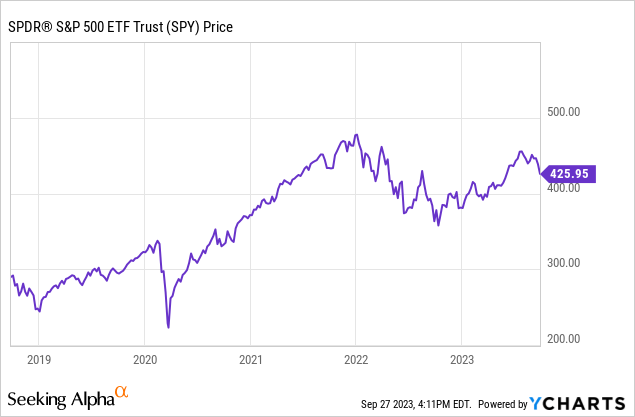

Investing strategies often have to evolve as market conditions become more challenging. While the S&P 500 (SPY) and most of the major indexes rose significantly over the last two decades, past performance is not always indicative of future results. With a slowing economy, inflation levels still at very high rates, and political uncertainty at historically high levels, investors will likely need different and more targeted approaches to achieve the same results moving forward.

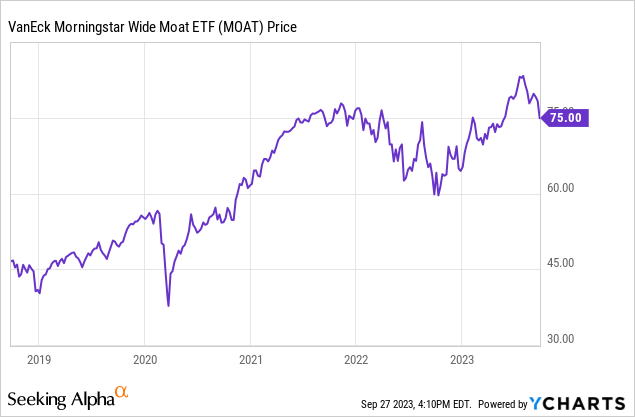

One of the more well-known exchange traded funds is the VanEck Morningstar Wide Moat ETF (BATS:MOAT). This Morningstar fund targets companies with a wide moat, which the ETF defines as follows;

A company whose competitive advantages we expect to last more than 20 years has a wide moat; one that can fend off its rivals for 10 years has a narrow moat; while a firm with either no advantage or one that we think will quickly dissipate has no moat.

This fund is a very actively managed fund that has a high annual turnover rate of 51%, which is the main reason why this ETF has consistently beaten the S&P 500 since the exchange traded fund’s inception in late April of 2012.

Today I rate this Morningstar Fund a buy. This VanEck fund has consistently outperformed the broader indexes. The managers of this ETF have shown they can adopt to difficult and fluid market conditions. The fund managers’ strategy of targeting companies with a proven track record also makes this ETF lower risk than investing in broader indexes. This fund has delivered noticeably better returns than most traditional index investing strategies since the ETF’s inception in early 2012.

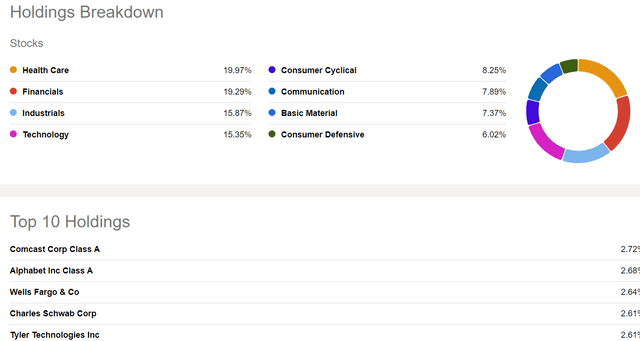

This Morningstar fund is well diversified on several different levels. The ETF has holdings concentrated across most major sectors, and the fund doesn’t have more than 20% of the ETF’s assets invested in any one sector. This VanEck fund also does not have any holding that rises to more than 3% of the overall fund. The ETF has 54 holdings that are in 8 different sectors.

A chart of MOAT’s holdings (Seeking Alpha)

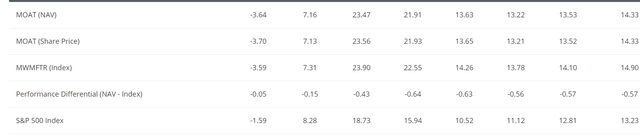

This fund has consistently outperformed the S&P 500 since the ETF’s inception, nearly eleven years ago. MOAT has offered investors total returns of 15.26% per year since 2014, while the S&P 500 has offered investors total returns of nearly 12% during this same time.

A Chart showing MOAT’s annual performance compared to the S&P 500 (VanEck.com)

This fund has a net expense ratio .46%, and $10.44 billion in assets under management. The current yield is 1.08%. The main reason why MOAT has consistently outperformed the S&P 500 is the managers of this fund have done a good job of generating alpha by making good individual stock picks on a year-to-year basis. This fund has a very high annual turnover rate of 51%.

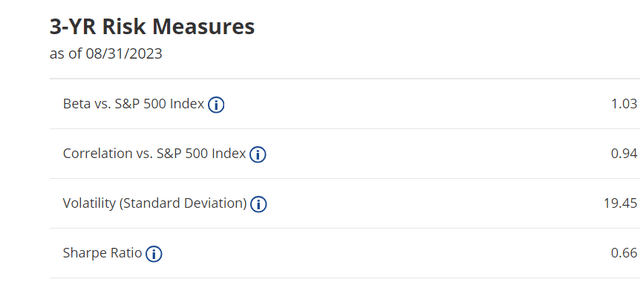

MOAT is a large cap fund, the average weighted market cap of companies in the ETF is $192.6 billion, and 99% of the stocks in this exchange traded fund are large cap companies. The standard deviation of this ETF is 19.45, which is slightly higher than the S&P 500’s standard deviation of 17.72.

A chart showing some metrics of MOAT (VanEck.com)

The reason this VanEck fund is slightly more volatile than the S&P 500 is because this fund targets companies with more alpha, which is the primary reason this ETF has consistently outperformed that broader index. The Morningstar fund’s managers are Ralph Lasta, Peter Liao, and Griffin Driscoll.

The market environment is very fluid right now. Inflation rates remain very high and economic growth rates remain anemic as well. Economic growth forecasts remain low as well, with the World Bank currently projecting just .7% growth in the Euro zone, Japan and the US, and just 1.1% growth in the US. While index investing worked very well over the last two decades, funds such as the VanEck Morningstar Wide Moat exchange traded fund, that can change strategies and shift which sectors these ETF’s are exposed to, are likely to continue to perform better in the current more challenging environment.

Read the full article here

Leave a Reply