The Nuveen Preferred & Income Securities Fund (NYSE:JPS) is one closed-end fund, or CEF, that could be used by investors who are looking to generate a high level of current income. This is evident in the fact that the fund currently boasts a 7.34% yield, which makes this one of the few assets in the market that has the ability to generate a higher current yield than a money market fund.

We last discussed this fund in early July. It has generally delivered a disappointing performance since that time, as shares of the fund are down 2.66% since that article was published:

Seeking Alpha

The fund’s distributions over the period helped to offset that poor price performance, though. In fact, when we take the distributions into account, investors in the fund have only lost 0.91%, which is actually better than the S&P 500 Index (SP500) has managed to deliver over the same period:

Seeking Alpha

As a few months have passed since the time that we last discussed this fund, it could be a good opportunity to revisit it and see what has changed. One potential major change is that the shareholders voted on a proposed merger with the Nuveen Preferred & Income Opportunities Fund (JPC), although curiously there is nothing in the media or on the fund sponsors’ website that says anything about the results of this vote. As such, this article will discuss this fund as it stands today with the assumption that the shareholder vote failed.

About The Fund

According to the fund’s webpage, the Nuveen Preferred & Income Securities Fund has the stated objective of providing its shareholders with a high level of current income while still preserving capital. Specifically, the website states:

The Fund seeks primarily to offer high current income consistent with capital preservation.

The Fund invests at least 80% of its managed assets in preferred and other income-producing securities, including hybrid securities such as contingent capital securities. At least 50% is invested in securities that are rated investment grade. The Fund uses leverage.

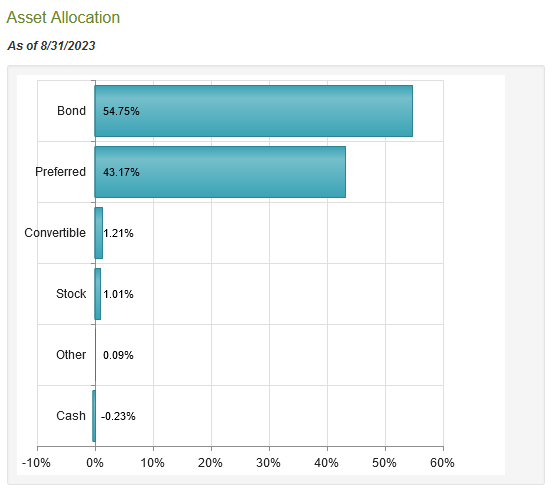

The fund’s asset allocation is generally in line with the above strategy description, although curiously the fund is more heavily weighted to bonds than preferred stocks at the moment:

CEF Connect

Bonds generally work very well for investors who are looking to preserve their principal. This is why many bond funds explicitly state the preservation of capital as one of their primary objectives. The reason for this is that bonds always return their face value at maturity unless the issuing entity defaults. Thus, an investor who purchases a bond when it is first issued and holds it until maturity is guaranteed not to lose any money unless the issuer defaults. However, this does not necessarily mean that the investor will not lose money in real terms, since unless the bond adjusts its face value for inflation, the face value of the bond might very well purchase less than it did when the bond was first issued. However, bonds are still a pretty good way to achieve the preservation of capital, which is one reason why they tend to be well-liked by conservative investors such as retirees. However, preferred stocks act much like bonds except that they have no maturity date. As such, they are generally not as good at preserving capital as bonds, but for the most part preferred stocks tend to hold their value over time much better than common stocks or other risky assets. The fact that the fund is more invested in bonds than in preferred stocks does somewhat support the theme of capital preservation that it is trying to establish with its objective.

I will admit that CEF Connect’s description of the fund’s asset allocation is quite strange. The fund’s Q3 holdings report states that 51% of the fund’s holdings consist of preferred stock with the remainder invested primarily in hybrid securities such as contingent capital securities. It lists only a 5.0% allocation to corporate bonds. With that said, CEF Connect is actually owned by Nuveen Investments, so its information is definitely coming directly from the fund’s sponsor. Therefore, we are left with one of three conclusions:

- CEF Connect’s definition of “bonds” includes what the holdings report calls a preferred stock with a maturity date. The normal difference between a preferred stock and a bond is that a bond matures, so these securities are bonds in all but name.

- The CEF Connect data above is dated August 31, 2023. That is considerably newer than the April 30, 2023, date on the fund’s most recent holding report. Thus, the fund’s positions may have changed since the most recent report posted on the website.

- CEF Connect is classifying anything that pays interest for tax purposes as a bond, and anything that pays dividends as preferred stock. This is an important difference between the two securities since companies make payments to bondholders with pre-tax money but make payments to preferred stockholders with after-tax money.

I am inclined to believe that all three conclusions are correct. The only real difference between a bond and a preferred stock that matures is that the bond is senior to the preferred stock in the event of bankruptcy. Otherwise, both securities should behave much the same way as far as market pricing is concerned so for the purposes of this article, “bond” will refer to anything that has a maturity date, and “preferred stock” will refer to traditional preferred stock that does not mature.

The fact that the fund is more heavily invested in bonds than in preferred stocks is still somewhat surprising though, as both its name and description strongly imply a preference for preferred stock. It is especially surprising when we consider that preferred stock generally has higher yields than bonds. Here are the current yields on the major indices tracking both domestic preferred stocks and domestic bonds:

|

Index |

Current Yield |

|

Bloomberg U.S. Aggregate Bond Index (AGG) |

4.51% |

|

ICE Exchange-Listed Preferred & Hybrid Securities Index (PFF) |

6.66% |

|

Bloomberg High Yield Very Liquid Index (JNK) |

8.28% |

(Current yield figures are the 30-day SEC yields of the exchange-traded funds tracking the indices, not the trailing twelve-month yields as published on most major financial sites).

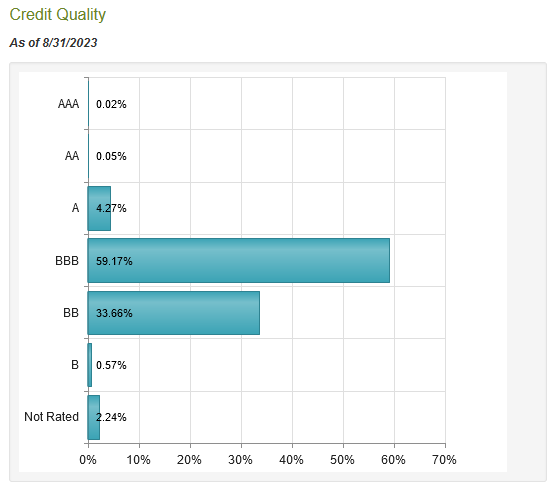

As we can see, unless the fund is investing in junk bonds, it should be able to achieve a higher level of income by investing in preferred stock as opposed to bonds. The description of the fund states that it will invest at least half of its assets in investment-grade securities. In fact, it is currently higher than that:

CEF Connect

An investment-grade security is anything rated BBB or higher. As we can see, that currently describes 63.51% of the fund. This is something that will undoubtedly appeal to those investors who are seeking safety, but it does make the fund’s asset allocation a bit more difficult to explain. In short, the fund does not appear to be invested in a way that maximizes the yield that it generates from the portfolio. It appears that it would probably be better off if it were more weighted to preferred securities.

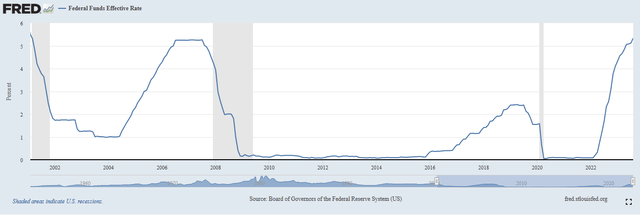

With that said, the bond’s overweighting to bonds compared to preferred securities may make sense if it expects that interest rates will increase further. As everyone reading this is no doubt well aware, the Federal Reserve has been very aggressively raising interest rates in an effort to combat the incredibly high inflation that has been plaguing the American economy. As of the time of writing, the effective federal funds rate sits at 5.33%, which is the highest level that the nation has seen since February 2001:

Federal Reserve Bank of St. Louis

When we last discussed the Nuveen Preferred & Income Securities Fund, the federal funds rate was at 5.08%. As such, the effective federal funds rate has increased by 25 basis points in the past two months. This has had an impact on the market price of bonds and preferred stocks. As we can see here, both the aggregate bond index and the preferred stock index mentioned above are down since the date that the last article was published:

Seeking Alpha

The performance that we see here is somewhat unusual. In most circumstances, preferred stocks decline more than bonds when interest rates go up. That has been the case since the start of 2022, right before the Federal Reserve began its monetary tightening process:

Seeking Alpha

The reason for this is that preferred stocks tend to have a much higher duration than bonds. Duration is a term that measures the sensitivity of a fixed-income security to interest rates, although technically it can be thought of as the time until the investor receives payments totaling whatever the initial investment was. In most cases, this means that the longer the period until maturity, the higher the duration. As preferred stocks usually have no maturity date, this means that they will usually have a higher duration and decline in value to a greater extent than most bonds when interest rates go up.

