Having first wrote on Lithium Americas (NYSE:LAC) in February of 2017, I’ve been well aware of the utterly massive amount of lithium the company is sitting on in Nevada. Imagine my amusement when a recent article pointed out “LAC is potentially sitting on one of the largest lithium deposits in the world.” Everyone (and I do mean everyone) in my life messaged me to tell me about it. My response: I’ve been writing on LAC for over six years; the deposit is even larger than the author of that article realizes and LAC has the prime real estate in that area.

Yet, the last year has not been a good time if you were invested in the lithium market. Some companies are in purgatory; others are beaten to a pulp. Yet, a few lithium companies offer exceptional value — potentially ridiculous value for the long-term investor.

In this article we will cover one that I think fits the bill for a long-term value play, Lithium Americas. Before we get into the company splitting into two parts, let’s review some amusing legal events.

Play Games: Win Prizes

Having monitored the LAC legal cases for years, it has been a story of LAC winning again and again via state court (and also at the appeals court level). The prosecution’s claims presented were rather silly or at times nonexistent.

Activists, having lost in court repeatedly, have decided to play new games — games with interesting legal consequences. According to the new lawsuit filed in May by Lithium Americas, the activists have been engaged in: Stealing equipment, vandalization, unjustly profiting, unlawful drone operation, oppression, fraud, malice, and trespassing. According to the suit, these fall under the following counts:

Count 1 – Civil conspiracy

Count II – Nuisance

Count III – Trespass

Count IV – Tortious Interference with Contractual Relations

Count V – Tortious Interference with Prospective Economic Advantage

Count VI – Unjust Enrichment

I find “Unjust Enrichment” one of the more interesting counts. Basically it is asking people for money to support illegal activity.

Unjust Enrichment (Humboldt Court System) |

Meanwhile, the defense is trying to make the claim that all of the above fall under the 1st amendment. While a person is well within their rights to protest, once it infringes on the rights of others, their rights end and the others begin.

It would be very hard to prove that all of the above could not have been protested in a legal fashion elsewhere rather than on BLM land. Land that has been designated to LAC to have dominion over. This comes in conjunction with tribal agreements. The courts will decide on these new actions by the activists.

A Catalyst to Move Lithium Americas

A catalyst is simmering within Lithium Americas: One that has the potential to move the stock; one that few people are talking about. Simply put, the company will soon split into two public companies and once this occurs the door to the catalyst opens. More on this in a moment. First, we need to lay down a timeline of actions which must first occur.

China, China, and More China

Things with China have been simmering for decades, but only in the last few years have things really started to warm up and not in a good way. Geopolitics and economics come into play. In response, the powers that be in the United States have put various economic speed bumps in the path of China, be it limiting access to semiconductor chip production or limiting the means of production via hindering China from obtaining necessary chemicals for the semiconductor manufacturing process. In response, China has threatened to ban various rare earth elements. Needless to say, it is not wise to be associated with China economically and unfortunately Lithium Americas has an association via China’s controlling interest in the South American project. It should be noted that China also owns stock in LAC but not a controlling interest.

Funding Thacker Pass Lithium

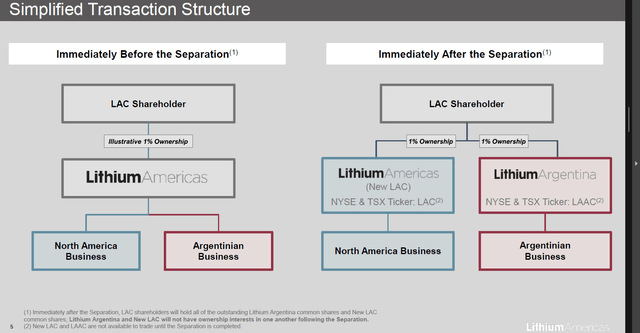

To distance themselves, Lithium Americas will break into two public companies. Current shareholders will receive stock in both of the new publicly traded companies. North American operations will be called “Lithium Americas” while South American operations will be named “Lithium Argentina”.

LAC Post Split (Lithium Americas)

This separation allows the China-dominated South American operation to go off on its own as a pure play. The North American operation is then free from the China-dominated South American operation and hence free from the geopolitical baggage that comes with it. With this, the powers that be are free to push for government loans for LAC for the Nevada project.

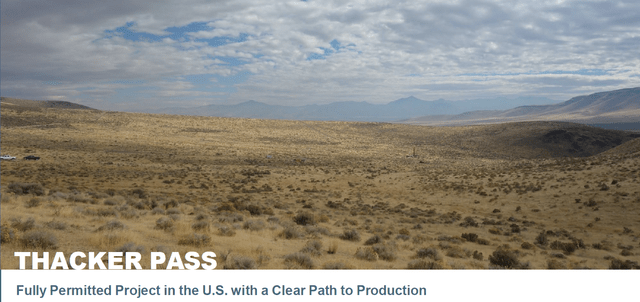

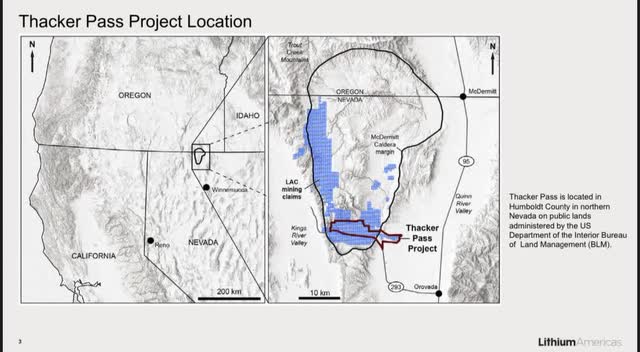

Thacker Pass (Lithium Americas)

What Things Look Like After Separation of LAC

Quite a few people have inquired what things will look like equity-wise after the company breaks into two parts. The answer is simple. Per the provided LAC chart, we can see that it will be an equal division. To make it simple, if you owned $1000 in LAC you would own $500 in each new company for a total of $1000. Do note the target of October 3 for the separation.

Lithium Americas After Split (Lithium Americas)

LAAC separation (Lithium Americas)

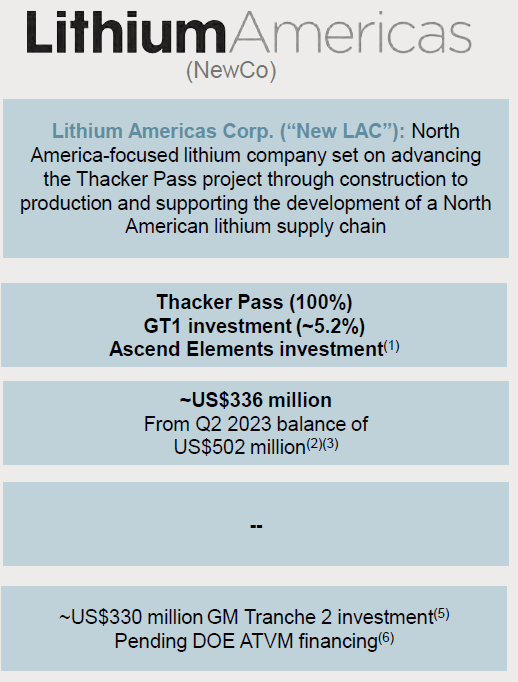

Lithium Americas Finances After Separation

LAC rough plan on what company finances look like per the August IR slide deck:

Lithium Americas Post Split (Lithium Americas)

