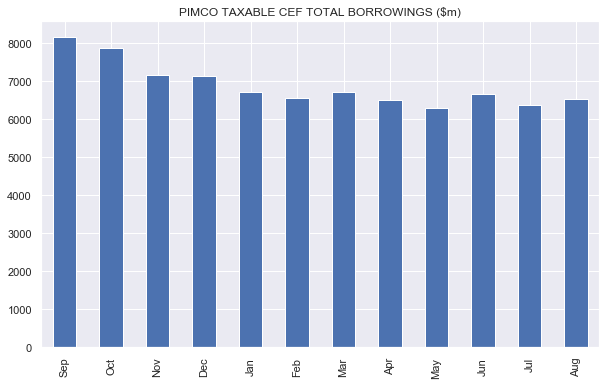

Borrowings ticked higher in the taxable suite, however not decisively, and remained in a range over the last 6 months or so.

Systematic Income

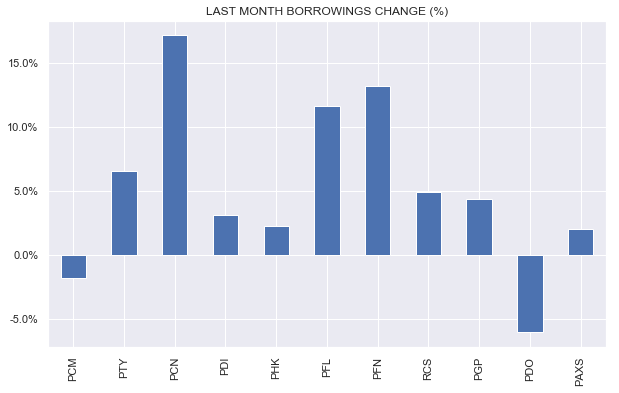

PCN, PFL and PFN saw the largest gains in borrowings. The leverage of these funds is fairly low at sub-30% so this could be a reversion to a more normal level. There could also be noise from the ARPS redemptions that we discussed in the previous month.

Systematic Income

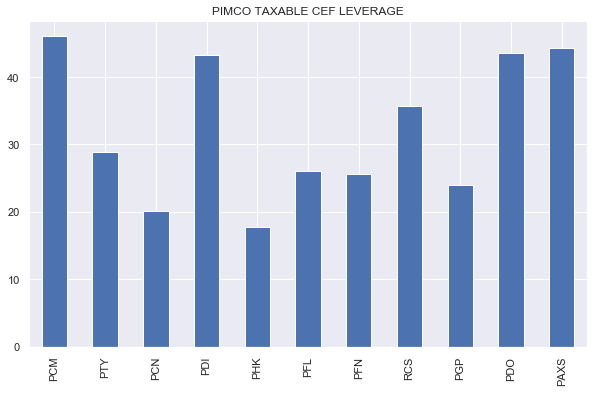

Leverage across the taxable suite remains very dispersed with PCM still in the lead in the high 40s.

Systematic Income

Market Themes

PIMCO recently released the shareholder report for the taxable CEFs. A couple of interesting things worth noting. One is that there are some chunky cash holdings in the funds. For example, PAXS has around 13% of its portfolio in Treasury repo i.e. they lend cash to a bank on an overnight basis collateralized by Treasuries.

What’s odd about this is that the rate they get paid on this is around Fed Funds or about 5.1%. However, the funds also borrow cash to finance their leveraged assets. On that cash they pay typically north of 6%. This is because these loans (reverse repos) are collateralized by credit-risky assets and are typically 1-month or longer in maturity.

You would normally expect the fund to use its available cash to prepay its reverse repo and save itself the 6%+ cost rather than put it to work at a rate of 5%. Net-net the fund is paying 1% to keep this structure in place and it’s not clear why. It may be operationally easier to just keep the overnight repo in place to facilitate a more nimble trading posture however it does come at a cost.

In terms of source of distributions, return of capital only showed up for PCM. This is good however it’s not very useful because the covered period is June 2022 to June 2023 – ancient history by today. Through this period average coverage was near or above 100% for the first 6 months and below 100% for the second 6 months.

On average it’s easy to see why ROC could be low or non-existent. However we are now in the 9th month after the midpoint of the period and coverage of the taxable funds remains very low at an average of just 68% which is an obvious risk for distributions going forward.

Another piece of news is that the funds completed their ARPS buyback. Taxable fund buybacks ranged from 25% for PHK to 78% for PFL. Tax-exempt numbers were smaller ranging from 11% to 24%. This is likely because the tax-exempt ARPS dividends are more attractive on a tax-adjusted basis i.e. 10% tax-equivalent yield on AA-rated bonds versus 8-10% yields on mostly sub-investment-grade assets. And the reason this is the case is that the ARPS maximum rate fallback for the tax-exempt funds is actually based on a taxable rate.

What’s likely to happen now is that the taxable funds will replace their redeemed ARPS with repo and the tax-exempt funds will replace the ARPS with variable-rate term preferreds. The cost of leverage will decrease and there will be a small NAV gain due to the ARPS buyback below par.

The press release mentioned that the tax-exempt funds have already issued standard variable-rate preferreds. These carry interest rates 1-2% below the ARPS. We wouldn’t be surprised if we see another ARPS buyback at slightly higher prices. PIMCO is adept at trying to squeeze every last cent out of each situation.

Takeaways

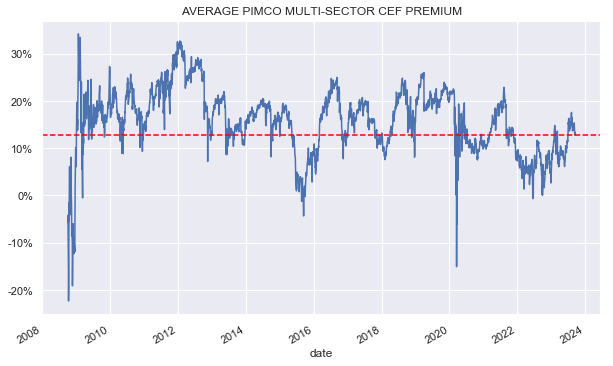

PIMCO taxable CEF valuations remain elevated as the following chart shows though the average is biased higher by fairly ridiculous PCM and RCS premiums.

Systematic Income

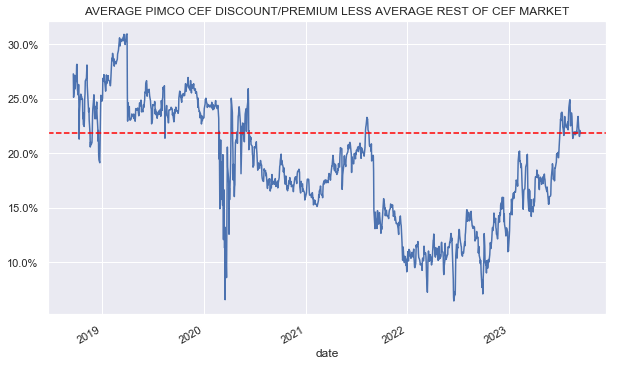

The valuation differential between PIMCO taxable CEF and the rest of the market remains wide.

Systematic Income

We remain on the sidelines across the suite as we expect better entry points over the rest of the year.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply