JPRE strategy and portfolio

JPMorgan Realty Income ETF (NYSEARCA:JPRE) is a relatively new real estate exchange-traded fund, or ETF, launched on 5/20/2022. However, it is the continuation of a mutual fund that started investing operations in January 1998. It has a portfolio of 27 REITs (plus cash and equivalents), a 12-month rolling dividend yield of 3.16%, and a net expense ratio of 0.50%. Distributions are paid quarterly.

Most real estate ETFs track indexes, but this one is actively managed. As described by JPMorgan, the Fund may invest in both equity and mortgage REITs, including small caps. It may also “invest up to 15% of net assets in illiquid holdings.” As of writing, the portfolio holds only equity REITs, mostly large and mid-cap capitalizations.

The next table compares JPRE with the three largest U.S. real estate ETFs regarding a number of characteristics.

|

JPRE |

VNQ |

SCHH |

XLRE |

|

|

Name |

JPMorgan Realty Income ETF |

Vanguard Real Estate Index Fund ETF Shares |

Schwab U.S. REIT ETF |

The Real Estate Select Sector SPDR Fund ETF |

|

Inception |

5/20/2022* |

9/23/2004 |

1/13/2011 |

10/7/2015 |

|

Expense Ratio |

0.50% |

0.12% |

0.07% |

0.10% |

|

AUM |

$314.97M |

$30.18B |

$5.46B |

$4.18B |

|

Dividend Yield |

3.16% |

4.88% |

3.42% |

3.84% |

|

Average Daily Volume |

$276.30K |

$340.57M |

$48.39M |

$165.84M |

|

Holdings |

28 |

165 |

124 |

34 |

|

Assets in Top 10 |

61.95% |

47.08% |

45.55% |

59.48% |

*1/1/1998 as a mutual fund.

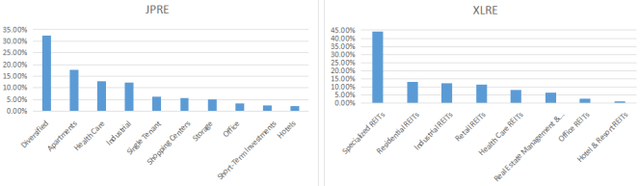

JPRE is a much smaller and less liquid fund. It is also significantly more expensive in fees, and more concentrated than VNQ and SCHH. In number of holdings and concentration, it is comparable to the large-cap sector benchmark XLRE. Even if different classifications are used in industry breakdowns, the chart below shows that JPRE over-weights residential, healthcare, storage REITs, and underweights retail REITs relative to XLRE. As a result, the JPRE portfolio looks more defensive.

JPRE vs XLRE industry breakdown (Chart: author; data: JPMorgan, SSGA)

The top 10 holdings, listed below, represent about 62% of asset value. Each of the top 4 names weighs between 7% and 10%. Risks related to other individual REITs are moderate. In XLRE, the top constituent (Prologis) has an even higher weight of 12.1%.

|

Ticker |

Name |

Weight |

|

AMT |

AMERICAN TOWER CORP REIT |

9.75% |

|

EQIX |

EQUINIX INC REIT USD |

8.17% |

|

DLR |

DIGITAL REALTY TRUST INC |

8.05% |

|

PLD |

PROLOGIS INC REIT USD |

7.26% |

|

WELL |

WELLTOWER INC |

5.91% |

|

O |

REALTY INCOME CORP REIT |

5.23% |

|

VTR |

VENTAS INC REIT USD 0.25 |

4.58% |

|

SUI |

SUN COMMUNITIES INC REIT |

4.45% |

|

UDR |

UDR INC REIT USD 0.01 |

4.35% |

|

PSA |

PUBLIC STORAGE REIT USD |

4.2% |

Historical performance

The next 2 charts compare total returns of JPRE since inception (as an ETF) and most non-specialized US real estate ETFs.

![JPRE vs competitors [1]](https://finfactories.com/wp-content/uploads/2023/09/2496631-1695676572507134.png)

JPRE vs competitors [1] (Seeking Alpha)

![JPRE vs competitors [2]](https://finfactories.com/wp-content/uploads/2023/09/2496631-16956765467501922.png)

JPRE vs competitors [2] (Seeking Alpha)

JPRE is among the best performers. It lags iShares Core U.S. REIT ETF (USRT) and JPMorgan BetaBuilders MSCI U.S. REIT ETF (BBRE) by less than 2%, and it is almost on par with First Trust S&P REIT Index Fund (FRI) and Vident U.S. Diversified Real Estate ETF (PPTY).

Technicals

Like all real estate ETFs, JPRE fell and broke a support last week, losing 5.2% in one week on concerns about rate policy. As of writing, it is about 7% below the 200-day moving average and 16.5% below the 52-week high of February.

JPRE price chart in daily bars by Finviz (Finviz.com)

Real estate experts claim this is an overreaction and the sector is undervalued. They may be right, but they have been telling the same story for months. Value is a bad timer. For people who are already invested in equity REITs, it may be too late to panic, and for those who are not, it may be too soon to buy. It has rarely been a good idea to catch a “falling knife” before it hits the floor. The next level where JPRE will stabilize for a couple of weeks may be a temporary floor, but waiting for it reduces the risk.

How I invest in real estate

I don’t try to time a bottom, and I am not a real estate expert, but I have studied quantitative anomalies in some funds for years. The Real Estate Rotation shared in my investing group is based on these anomalies. This model picks funds, avoiding the risks of individual REITs. About once a month, a multifactor formula points to the fund with the best probability to outperform its peers in the next few weeks. Since I started publishing updates on this model in my investing group on 8/2/2021, it shows a moderate loss in capital (about -8%) and a gain in total return thanks to high distributions. In the same time, all real estate funds are in deep loss, even with distributions.

Of course, past performance is never a guarantee of future returns. Even the best strategies may go wrong for a while. This rotational model doesn’t change positions very often. It has been long in Cohen & Steers Total Return Fund (RFI) for a few months, but it may change at any time from now (more info at the end of this post).

Takeaway

JPMorgan Realty Income ETF is a real estate ETF launched in May 2022, but with a long history as a mutual fund. It is actively managed: it means the strategy is very flexible, and also impossible to duplicate or back-test like an index-based ETF. Now, JPRE is invested in 27 equity REITs, mostly in large capitalizations of the sector. The portfolio is very concentrated in the top holdings, but more defensive than XLRE. It is among the best performers among its peers, despite higher expenses. The sector has been beaten down for months and has just broken a support last week.

Even if experts claim that REITs are undervalued, it is probably wise to wait for some consolidation before buying JPRE or any other real estate fund. For transparency, I use a rotational strategy with an edge over holding a real estate fund on the long term.

Read the full article here

Leave a Reply