All financial numbers in this article are in Canadian dollars unless noted otherwise.

Introduction

It’s time to discuss my favorite long-term railroad play: Canadian Pacific Kansas City (NYSE:CP), or CPKC for short. Also, some still refer to it as Canadian Pacific, as old habits die hard.

On August 15, I wrote an article titled Canadian Pacific Kansas City: The Go-To Railroad For Growth.

In this article, I’ll elaborate on that article and significantly expand my thesis to explain why I do not believe that CPKC has a lofty valuation after the merger between Canadian Pacific and Kansas City Southern closed.

Not only do I disagree with some valuation critics, but I believe that CPKC is one of the best dividend growth stocks for long-term investors.

The company is building one of the best railroad networks in the world. It is about to sustain double-digit annual EBITDA growth, boost margins, and lower debt to levels that support a return to dividend growth and what is likely to become aggressive buybacks.

Furthermore, I believe that billionaire investor Bill Ackman is right when he makes the case that CPKC is about to double its earnings.

Having said all of this, there’s a lot to discuss.

So, let’s dive into the details!

The Greatest Rail Network In North America

CPKC is one of the few companies that does not have an investment advisor like Vanguard as its largest shareholder. Its largest shareholder is TCI Fund Management, with more than $30 billion in assets under management.

This fund owns 6% of CPKC. CPKC has an 11% weighting in its portfolio.

Another major investor is Bill Ackman’s Pershing Square Capital Management, which owns 1.6% of the railroad. The railroad accounts for 8% of its assets under management.

Pershing Square Capital Management

Mr. Ackman is certainly one of the more outspoken hedge fund managers.

In his most recent Investment Manager’s Report, he outlines why he owns the railroad. I highlighted some key parts.

The combination with KCS is an incredible accomplishment for CPKC’s industry-leading management team. CPKC is the first and only single-line railroad linking Canada, the United States, and Mexico. Not only does the combination create tremendous growth opportunities for CPKC, but it also increases competition in the rail industry overall, improving transportation options for shippers, and reducing greenhouse gas emissions by shifting more freight from truck to rail.

While it has only been several months, the management team has hit the ground running and already announced numerous contract wins in the midst of integrating the two networks. In June, CPKC held its inaugural Investor Day as a combined company that highlighted the many growth opportunities unlocked by leveraging CPKC’s unique three-country network, and provided 2024-2028 financial targets. If CPKC were to achieve these targets, the company’s earnings-per-share would increase to over $8 by 2028, or more than double the current level. In summary, the substantial revenue and cost synergies realized from the merger should lead to accelerated earnings growth for the foreseeable future.

Despite CPKC’s attractive long-term earnings outlook, the stock continues to trade at a discount to our view of intrinsic value and its closest peer, Canadian National. We believe the magnitude of synergies is larger and the path for realization is longer than investors originally anticipated, providing CPKC with profitable long-term growth and catalyzing share price appreciation in the years to come. – Pershin Square Capital Management

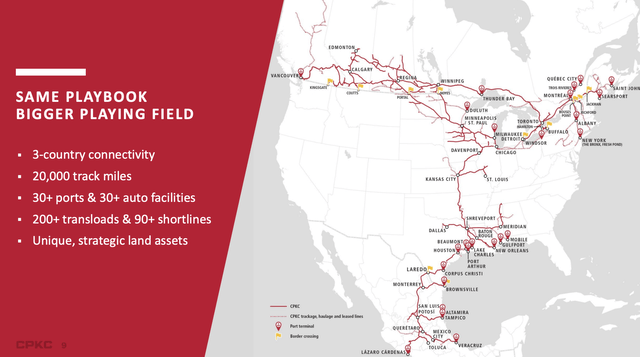

As almost everyone knows by now, CPKC became the first railroad to combine all North American nations this year. Its network is simply impressive, combining three nations, more than 30 ports, 30 car production facilities, Mexico’s industrial heart, the U.S. Midwest, and all major economic hubs of Canada.

Canadian Pacific Kansas City

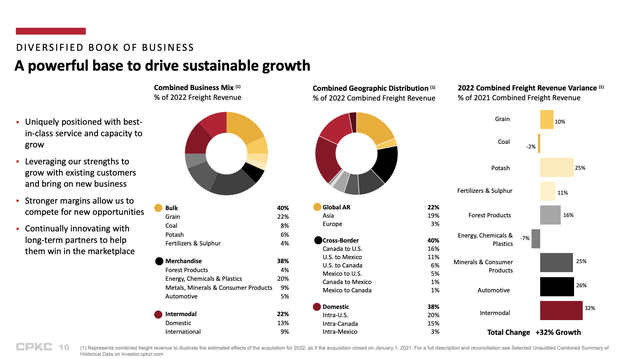

In this case, one of the things that was very important to me when buying railroads was bulk and merchandise exposure.

Not only do I want a wide-moat railroad, but I also want a railroad that ships high-margin products that enjoy high demand at home and abroad. The goods that fuel our economies.

Looking at the overview below, intermodal accounts for just a fifth of total revenue. Bulk accounts for 40% of total revenues. More than half of this comes from grains.

Merchandise accounts for 38% of total revenues. This includes key commodities like energy and various minerals.

Canadian Pacific Kansas City

To give you an example of the price difference between intermodal and bulk/merchandise. In the second quarter, the company generated $1,482 per intermodal carload. It made $4,630 per grain carload and $5,779 per fertilizer carload.

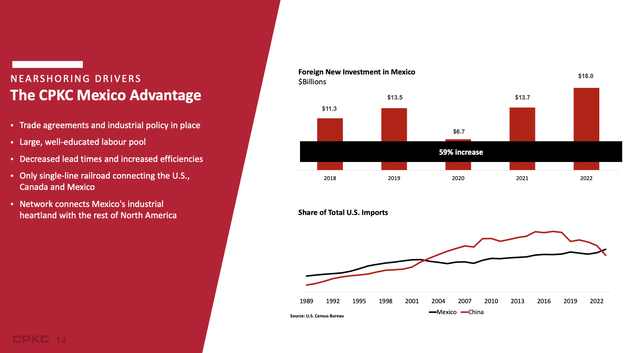

Additionally, the company benefits from exploding investments in Mexico, as it is becoming a hotspot for companies that re-shore and outsource production.

Canadian Pacific Kansas City

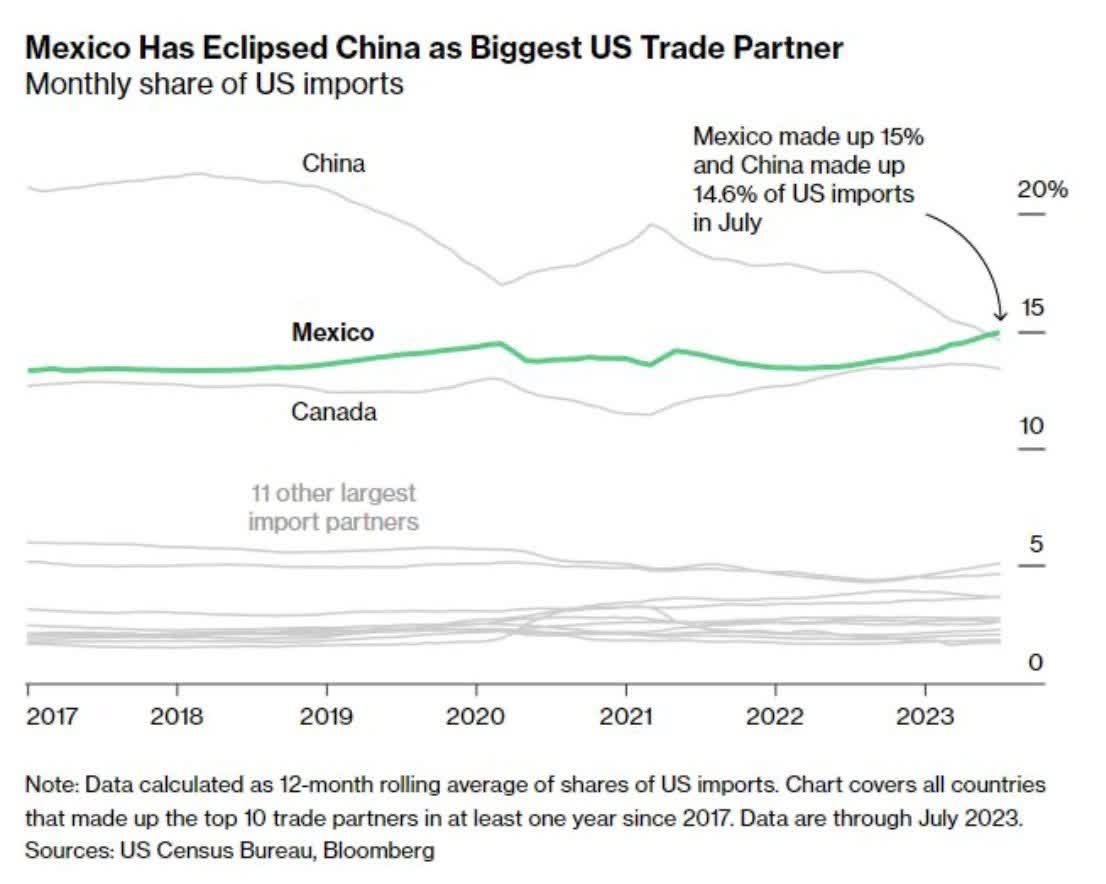

Mexico is now a bigger trading partner of the United States than China!

Please note that Chinese companies are also investing in Mexico, as it allows them to avoid certain trade tariffs. This is a win-win for CPKC.

Bloomberg

With that in mind, one of the reasons why I’m writing this article is CPKC’s attendance at the Morgan Stanley Annual Laguna Conference earlier this month.

CEO Keith Creel elaborated on key developments that don’t just matter in general, but especially in light of ongoing economic challenges.

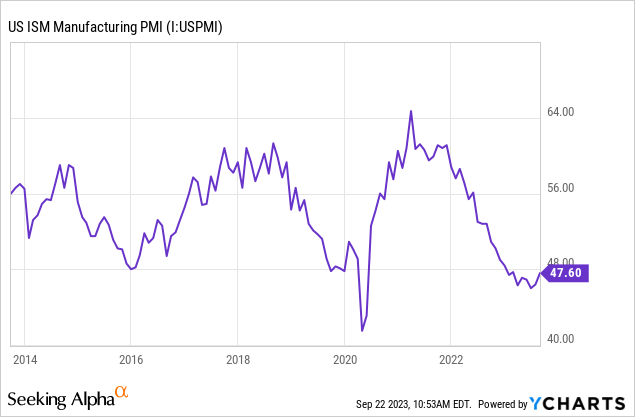

Mr. Creel mentioned that overall demand was slightly softer than anticipated, being down 4% quarter-to-date. This makes sense, as this is what the ISM Manufacturing Index looks like, a great leading indicator of industrial demand:

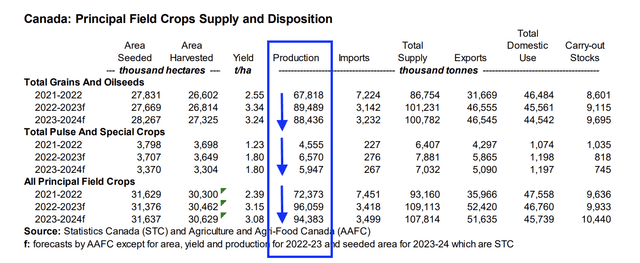

However, he expected a stronger finish to the third quarter, particularly due to the upcoming grain harvest, which is expected to boost demand. I agree with this assessment, as official Canadian data shows strong production growth in all key areas.

Agriculture & Agri-Food Canada (Leo Nelissen Annotations)

The CEO also anticipates a robust performance in the subsequent quarter, benefiting from strong demand in various sectors like coal, potash, grain, and intermodal.

Essentially, the company’s strategies and synergies resulting from the merger were seen as significant contributors to offsetting macroeconomic headwinds.

