Overview

My recommendation for Universal Music Group (OTCPK:UMGNF) is a buy rating, as I believe the business is well-positioned to benefit from the rising adoption of music subscription services. Notably, I think the time for a price hike is near the corner, which will be a key growth driver for UMGNF moving forward.

Business

UMGNF is a diversified conglomerate overseeing a wide spectrum of enterprises encompassing recorded music, music publishing, merchandising, and audiovisual content across over 60 global regions. Their core activities involve the discovery and nurturing of talented recording artists and songwriters. Additionally, UMGNF is deeply involved in the production, distribution, and promotion of music. Over the past 5 years since 2017, the business has continued to grow at a very healthy clip of 13%, from EUR5.6 billion in revenue in FY17 to EUR10.3 billion in revenue in FY22. Not only was revenue a great performer, but business profitability has also continued to improve at a steady clip, from EUR977 million in FY18 to EUR2 billion in FY22. The business reports in 3 segments: recorded music, music publishing, and merchandise, which represent 77%, 17%, and 6% of FY22 revenue, respectively. A similar ratio is for EBITDA as well, at 81%, 17.5%, and 1.5%, respectively.

UMG

Recent results & updates

UMGNF’s 2Q23 results were a resounding success. Group revenues were 6% higher than anticipated. Subscription streaming grew at a faster clip than anticipated, increasing to 13.0% from 10.3% in 1Q23, and ad-supported growth increased to 5.3% from -2.2%. Strong operating leverage and EUR24 million in cash compensation savings contributed to an adjusted EBITDA of EUR590 million, which was 9% higher than projections. UMGNF’s 2Q23 results show the company can adapt and thrive in a digitally transformed (subscription-based) market, in my opinion.

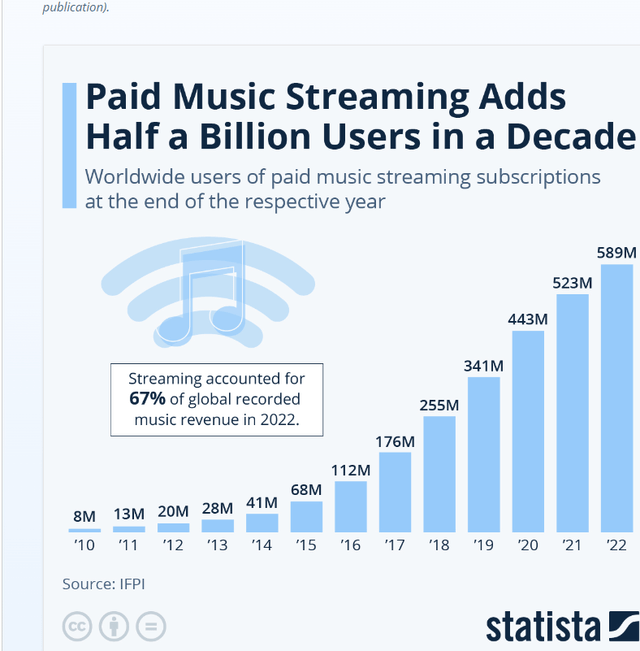

In my opinion, UMGNF will benefit from streaming’s continued rapid expansion beyond 2023. The IFPI, as referenced in the 1Q23 earnings call, predicts that the market will expand by at least 25% in the coming years as the number of subscribers increases from 600 million to more than 1 billion. While it took the world more than a decade to reach 600 million subscribers, I believe the incremental subscriber adds from here will be at an accelerated pace given the internet infrastructure (mobile internet bandwidth was not sufficient to support music streaming back then) and demographic tailwind (younger generations demand convenience more than older people).

Statista

With more and more people using music streaming services like Spotify, YouTube Music, Deezer, etc., I expect these companies to raise their prices, which would be good news for major record labels like UMG that have revenue-share licensing agreements with these services. To give some context on why these subscription platforms are important, First, revenue trends in the industry have shifted positively since the introduction of digital music streaming platforms, following years of structural decline due to the proliferation of digital piracy in the early 2000s. Royalties from streaming have begun offsetting losses from the sale of physical downloads, which has been positive for the industry. The subscription model is central to streaming’s success, in essence. There are just so many more benefits to streaming, which is the reason why I am positive about the industry. For instance, the platforms either charge a monthly fee in exchange for access to the entire music library or they offer the service for free in exchange for the listener’s attention to advertisements. Since subscriptions have become a way of life for many people and prices have been relatively stable for a long time, I think it’s fair to raise them now. This would be similar to the Netflix model, in which they were cheap for most of the 2020s until everyone got “hooked” to the services, then they started raising prices, gushing in tons of cash. I think the platforms will follow a similar game plan, which will be music to UMGNF’s ears.

Valuation and risk

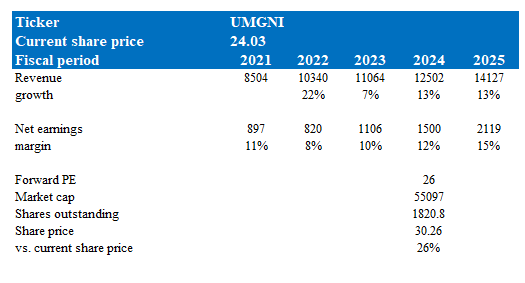

Author’s valuation model

According to my model, UMGNF is valued at $30 in FY24, representing a 26% increase. This target price is based on my growth forecast of low teens in FY24 and FY25, which is the business’s historical growth rate, supported by subscriber growth and also price increases. As revenue grows and UMGNF continues to experience operating leverage, margins should have no issues expanding back to historical levels in the mid-to-high teens percentage range. UMGNF 26x forward PE, which I believe to sustain at this level as I expect growth and margins to continue expanding. At 26x PE, UMGNF is trading in line with Warner Music Group (WMG), which is trading at 25x forward PE. Both of these companies are expected to grow similarly and have similar margins.

The risk with UMGNF is that its adoption of streaming subscription services might be a lot slower as UMGNF will now need to penetrate developing markets. In these markets, it would be tough for UMGNF to start with high prices (to support pricing growth). As such, growth might be slower than expected over the medium term.

Summary

I recommend a buy rating for UMGNF due to its favorable positioning to capitalize on the growing adoption of music subscription services. Recent results, such as the strong 2Q23 performance, demonstrate UMGNF’s ability to adapt and thrive in the evolving digital market. The ongoing expansion of the music streaming industry is expected to benefit UMGNF, especially as subscriber numbers continue to rise. Furthermore, the potential for price increases in streaming services is a positive indicator for major record labels like UMGNF, which have revenue-sharing agreements with these platforms. This aligns with the industry trend of streaming platforms evolving their pricing models over time, akin to the success seen in the streaming video industry.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply