Note: figures in this article are in Canadian dollars unless indicated otherwise.

When we first saw the news that Enbridge Inc. (ENB) would acquire Dominion Energy’s (D) utility assets, which we discussed here, we suspected ENB may be pursuing a similar path as TC Energy Corporation (NYSE:TRP). TRP recently announced that it would spin off its liquids pipeline business into a standalone publicly-owned entity. We believe the spinoff is likely to spur a higher stock price for TRP, and the announcement factored into our decision to buy TRP shares at USD$34.15-equal to CAD$44.40-during the selloff that occurred the following day.

On closer inspection, our analysis shows that ENB won’t benefit from a split into standalone liquids and non-liquids companies. In fact, it could cause the company to lose some of the valuation premium it enjoys from its stability and diversification. ENB’s former CEO, Al Monaco, believed that the market would pay a premium valuation for a company that possessed scale and breadth throughout the midstream value chain. At least in ENB’s case, our analysis indicates he was correct.

TRP Shares Offer Greater Upside

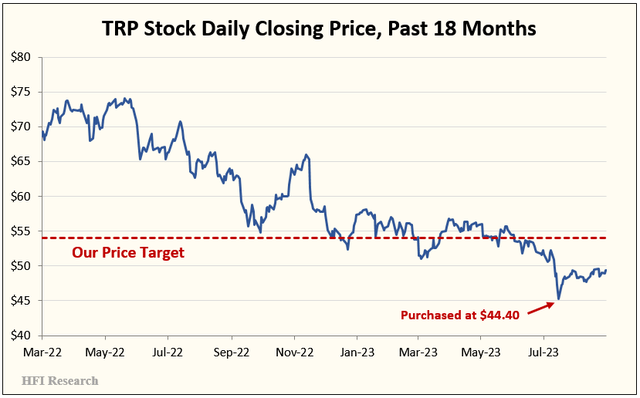

Over the past year, TRP’s shares sank as investors grew concerned about the company’s high leverage, lack of progress in deleveraging, and a series of operational setbacks that included massive cost overruns in its Coastal GasLink project and an oil spill from its Keystone Pipeline. TRP’s selloff caused its shares to trade significantly below our price target.

HFI Research

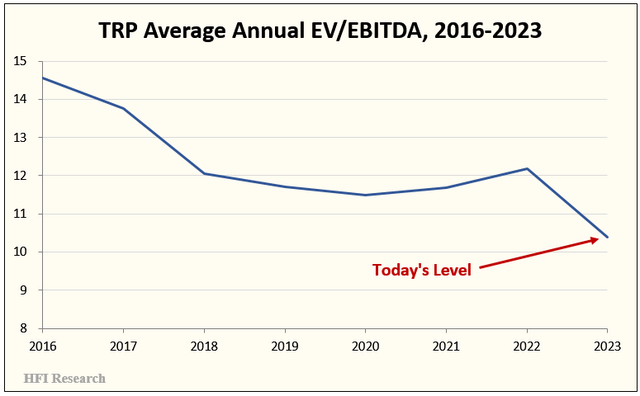

On the evening of July 28, the company announced that it would sell its Columbia Gas and Columbia Gulf assets for $5.2 billion. Investors were disappointed by the low 10.5x EBITDA multiple that the Columbia assets fetched. The next day, TRP’s share price fell as much as 7.6%, to a 10.1x EV/EBITDA multiple, the lowest market valuation since 2005 and well below the shares’ long-term average multiple of 12.0x, as shown in the chart below.

HFI Research

As TRP shares sunk to historic lows, their long-term investment proposition became more attractive. A simple reversion of their trading multiple back to its historical average would spur a significant increase in the share price.

To get there, the company would have to show progress deleveraging and improving its operational track record. We believed that both were likely over the coming quarters. However, the spinoff announcement, which was made the same day as the Columbia asset sale was announced, added an interesting wrinkle to the TRP investment proposition. By separating its liquids segment from the rest of its business-which operates primarily in natural gas pipelines and utilities-TRP could eliminate a segment that acted as a drag on its stock’s trading multiple. Liquids-focused long-haul pipeline businesses trade at EV/EBITDA multiples below 10.0x. By contrast, a pure-play natural gas and utilities business would trade in line with publicly-listed peers at an EV/EBITDA multiple greater than 11.5x, well in excess of TRP’s 10.1x. Moreover, the two new standalone entities could benefit from greater operational focus and from management teams that are more strongly incentivized to expand in their respective markets.

TRP’s Value Proposition

Today, TRP shares trade at a 10.5x EV/EBITDA multiple. As such, they still offer significant upside if their multiple re-rates to 11.5x or above.

If TRP can complete its Coastal GasLink project, generate strong operating and financial results as it did in the second quarter, and reduce leverage through a combination of EBITDA growth, asset sales, and/or paring back growth capex, we believe its multiple can revert back to its former highs. The spinoff makes such an outcome more likely because TRP will have jettisoned its low-multiple, low-growth-but high-profile-liquids assets. The remaining assets will garner a much higher multiple.

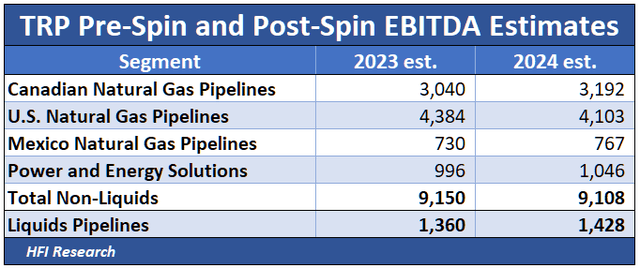

The following figures shed some light on the impact of TRP’s planned business separation for current shareholders. An Adjusted EBITDA breakdown by segment for 2023 and 2024 is shown below.

HFI Research

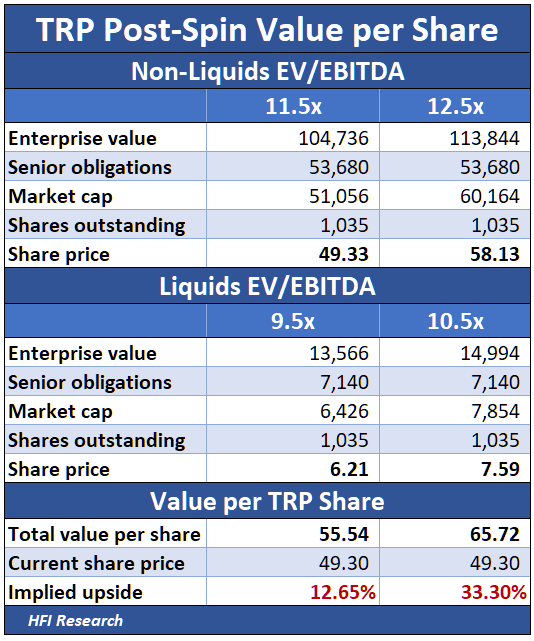

If we apply the appropriate EV/EBITDA multiples to these Adjusted EBITDA estimates, we get the following values for TRP’s separate liquids and non-liquids businesses.

HFI Research

At low EV/EBITDA valuation multiples, we estimate the separated entities are worth $55.54 per TRP share, whereas at high multiples, their value increases to $65.72. These prices imply 12.7% and 33.3% upside from TRP’s current share price of $49.30.

The high-value scenario is consistent with a 14.5x P/E ratio. In the years before 2023, TRP’s shares traded in a P/E range of 14x to 20x.

ENB Shares Fare Worse in a Split

In contrast with TRP, we estimate that ENB shares have less upside in a separation scenario. If ENB’s management acquired the Dominion utility assets in the hope of securing a permanently higher multiple after a split of the business, we think they’re likely to be disappointed.

The underwhelming result for ENB shareholders amid a business split is the same whether we consider ENB’s value from the perspective of EV/EBITDA or distributable cash flow.

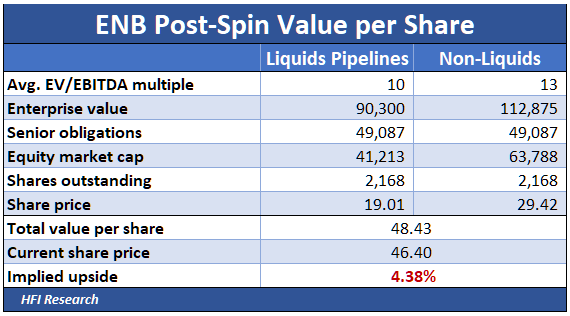

An EV/EBITDA valuation implies 4.4% upside from the current price of $46.40.

HFI Research

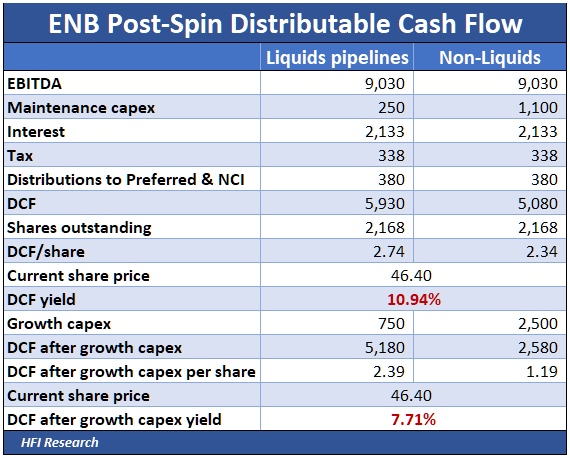

A distributable cash flow (DCF) valuation implies little upside based on ENB’s capacity to pay a common dividend. If we factor growth capex into the equation, the income prospects for ENB shareholders are essentially the same as they are today.

HFI Research

Between 2017 and 2022, ENB’s annual average EV/ EBITDA multiple fluctuated between 11.8x and 16.7x despite its heavy liquids weighting. The historical multiple is significantly higher than the North American midstream average, indicating that investors were willing to pay a premium for the business. A separated entity could see the shares lose any premium valuation, particularly the standalone liquids business.

TRP Offers Greater Upside than ENB

TRP offers greater upside potential than ENB because, first, its current EV/EBITDA multiple of 10.5x is much lower than both its historical average and that of its natural gas-weighted peers. ENB shares trade at a 10.9x multiple, which is higher than liquids-weighted midstream businesses and more closely in line with natural gas-weighted operators.

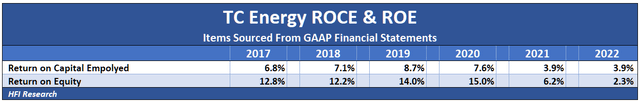

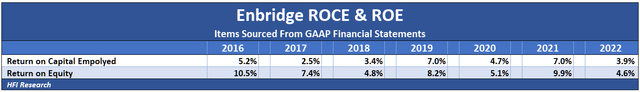

The second reason why TRP offers greater upside potential is that it generates a significantly higher return on capital employed (ROCE) and return on equity (ROE) than ENB. In fact, ENB’s ROIC and ROE are so low that we don’t see a good reason for its shares to trade at a premium multiple.

HFI Research

HFI Research

Note that for TRP, the Keystone XL permit cancellation and Coastal GasLink cost overruns resulted in $6.3 billion of impairment charges in 2021 and 2022. The charges dramatically reduced net income in those years and were the main culprit behind the company’s low ROCE and ROE. If we exclude those charges in the calculation of net income, TRP’s ROCE in 2021 and 2022 increases to 9.58% and 10.03%, respectively, while its ROE increases to 14.50% and 12.70%. We don’t mean to downplay the shareholder value destroyed during those years, but as long-term shareholders, we recognize that the adjusted figures are more representative of future returns.

A reversion to historically normal returns on capital will be another factor that will benefit TRP’s trading multiple. It may take a few quarters to get there, but in the meantime, we’re comfortable with our $54 price target and the 9.5% upside it implies from today’s share price.

Conclusion

If TRP’s management can execute over the coming quarters-and we expect that it will-its share price will benefit from lower leverage, a high return on capital, and a separation into standalone liquids and non-liquids entities. ENB shares, meanwhile, have roughly equal income generation potential as TRP’s but have significantly lower appreciation potential due to their higher trading multiple and the company’s lower return on assets. Even if ENB decides to split into two standalone entities, its shares aren’t likely to benefit.

For this reason, TRP is a better buy than ENB. We maintain our $54 price target and Buy rating on TRP shares. Once management demonstrates progress toward its stated goals, such as lower leverage and a completed Coastal GasLink pipeline, we’ll consider increasing our price target to a level more closely in line with our EV/EBITDA valuations sketched above.

Given the high probability of improvement over the next few quarters and a clear catalyst for a higher share price, TRP equity is a very good choice for conservative investors who seek both income and capital appreciation over the long term. Today’s low-multiple share price represents an outstanding buying opportunity.

Read the full article here

Leave a Reply