This is what Creel said with regard to Mexico:

But what I see over the next 5 years, for sure, is not less demand, more demand. You’ve got Tesla that’s building a new facility, you’ve got BMW that’s expanding. You’ve got Constellation that’s building their facility at Veracruz. You’ve got our steel producers that are expanding their networks. You’ve got steel producers from the U.S. that are building new locations in Mexico. You’ve got Bosch. There’s a long list, Mattel. I mean the reality is derisking supply chains, getting your product to market to the shelves. I think we’ve all learned the risk of — depending upon things that are produced overseas to get to our shelves and all the tsunami challenges that we had, the cost inflation, all those things. – CPKC

Despite having some challenges in Mexico after the merger approval, the company made clear that its approach involves focusing initially on stabilizing the U.S. and Canadian networks before making significant changes in Mexico.

They also announced a modification in the organizational structure to address specific operational needs, highlighting the dynamic and adaptive nature of their operations.

Having said that, the railroad confirmed that the integration synergies are on track, with progress seen in both cost and revenue synergies.

Cost synergies were being realized through headcount reductions and fuel efficiency improvements.

On the revenue synergy front, the company has exceeded expectations, already achieving $350 million in revenue synergies within the first eight months of the merger, positioning itself well to meet its targeted $1.5 billion revenue synergy over a 5-year plan.

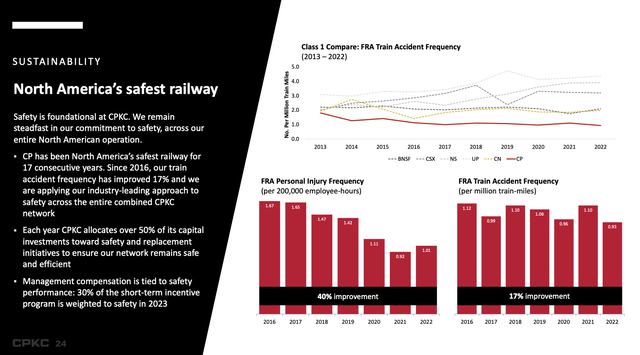

CPKC is also doing it without increasing accident risks.

Looking at the chart below, pre-merger Canadian Pacific has the best accident statistics – by a wide margin. Even over the past few years, the company was able to focus on efficiencies without seeing an uptick in accidents. My other holding, Norfolk Southern (NSC), is not doing so well.

Canadian Pacific Kansas City

Moreover, it is important to address competition from other railroads. Union Pacific (UNP), for example, has access to Mexico. The same goes for other railroads that start to work together.

The quote below is from the aforementioned conference, where Creel addresses the benefits that come with using just one railroad with direct Mexico access instead of railroads that work together. CP is simply in a better spot to offer a better service, which comes with pricing benefits.

if you’ve got a 3 railroad move, you can take a day out of it, but you can’t take the complexities out of 3 railroads run by 3 different operating groups, being guided by 3 different sets of priorities versus 1, so the complexities historically, I don’t care who you are, I’d never argue that a 3 railroad moves can be the same and achieve the same potential as one railroad move. There’s a huge material mileage difference. And in this case, in that 3-lane move, what UP has, and I’ll speak to UP’s network, they’ve got a great network between Laredo and Chicago. It’s shorter than ours. It’s grow flies. We’re going to get to Mexico, everything they have in U.S., we pick back up in Mexico. — and it’s our terminals. So at the end of the day, their best day versus our best day. I think there’s a place for both. But I do think if we do our jobs, that the premium freight is going to be in our railroad because it’s going to be the most reliable, the most consistent and the transit time is going to be the best. And quite frankly, we’re going to strive to be the best operators and do what we say to our customers we’re going to do. – CPKC

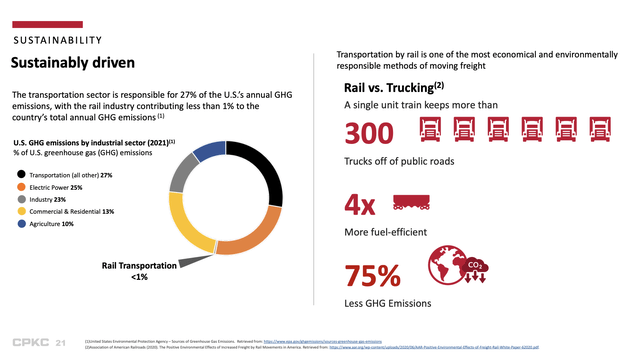

Furthermore, the company’s rail lines are competing with less efficient trucks. A single train can take 300 trucks off the road between Chicago and Mexico. The railroad is 4x more fuel efficient and emits 75% less emissions.

Canadian Pacific Kansas City

This also helps customers to make their supply chains more sustainable.

Currently, the trucking market is not very tight, as poor conditions have hurt demand. However, once demand comes back, rails become increasingly more competitive versus trucks, which should come with additional growth opportunities – especially in light of labor shortages.

Based on this context, I also believe that CP is attractively valued.

CPKC Valuation & Shareholder Return Potential

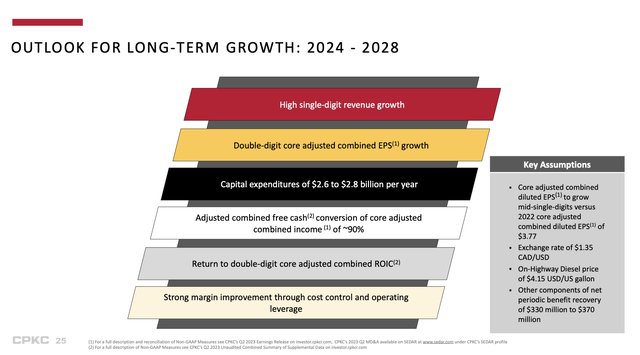

CPKC’s growth plans are ambitious. The company is expected to maintain high single-digit annual revenue growth through 2028. Moreover, higher margins are expected to result in double-digit core EPS growth.

Canadian Pacific Kansas City

Furthermore, high growth is expected to lower the company’s leverage ratio very quickly. As of 2Q23, its leverage ratio is 3.6x EBITDA. Once it hits 2.5x EBITDA, the company is in a good spot to boost its dividend and buybacks again.

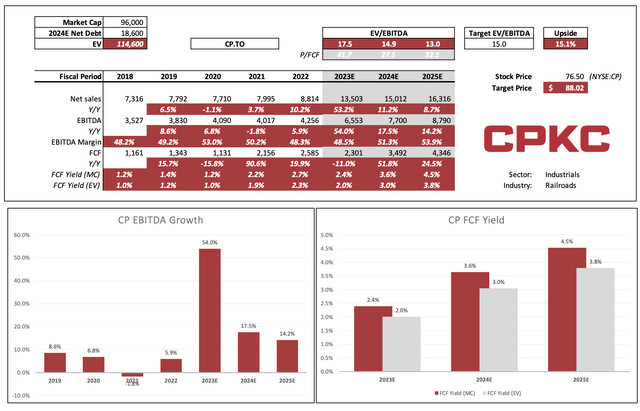

Analysts currently believe that the company will be able to lower net debt to $18.6 billion at the end of next year. This would imply a 2.4x net leverage ratio, meaning we’re not far from accelerating shareholder distributions.

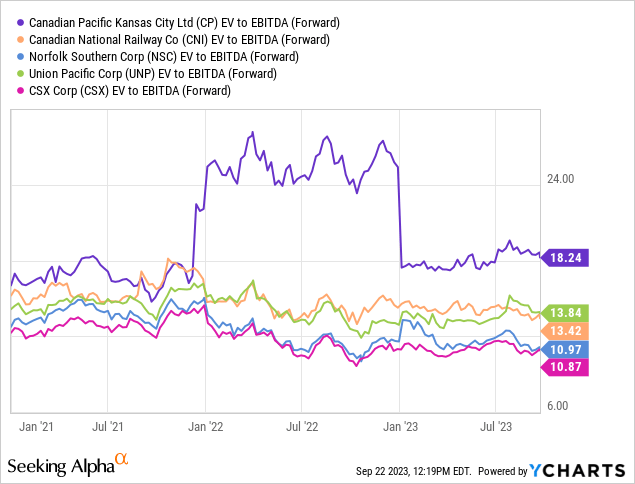

With regard to the valuation, CP has the highest valuation among Class I railroads. The stock is trading at 18.2x NTM EBITDA.

The good news is that this is warranted. After all, a company with higher growth expectations deserves a higher multiple.

It also helps that strong growth expectations result in a quick valuation decline.

EBITDA growth is expected to average 15.9% in the next two years, which brings the valuation to 13x 2025E EBITDA. Moreover, an even stronger surge in free cash flow is expected to result in a 4.5% FCF yield in 2025. This protects the company’s 0.7% dividend yield and paves the road for aggressive buybacks and dividend growth after 2024 (maybe already in 2024).

Leo Nelissen (Based on analyst estimates)

If we apply a 15x longer-term EBITDA multiple, the stock is 15% undervalued.

Additionally, the company is expected to maintain double-digit earnings growth well beyond 2025, as I already mentioned.

The current consensus target for NY-listed shares is $90.60, which is roughly in line with that estimate.

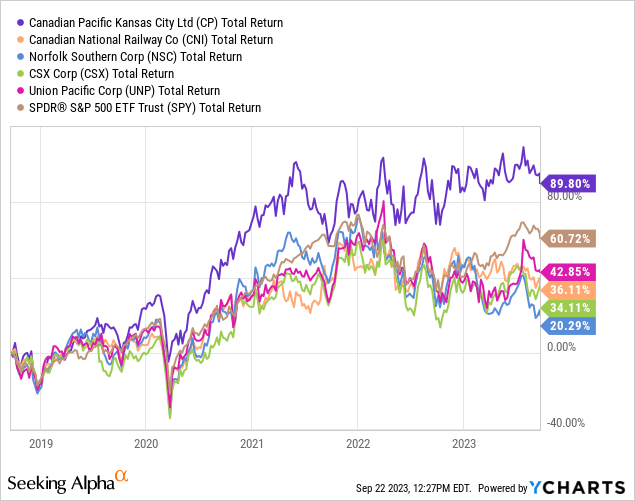

Over the past five years, CP shares have returned 90%, beating peers even before the 2022 growth slowing trend.

It was also the only railroad that outperformed the S&P 500.

While I do not expect CP shares to take off until economic growth indicators bottom, I have little doubt that CP will be a great source of long-term outperforming returns.

I truly believe it’s the best railroad on the market, with a top-tier moat capable of delivering accelerating dividends and buybacks for decades to come.

Given the new developments and tremendous post-merger progress, I stick to a Strong Buy rating.

Takeaway

I believe CP is the best railroad money can buy. I even believe it’s one of the best dividend growth stocks on the market.

The merger with Kansas City Southern has set the stage for exceptional growth, with a uniquely expansive rail network spanning three countries.

Key investors like TCI Fund Management and Bill Ackman’s Pershing Square Capital Management have shown their confidence, underscoring CPKC’s promising trajectory.

The company’s strategic focus on high-margin bulk and merchandise shipping, particularly in a booming Mexican market, positions it for sustained profitability.

Despite near-term economic challenges, CPKC remains resilient, backed by solid synergies and a commitment to operational excellence.

The growth outlook, the company’s sustainable practices, and its attractive valuation reinforce my conviction: CPKC is the premier choice for investors seeking substantial and lasting returns.

Reasons To Be Bullish

- Robust Rail Network: CPKC has an impressive rail network covering three countries and strategic economic hubs.

- Diverse Revenue Sources: It generates most of its revenue from high-margin bulk and merchandise shipments.

- Strategic Position in Mexico: Positioned well to benefit from investments and trade partnerships in Mexico.

- Synergies and Growth: The merger unlocked substantial synergies, contributing to accelerated earnings growth.

- Efficiency and Sustainability: CP is capable of taking trucks off the road and making supply chains more sustainable.

- Attractive Valuation and Outlook: The stock is attractively valued, justified by strong growth expectations.

- Potential for Shareholder Returns: I anticipate significant growth in shareholder distributions, including dividends and buybacks.

- Consistent Performance and Future Potential: CP has historically outperformed peers and is expected to continue delivering strong returns.

Read the full article here

Leave a Reply