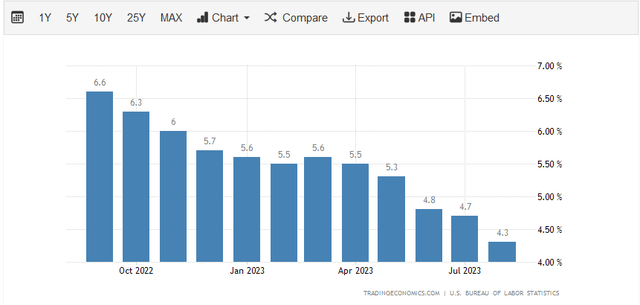

The point of the above discussion is that if the fund’s management expects that interest rates will continue to rise, they may weight the fund’s assets towards bonds as opposed to preferred stocks. The theory behind this is that the fund will lose less money as rates rise. This may not be a bad bet today. The Federal Reserve has implied that it may consider an additional rate hike this year, although there are still some analysts predicting that rates will simply remain flat at today’s level until the economy finally cracks and enters into a recession. The recent strike by the United Auto Workers might be the event that will finally break the labor strength that has been supporting the economy and cause a recession. The Anderson Economic Group states that a ten-day strike could reduce the national gross domestic product by $5.6 billion and plunge the state of Michigan into a recession. This could, if nothing else, have a sufficient effect on the nation’s economy that the Federal Reserve decides to stop hiking rates until more data on the effects that the current rate hikes have had on the economy become more apparent. On the other hand, the core consumer price index stands well above the 2% rate that the Federal Reserve considers to be acceptable:

Trading Economics

Thus, until this rate drops significantly, it seems unlikely that there will be any rate cuts. As we just saw, preferred stocks outperformed bonds over the past two months. We also continue to have an inverted yield curve, so the market is clearly expecting the Federal Reserve to cut rates sooner rather than later. In that situation, preferred stocks will probably outperform bonds, and that could drag on the fund’s performance compared to peers that are more weighted towards preferreds.

Leverage

As mentioned earlier in this article, the Nuveen Preferred & Income Securities Fund employs leverage as a means of boosting its returns. I explained how this works in my previous article on the fund:

In short, the fund borrows money and then uses that borrowed money to purchase preferred stocks and bonds. As long as the purchased securities have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, so this will usually be the case. With that said, the use of leverage for this purpose is not as effective with rates at 6% as it was when rates were at 0%.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. Thus, we want to ensure that the fund is not employing too much leverage since that would expose us to too much risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the Nuveen Preferred & Income Securities Fund has levered assets comprising 35.89% of its portfolio. This is an improvement over the leverage level that the fund had the last time that we discussed it, which is probably a very good thing in today’s environment. As I mentioned in a previous article, we have already seen some funds have to cut their distributions due to the rising costs of servicing their leverage. In addition, the benefits of leverage are much less than they once were because the yields that the fund can receive on the purchased assets and the rate that it has to pay on the borrowed assets are much less than they once were. The fund appears to be lowering its leverage and the risks associated with that leverage, which is a very good thing right now. We should appreciate this.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Nuveen Preferred & Income Securities Fund is to provide its investors with a high level of current income while still ensuring the preservation of capital. In order to accomplish this objective, the fund invests in a portfolio consisting of preferred stock, bonds, and hybrid securities that provide the majority of their investment returns in the form of direct payments to their investors. As such, we can expect that most of these securities will have fairly high yields. That is certainly the case, as we can see simply by looking at the yields of the indices above. This fund takes things a step further and applies a layer of leverage to boost the effective yield that it earns from these assets. It then takes the income that it receives from all of these securities and pays it out to its own shareholders, net of the fund’s expenses.

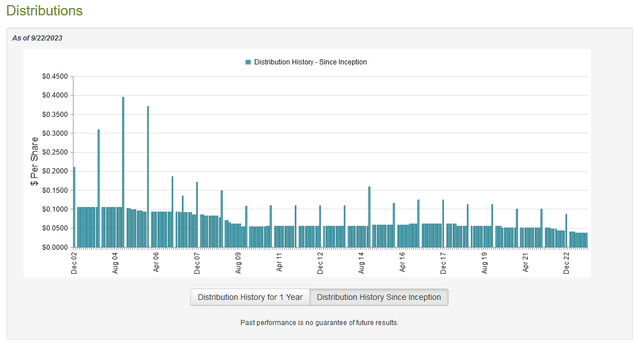

We can thus assume that the fund will have a very high yield itself. That is certainly the case as the fund currently pays out a monthly distribution of $0.0380 per share ($0.456 per share annually), which gives it a 7.34% yield at the current price. Unfortunately, the fund has not been particularly consistent with its distribution over the years. As we can see here, it has both raised and lowered it multiple times over its lifetime:

CEF Connect

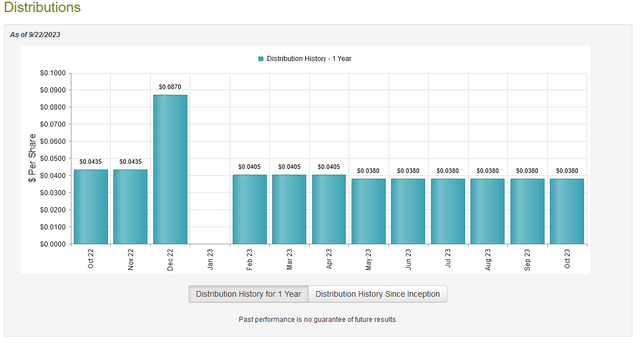

The fact that the fund’s distribution has varied quite a lot over time may be something of a turn-off for those investors who are seeking a safe and secure source of income with which to pay their bills and finance their lifestyles. The fund has cut its distribution twice in the past twelve months, which will certainly be even more of a turn-off:

CEF Connect

With that said though, most fixed-income closed-end funds have had to reduce their distributions over the past twelve months as rising interest rates have driven down the value of bonds and preferred stocks, which has diminished the net assets of most fixed-income funds. The distribution cuts were necessary despite the fact that newly purchased assets have substantially higher yields due to the scale of the losses that have been suffered. After all, the funds do not want to deplete their assets any more than has already been done.

With that said, anyone who is purchasing this fund today will receive the current distribution at the current yield. This investor will not be negatively impacted by events that the fund encountered or had to deal with in the past. The most important thing is how well it is able to sustain its distribution at the current level. Let us investigate this.

Unfortunately, we do not have an especially recent document that can be consulted for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on January 31, 2023. As such, it will not include any information about the fund’s performance over most of this year. That is unfortunate as 2023 has so far proven to be a much better year for most fixed-income assets than 2022. This report will give us a good idea of how well the fund managed to handle the incredibly challenging market environment that dominated that year though, which could provide some insight into the quality of the fund’s management. After all, anyone can make money in a bull market but it far more difficult to perform well during a bear market.

During the six-month period, the Nuveen Preferred & Income Securities Fund received $9,823,637 in dividends and $67,678,729 in interest from the assets in its portfolio. As preferred stocks have higher yields than bonds in most cases, this leads us to believe that the majority of the assets in the portfolio are indeed technically bonds. When we combine the payments that the company received from these assets with a small amount of income from other sources, the fund had a total investment income of $77,594,417 during the period. It paid its expenses out of this amount, which left it with $43,903,893 available for shareholders. That was, unfortunately, not nearly enough to cover the $53,073,479 that the fund paid out in distributions during the period. At first glance, this is likely to be concerning as we normally would like fixed-income funds to completely finance their distributions out of net investment income.

However, the fund does have other methods through which it can obtain the money that it needs to pay the distributions. For example, it might have been able to exploit fluctuations in bond or preferred stock prices to earn some capital gains profits. The fund did, fortunately, have some success at this during the period. The fund reported net realized gains of $5,516,456 but these were partially offset by $2,659,790 net unrealized losses during the period. Overall, the fund’s assets declined by $6,312,920 after accounting for all inflows and outflows during the six-month period. This certainly explains why the fund was forced to cut its distribution twice, as it is clearly struggling to pay its distributions.

We will have to wait until the fund releases its full-year report in order to determine whether or not the new distribution is sustainable. The fund should be able to get pretty close considering that its net investment income probably went up this year and the optimism with respect to the reversal of the Federal Reserve’s monetary tightening policy provided some opportunities for capital gains. The fund should release its annual report within the next few weeks so we should not have to wait too long to have this information.

Valuation

As of September 21, 2023 (the most recent date for which data is currently available), the Nuveen Preferred & Income Securities Fund has a net asset value of $7.33 per share but the shares only trade for $6.21 each. This gives the fund’s shares a 15.28% discount on net asset value at the current price. This is a very attractive discount that is better than the 13.03% discount that the shares have averaged over the past month. As such, the current price certainly appears to be a good entry price for the fund.

Conclusion

In conclusion, the Nuveen Preferred & Income Securities Fund has a vastly different portfolio than what might be expected, as the fund is more weighted toward bonds than towards preferred stocks. However, that could be a good thing in the event of more interest rate hikes, as bonds usually outperform preferred stocks as interest rates rise due to their lower duration. The reverse is true when rates are cut, though, so this same thing could negatively affect the fund’s performance versus a fund that is entirely invested in no-maturity preferred stocks. I am certainly not optimistic about the prospect of near-term rate cuts because inflation still remains entirely too high. However, the recent automobile industry strikes could certainly push the state of Michigan into a one-state recession and have a noticeable negative impact on the American economy as a whole. The fund does appear to be a reasonable way to earn a high yield, though, but it is still uncertain how well it can sustain its distribution.

Read the full article here

Leave a Reply