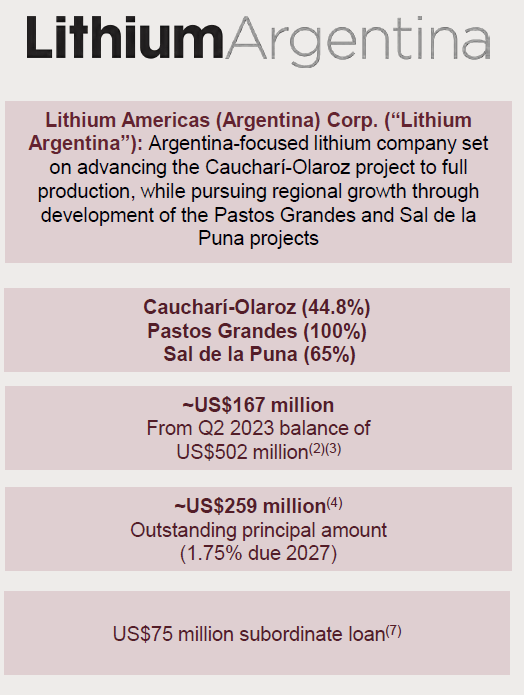

And Lithium Argentina:

Lithium Argentina (Lithium Americas)

Speaking of South America Lithium

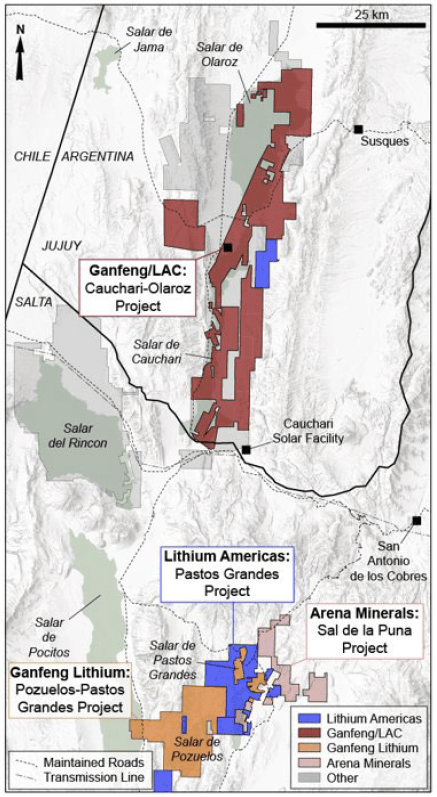

We can see the footprint and potential for expansion in Argentina is very large. Note the LAC projects in red, blue, and pink. The Cauchari-Olaroz project will be the first to spin up to full production and then a planned expansion will occur. Meanwhile, a feasibility study is ongoing for Pastos Grandes. The mental thought process one should engage in is “What does this look like in 5 or 10 years as projects come online and expand?” I would venture it looks quite favorable.

South American Projects (Lithium Americas)

Government Loans to Thacker Pass

Getting back to North America, the split gives the Thacker Pass operation in Nevada the freedom to obtain U.S. government backing via 1% interest loans for the Thacker Pass project. Make no mistake, these potential loans could be massive.

While LAC has funding from the automotive industry, they still need an utterly preposterous amount of capital to fund Thacker Pass. How much exactly? We can make some rough guesses based on the above. LAC Post Split will have roughly $336 million cash give or take a little. We can assume they might gain a small amount due to shipping product. An additional $330 million is available from GM. Added together we get: $666 million. Thacker Pass Phase 1 project cost is $2,268 million. This leaves $1,602 million in additional required funding. Per an interview with Lithium Americas CEO Jonathan Evans, typically government loans are in the range of 55% to 75%. This would bring in: $881 million at 55% or $1,201 million at 75%. This still leaves quite a bit left over to fund.

A 55% loan would leave $721 million in funding needed while a 75% loan would yield $401 million left to fund. With the backing of GM and the government, additional doors can be opened to fund the required amount left over. Taking on debt or accessing the stock market can meet the funding gap. Meanwhile, Lithium Americas is pushing progress forward at Thacker Pass via prep work on the lithium mine location.

Moving Forward at Thacker Pass (Lithium Americas)

Rising Tide Raises All Lithium Ships

Lithium stocks have been under tremendous pressure over the past year. Many names have suffered: Standard Lithium (SLI), Century Lithium (OTCQX:CYDVF), to name a few. However, these names should benefit from massive government loans given time.

Yet, one has to wonder if and when Lithium Americas receives a rather large loan will people once again look at lithium plays? Could that be a trigger to increase interest in the white metal? I think it is a possibility. Even Exxon (XOM) is getting into lithium via property that is near Standard Lithium in Arkansas.

A Monster Lithium Land Package

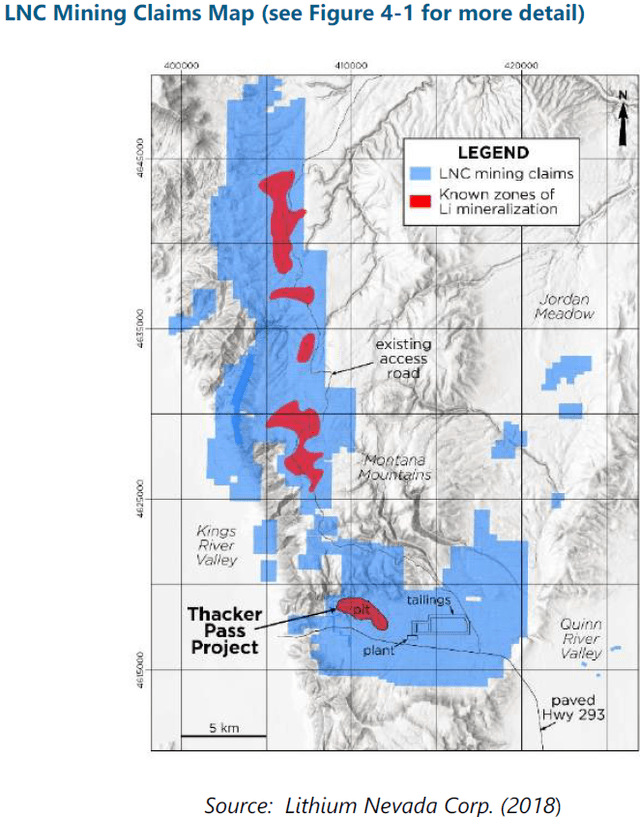

This generation of investors tend to have a tragic flaw of no patience and little ability to look long term. Ponder the picture below for a moment and ask “What does the future look like once Thacker Pass is operational and generating revenue?” As previously discussed, LAC is sitting on a monster of a deposit but few recognize just how much land LAC has in the McDermitt Caldera. We can see Thacker Pass in the below graphic, but note all the blue areas of LAC land rights that extend all the way to the Oregon border.

Lithium America Land Holdings (Lithium Americas)

While land is nice, does it have lithium on it? The answer from the 2018 technical report from LAC is “yes.” Note the areas in red (shown below) are known zones of lithium. What we see are four possible areas to expand given time (and water needs). One might think of this as four additional Thacker Pass areas that might come about in the future.

Lithium Depositis (Lithium Americas 2018)

Risk

Investing in mining companies comes with extreme risk. A variety of factors can impact one’s investment: Mining delays, equipment problems, funding issues, politics, environment challenges. You name it and when it comes to mining expect, if not demand, problems and delays. Lithium Americas is no different as it seems the South American project has been delayed to mid-2024. (We might as well add more delays into that estimation.)

The point is if you are investing in any mining company you need to have patience. An additional point of risk is the obvious: Interest rate raises, a choppy stock market in lithium, add raging inflation. These factors could impact EV adoption and lithium prices which in turn could impact project profitability. Yet these are short term concerns and will ebb and flow given time from periods of gloom and doom to euphoria and back again. Such is the cycle of investing.

Take Away

If Lithium Americas obtains a government loan the stock might react in a positive manner. Short term the company will split into two parts and each part will receive competent management from the existing LAC. This bodes well for each company. Right now LAC presents quite a value for the long term patient investor. However, macro issues are looming. Inflation still rages out of control. Interest rates continue to drift upward. Frankly put, the market is very choppy. Yet for the long term buy and hold investor, this stock might represent a ridiculous value play given the long-term EV outlook and political support worldwide.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply